The 17 brokerage firms of the Colombian Stock Exchange have recorded profits of over $170 billion in the first half of the year and each has found a niche in activities that go beyond the ailing stock market and, in the case of Casa de Bolsa*, they have found synergies by being part of financial conglomerates such as Grupo Aval.

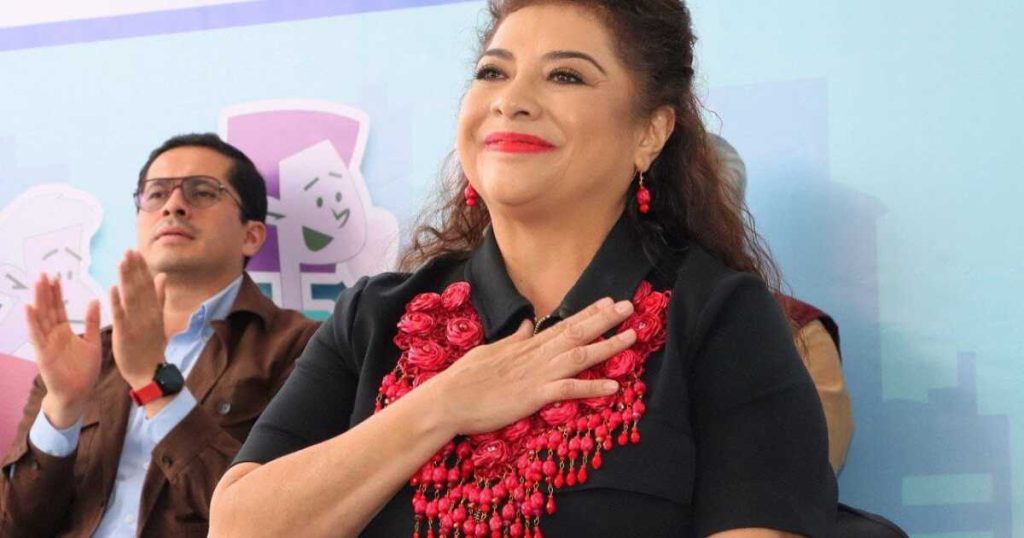

Oscar Cantor, president of Casa de Bolsa, spoke with Portafolio.

How has this year gone for you?

If we compare 2024 with 2019, we realize that our client business has doubled its revenue and we expect to earn about $40 billion this year from that business.

Our business verticals have to do with alliances we have with entities of the Aval Group, especially with Corficolombiana and Fiduciaria Corficolombiana.

(We recommend: Inflation would be impacted by 2% with the $6,000 increase in diesel).

We have an alliance with Banco de Bogotá, which complements its service offering to its premium banking clients through the stockbrokerage firm, which is dedicated to offering investments in the local and international markets.

Another reason is to deliver the best possible execution to our clients when they want to invest or divest.

The business of brokerage firms has changed a lot…

Although there is competition in certain business units because the brokerage license is so broad, different strategies will be found and in fact the industry has done very well. It has a return on equity above 15%, which shows that it is healthy in terms of profitability.

50% of our income comes from the commission contract, but we are a different case because our reason for being is the execution of operations for our investors and clients.

What was the balance of the first half of the year for Casa de Bolsa?

We trade $8.5 trillion in fixed income, which is basically bonds, and demonstrates the ability to execute to help clients invest and divest in fixed income.

(You can read: ‘Here, with the health crisis, opportunities arise’: Holland & Knight).

In June we were fourth in private debt negotiations and fifth in public debt negotiations, and I am speaking in the industry.

We aspire to stay there and for that we have strengthened the execution teams for this type of business in shares where we negotiated $1.8 billion in the first half of the year, which puts us in third place in the accumulated ranking for the year, but in June we were second. This shows why the commission contract is so relevant for Casa de Bolsa because our obsession is to have business execution desks for clients.

How many resources do they manage?

An important issue is the distribution of the Fiduciaria’s collective investment funds. We have approximately $8 billion in assets under management among the different products. We have the offer of investments abroad through the Banco de Bogotá Panama and its brokerage firm.

We have a correspondent agreement through which we offer investments outside the country with the best asset managers in the world.

And the stock market is getting smaller and smaller…

Volumes on the stock market have fallen over the past two years mainly due to rising interest rates, and fixed-income securities have not performed very well.

(You can read: Complaints about ‘black market’ in passport appointment scheduling will be investigated).

The problems of the stock market in Colombia, particularly shares, has many edges and we must all work to make it deeper and more accessible to more issuers and participants.

There are good initiatives to try to democratize investors’ access to the market, such as buying leading global shares and integrating stock exchanges.

What is needed to increase investment?

It is essential that there is less uncertainty, because when our industry sells investments, it sells confidence and in recent times uncertainty has grown. The rules of the game need to be a little clearer.

(You can read: Spanish friend of Petro and accused of enriching himself in the country breaks his silence).

How do you view the tax system and the recovery?

The elements that will revive the economy have already been invented. By channelling savings and investment we can contribute to the reactivation.

It is important to design the tax reform in such a way that it does not generate uncertainty and does not generate the opposite effect of lower growth because if it is not implemented well it can end up having the opposite effect of affecting growth.

*Stock Exchange is part of the group that owns El Tiempo and Portafolio.

HOLMAN RODRIGUEZ MARTINEZ

Portfolio Journalist