If you are an independent worker or on the payroll and this Holy Week If you plan to go out or make a trip to the interior of the country, you should know that you can take advantage of the expenses you make in restaurants, bars, hotels or tourism and craft services, among others, to deduct them from the payment of your Income tax or even, if it is the case, obtain a refund the following year.

How to deduct my income tax expenses?

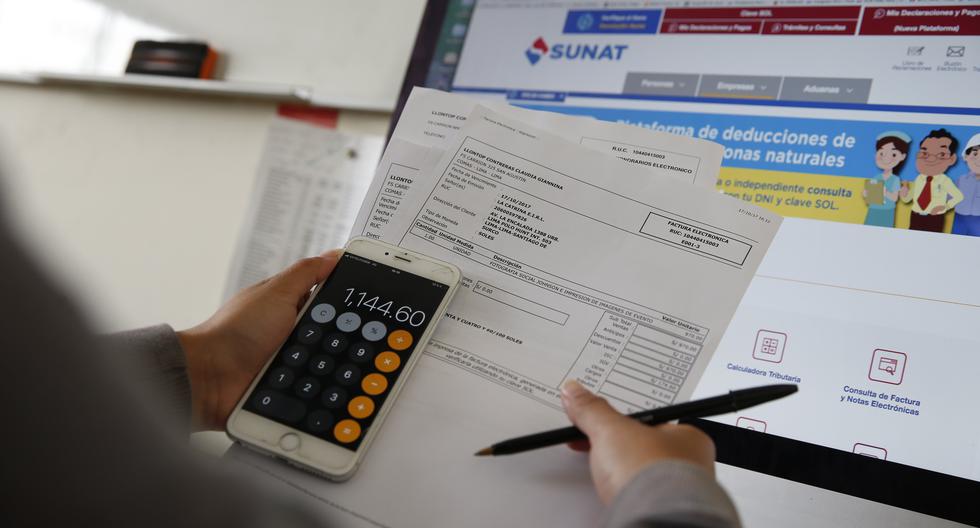

To obtain this benefit, it is essential that you go to formal establishments and request that they give you an electronic proof of payment, which includes your DNI number, and if you are a foreigner you can indicate your RUC number, for each consumption or service that you do.

If you go to restaurants, bars and hotels, you must request an electronic sales receipt and the amount that can be deducted from Income Tax is 25% of the total transaction. Do not forget that, if you request delivery service, you must also request an electronic sales receipt, in order to accumulate your expenses.

If your thing is to travel, the discounts for expenses are greater, as long as they are supported by receipts for electronic fees. If you hire a tour guide service, adventure tourism service, ecotourism or similar, the reduction is 50% of the voucher .

LOOK: Easter 2022: the best destinations to travel to the interior of the country on these April holidays

A similar percentage applies to artisan services, also supported by receipts for electronic fees and provided that the service provider is registered in the National Registry of Artisans in charge of the Mincetur.

Travel and tourism agency services, travel and tourism operating agency services, tour guide services, among others, may also be subject to tax reduction, for a percentage of up to 25%.

It should be noted that the deductible expenses are those that are made during the year and can be used to reduce the Income Tax that must be regularized in the Annual Declaration, provided that the worker’s annual income exceeds 7 UIT (S/ 32,200).

Said expenses, which also include expenses for trades or professional services, for lease or sublease and for contribution to EsSalud by domestic workers, have a deduction limit of up to 3 UIT (S/ 13,800) per year.

LOOK: Holy Week: will the emergency declaration of the National Road Network affect land travel?

What is Income Tax?

It is the tax that is paid for the income received during a fiscal year (in the case of Peru, it begins in January and ends in December).

This income can come from:

- Leases or other types of assignment of real estate and personal property

- Shares and other transferable securities (capital gains)

- Of the work carried out in a dependent and independent way

This declaration is made in the month of March and is structured or divided into 5 categories that determine who, what types of income and the levels of taxation will apply to each case.

RECOMMENDED VIDEO

:quality(75)/cdn.jwplayer.com/v2/media/JC68IHHd/poster.jpg)