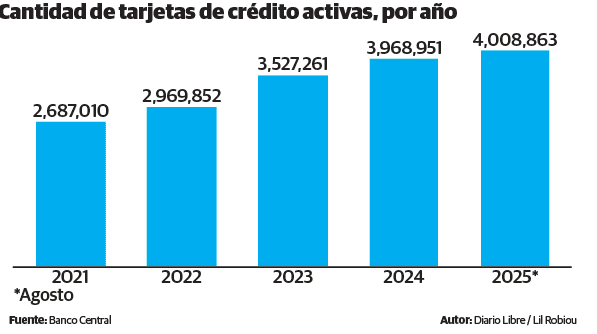

The number of Active Credit Cards In the country it does not stop growing. The amount of plastics of this type in the hands of users registered an interannual increase of 74.6 % between the closure of 2021 and August 2025.

During the aforementioned period, these credit instruments went from 2,687,010 units to 4,008,863, representing an absolute rise of 1,321,853, according to the statistics of the Central Bank of the Dominican Republic (BCRD).

Although October last year Figure as the period in which the greater number of such cards there were in the country, with 4,009,326, subsequently suffering a fall in the following three months, the records show that the figure was recovered again this year.

Until August 2025, in the country there were only 463 less than those registered in October of the previous year, which reached its largest peak, according to the BCRD data.

These reflect that, on average, between 2021 and 2024, the amount of these instruments in the hands of users grew 330,463 every year. Meanwhile, between January and August of this year, 64,131 new plastics were activated.

Less low amount

However, the figures also show that the number of Credit cards whose limit does not exceed 15 thousand pesos, the opposite happening with the active plastics that exceed that amount.

-

The payment instruments on credit that did not exceed 10 thousand pesos were reduced by 91,332, from 750,379 in August 2024 to 659,047 to the same month of this year, suffering a fall of 12.2 %. Similarly, the plastics that went from 10,001 pesos to 15 thousand dropped 5.1 %, equivalent to 13,166 credit cards, falling from 258,772 units to 245,606.

The greatest amount

In the opposite direction, the cards whose amounts range from 15,001 pesos and greater than 150,000 records an increase in the amount of active plastics, the latter being the one that greater absolute increase registered in the last year, according to the BCRD data.

The active plastics whose amount of credit Available exceeds 150,001 pesos had an increase of 43,663 units between August 2024 and the same month of this year, from 632,140 to 675,803, representing an increase of 6.9 %.

These were followed by those ranging from 15,001 to 25,000, which went from 517,239 in August of last year to 554,446 in the same month of 2025, representing an increase of 37,207 units, equivalent to 7.2 %.

Meanwhile, those that have an approved amount ranging from 50,001 pesos to 75,000 went from 359,152 to 394,108 during the aforementioned period, equivalent to 34,956 additional plastics and representing a growth of 9.7 %.

The Multiple banks dominate

The Banks Multiple are the financial intermediation entities that register the largest amount of credit cardholders. Of the little more than four million plastics of this type active until August, they grouped 88.5 % of the total, equivalent to 3,548,374 units, according to the Central Bank records Dominican.

These entities were followed by Savings and Loan Associationswith 452,050 active plastics of Credit cardsrepresenting 11.2 % of the total. The remaining 8,439 payment instruments on credit were held by customers of the Banks savings and credit, which only equivalent to 0.2 %.