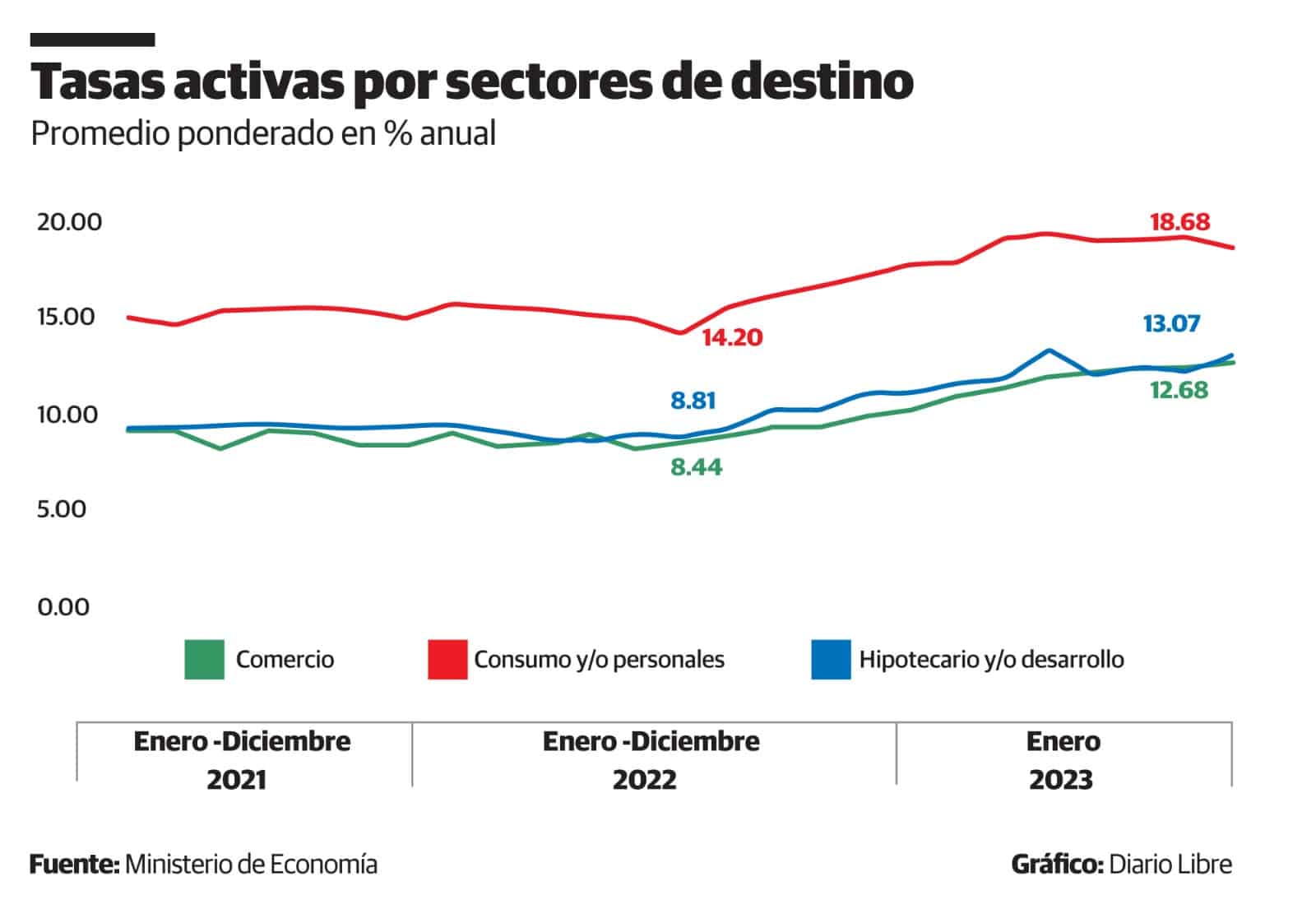

A year ago, in January 2022 to be more exact, the interest rate weighted average of a consumer loan or staff was from 14.20%. Twelve months later, that is, in January 2023, she went up to 18.68%, for an increase of 4.49 percentage points. According to the Ministry of Economy, this is a effect of monetary policy restriction adopted by the Central Bank.

As recorded by the ministry in its most recent Macroeconomic Situation Report, the interest rate of the consumer loans or personal has been the one more has varied.

Second is that of mortgage loans or development, which went from 8.81 to 13.07%, for a rise of 4.25 percentage points. While that of trade loans varied 4.24 percentage points, going from 8.44 to 12.68%.

The weighted average rates are higher than those registered in 2021, when in November of that year the Central Bank began to increase its interest rate of monetary politics to contain inflation, taking it from 3.00% to 8.50% annual currentimpacting the purchasing power of people and companies to reduce the pressure and lead to a balance between supply and demand.

Interest rates by destination

January 2023 vs. January 2022

4.49percentage points

consumer loans

4.25percentage points

Mortgage loans

4.24percentage points

trade loans

The customer feels it

Although with the tight monetary policy -which other countries have also applied in the current context- it was possible to moderate the rise in prices to place the inflation YoY in January at 7.24%this has also led to a increase in interest rates gradually in the different types of credit and deposit products in the financial system, depending on whether they are contracted: at a fixed or variable rate.

That gradual increase a client has experienced it from a commercial bank. Since he took a mortgage loan in November 2016 and until that same month of 2021, he paid the bank 24,737 pesos per month, despite the fact that the rate was fixed for one year.

Already by February 2022, the monthly payment had gone up to 25,156 pesos and in November of that same year -when the bank notified him again of a new increase in the rate- it was increased to the 26,634 pesos that it currently contributes.

In short, in a year went on to pay 1,897 pesos monthly more for your mortgage loan.

Market Rates

Last January, the active interest rate (the one that the client pays to the bank when he takes out a loan) was located in 14.96%above the annual average of the last seven years (12.67%), indicates the Ministry of Economy in its report.

The passive rate (the one that the bank pays to the client for deposits) was positioned above the historical series since 2013, when it was located in 10.02%. However, the ministry notes that it registered a slight reduction of 0.17 percentage points compared to December 2022, when it was at 10.19%.

The economist Jaime Aristy Escuder analyzes in his blog that between March 2020 and November 2021, the active rate weighted average stood at 10.13% and the passive at 3.39%. The margin between both rates was 6.73%.

It indicates that between January and February of this year, the active interest rate began to rise much faster than the passive, placing the margin at 6.05%, “a level that is below the historical average of 7.68%.”

He concludes by projecting that the active interest rate will follow going up faster than passive in the coming months.