In recent days the debate for pension reform was stirred again, after Colpensionthey can be used to subsidize the system when the changes begin.

Andrés Velasco, president of Asefondos, spoke with Portfolio about this situation and explained that before any transfer, the double advice must prevail, in order to safeguard the right to choose that Colombians have. He also said there are several technical tables where these requests can be addressed.

See here: JP Morgan reaffirms that the fiscal crisis took its toll on the flexible credit line

Should we move high -risk workers?

I believe that the first thing to point out is that the norm establishes that high -risk pensions can only be recognized by colpensions and that is something that is clear and that we understand, because it is a subsidized pension. Recall that high -risk pensions have a privilege, since they can be obtained at age 55, even 50 years old, provided that it has been quoted at least 700 weeks, with an additional price of 10% by the employer for the activities defined in the law as of high risk.

Being a subsidized pension, for granted in special conditions, it is not possible that it be recognized through the solidarity individual savings regime, which only grants pensions based on the contributions made and the profitability they generate. That said, one thing is that the pension can only be recognized by Colpensiones, and another very different is that contributions can only be received in Colpensiones.

Andrés Velasco, president of Asofonds.

Courtesy – Asofondos

Can they be in AFPs?

Since 2004, the Ministry of Labor clarified that people who would not have moved to Colpensiones and that they had high risk contributions had to continue receiving, by their employers, both additional 10% and the basic contribution in the pension administrators in which they were affiliated.

That is a consecrated privilege for Colombians from Law 100 of 1993, which guarantees the right to decide in which entity we want our contributions to be carried out. In addition, Law 1748 of 2014 ratifies that right and establishes that it is we who determine when and where we moved, within a process regulated by said norm.

Also read: Climatic events hit 78% of companies and 40% have no resources to adapt

Are they as many as Colpensiones says?

In our accounts, it is about 40,000 workers, and the amount will depend on the balance they have in their individual savings accounts the people who decide to move. Who should it do it? To those Colombians who develop an activity classified as high risk, under the special pension regime, and who have the expectation of pensioning in these conditions.

For these people who meet the criteria, it is advisable to move to colpensions. In fact, from private pension funds, within the advice provided, they would be told exactly that, that it is convenient for them to pass, because the law, in particular the decree law 2090 of 2003, allows them to pension in special conditions. However, not all affiliates who have quoted a few weeks in high -risk activities are favorable.

Andrés Velasco, president of Asofondos

Courtesy – API

Who does not suit them?

In many cases, the most convenient thing is to remain in the individual savings regime with solidarity (RAIS). This happens, for example, when affiliates have made high contributions during their working life and, consequently, have accumulated a significant balance in their individual savings account.

In situations where the person does not complete the necessary weeks to pension, or when he has had high income that strengthened his account, it is very possible that the pension in the RAIS is more beneficial. The fundamental thing here is to understand that the decision to move or remain in a fund corresponds only to the worker, in accordance with the provisions of the law.

More information: Cryptocurrencies in Colombia: Financial refuge to tool for remittances

Is the colpensions claim valid?

We understand the purpose. In a meeting that we held with the Minister of Finance Germán Ávila, with the president of Colpensiones and with representatives of the Ministry of Labor, it was concluded that it was necessary to purify the information to contact those people who are convenient for them to move, that is, who have the expectation of pensioning under this high -risk scheme, so that they can pass to Colpensions.

This, of course, for the benefit of them, although the final decision on the transfer corresponds only to the workers. Now, there are also other people for whom it is surely not convenient, and precisely in that process will be purified.

In that sense, we understand the purpose of what is raised. The numbers shared by the president of Colpensions represent a potential universe, as long as all these people will be favorable to move. However, it will be through the exercise of the technical tables that will be defined more accurately who are the ones that should really be transferred and what is the size of the individual savings accounts that would pass to colpensions.

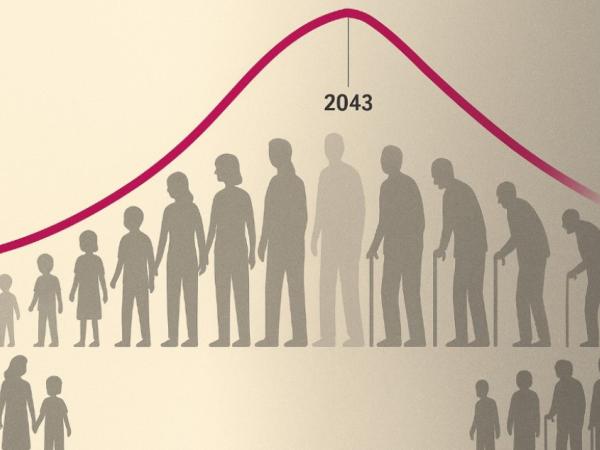

The pension savings in Colombia is one of the issues that matter most about pension reform.

Chatgpt image

Would the stability of private funds affect?

We are talking about a potential universe of 40,000 people with individual savings accounts, which would mean important, probably considerable amounts, but in no case would put solvency at risk or relevantly affect the risk variables of private funds. It is worth remembering that, at the end of the first half of last year, these funds administered a heritage close to $ 500 billion.

Other news: Hamas accepts the release of hostages in Gaza and requested to negotiate Trump’s peace plan

What should the savers do?

All the news that has been generated revolves around people who have had quotes in high -risk activities. That is, if you are a worker who at some point quoted, or for which an additional quote of 10% was made, or if he still asks, the question that should be asked is whether you have the expectation of completing the 700 weeks required with that additional 10%.

In case it is, it is very likely that what suits you is to move to colpensions. If that is your case and you are in the RAIS, the invitation is to communicate with pension fund managers, so that we can initiate an advice process and define jointly if it is appropriate to move to the special high -risk regime.

Now, if you are one of the Colombians who have not quoted under this scheme, which adds the vast majority, it must be clear that from the pension fund managers we seriously assume the custody of the fiduciary duty that we have in front of all the affiliates who have trusted us. Our commitment is to continue working to continue multiplying the pension savings resources of the affiliates and guarantee the strict compliance of the norms in relation to the resources that each person has saved.

Daniel Hernández Naranjo

Portfolio journalist