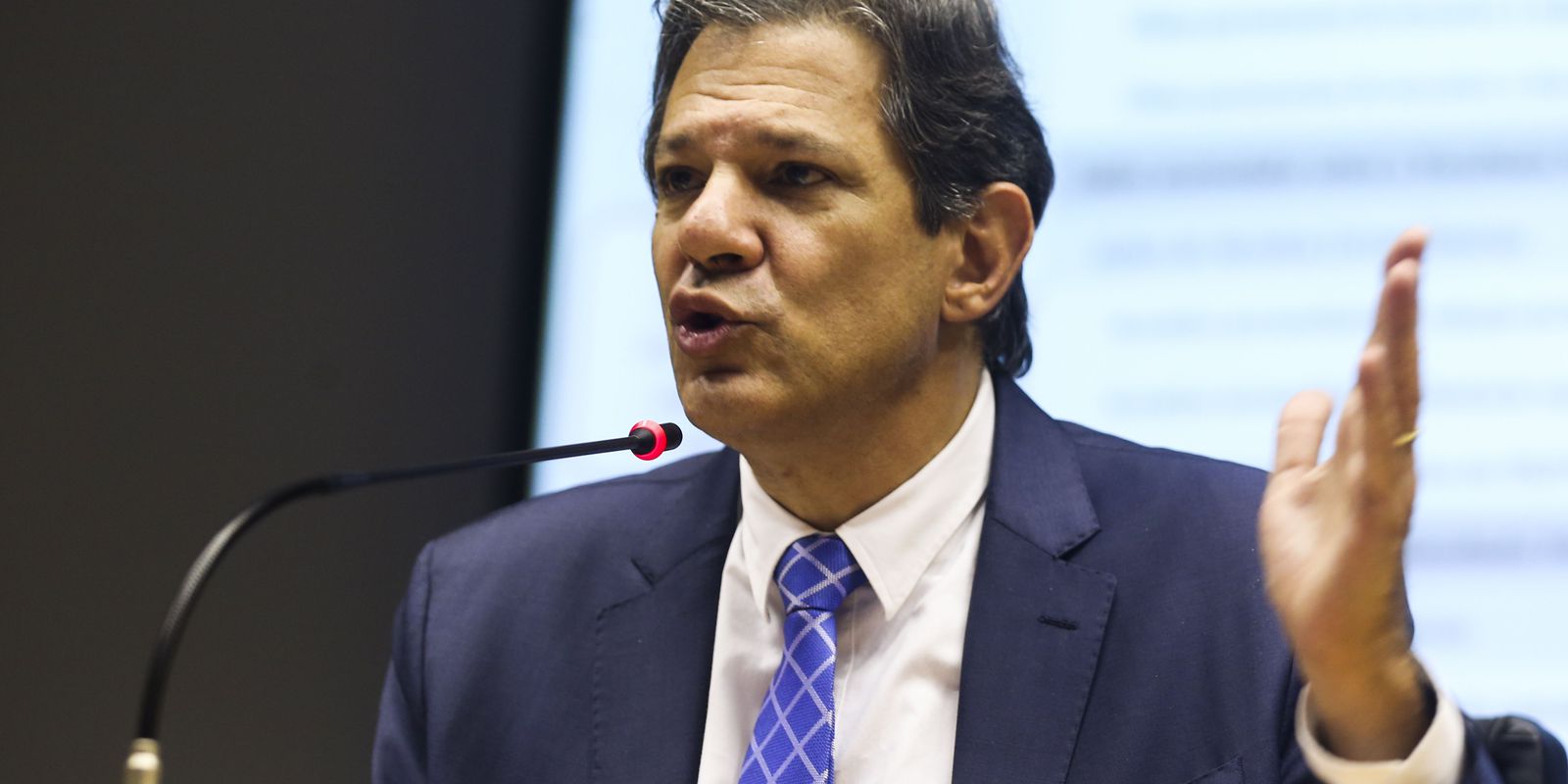

The recomposition of the original rates of the Tax on Industrialized Products (IPI) was left out of the fiscal package announced last week as a government commitment with the tax reform, said today (16) the Minister of Finance, Fernando Haddad. On a trip to Davos (Switzerland) to participate in the World Economic Forum, he said that the scope and maintenance of the tax will be discussed in the tax reform proposal later this semester.

According to the minister, the reform will seek to reduce the tax burden for the industry, which, in his words, is disproportionate to the sector’s share of the Gross Domestic Product (GDP, sum of goods and services produced).

“[A reforma tributária] it is essential to seek tax justice and to reindustrialize the country. Because industry currently pays almost a third of taxes in Brazil and accounts for 10% of production. There is a very big imbalance. This is the path”, declared the minister at the door of the hotel where he is staying at the end of the first day of the agenda.

For Haddad, there is maturity, both in the Chamber and in the Senate, to reach a consensus and vote on the tax reform this semester. The minister affirmed that the government has the exemption of the industry as a commitment and again said that Congress will base itself on the two texts that had their discussion interrupted in the last government, one in the Chamber and another in the Senate, which are based on ideas elaborated by the Special Secretary for Tax Reform, Bernard Appy.

Earlier, the vice-president and Minister of Development, Industry, Commerce and Services, Geraldo Alckmin, said that the government’s goal is to extinguish the IPI in discussions on tax reform and that the Minister of Finance had “sensitivity” in maintaining the exemption of 35% that came into effect last year. Alckmin made the statement at an event held by the Industry Federation of the State of São Paulo (Fiesp).

The texts pending in the House and Senate provide for the merger of various taxes, including the IPI, by type or more of Value Added Tax (VAT), which would be shared between the Union, states and municipalities. One of the proposals, currently being discussed in the Senate, foresees that the IPI would be maintained only as a tribute to burden products that are harmful to healthsuch as tobacco, alcoholic beverages and sugar products.

According to Haddad, the end of the IPI tax and the reduction of other taxes would be financed by increasing the Income Tax on richer taxpayers. He said that the reform “will not be neutral” and will seek to correct the regressivity (greater burden on the poorest) of the Brazilian tax system.