The international grain prices improved this Friday after suffering sharp falls, and closed with a slight weekly rebound. in the local market The demand for cattle loses strength and a pronounced drop in slaughter is anticipated, although the steer resists in the axis of US$ 4 per kilo. Wool fell to its lowest price level in the current harvest, with quality problems and the textile industry still resentful. This was the weekly closing in the markets of three of the main items of the agribusiness that Uruguay produces and exports.

Grains: tie in the hour

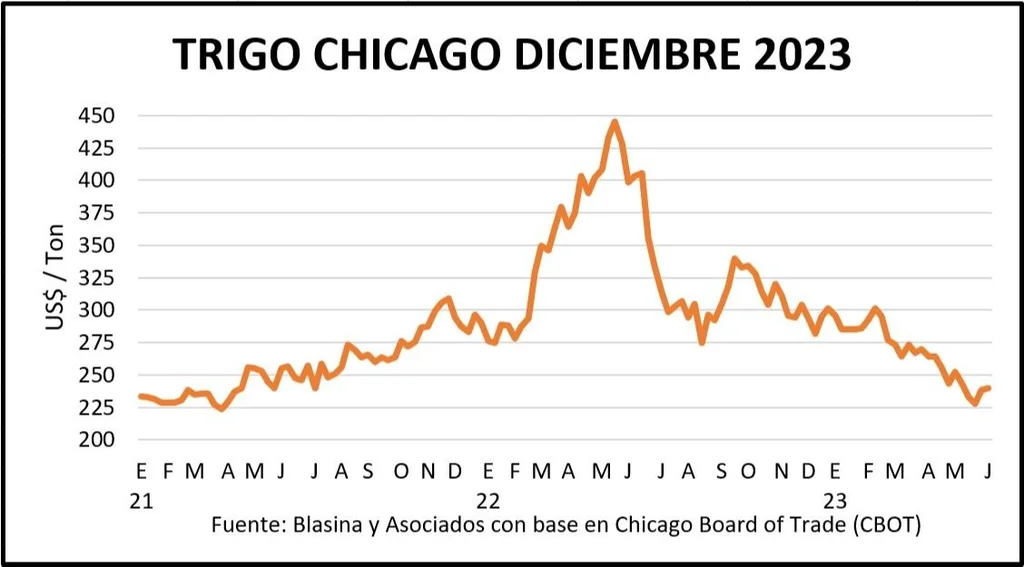

It was a week of volatility in grain prices. It began with pronounced falls and soybean prices fell to their lowest levels since before Russia’s invasion of Ukraine. Subsequently, a recovery logic was accelerated that led to a weekly closing almost equal in prices.

The 2024 soybean that came to be offered below US$400 in Uruguay, closed in the Chicago market above that reference, US$438 for March of next year.

Soybeans in Uruguay this Friday were trading between US$420 and US$430, corn US$300 and wheat US$260 a ton.

Soybeans available in Chicago closed this Friday at US$497, with a rise of 8.5% in the last round of the week and US$464 in the August position.

Grain market.

In Uruguay the situation of the harvest of soybean and corn crops is uneven. In the south of the country, Copagran’s benchmark for harvest progress is between 60% and 70% of the cultivated area and more than 90% in the northern coastal departments. Yields: 1,000 kilos per hectare in the north and around 300 to 400 kilos in the south, with 40% to 50% of the area unable to be harvested, and a general average of around 600 kg/ha, estimated this week by Alejandro Solsona, vice president of Copagran.

In the south, more than 90% of the corn crops were lost and second-rate corn is being planted in the north.

For winter crops, rapeseed area projection seems to be further reduced than expected compared to last year; most of the area devoted to cultivation is already planted.

The area of wheat will grow – the long cycles were planted, almost 50% of the area – and that of barley would remainwith more than 30% implanted.

Among the factors that have an impact on prices, for the first time in the United States weather threats are mentioned on summer crops that are beginning their cycle.

The US Department of Agriculture (USDA) raised from 20% to 28% the proportion of land devoted to soybeans that experiences some degree of drought, a figure that is much higher than the 10% of a year ago. In the case of corn, the threatened areas went from 26% to 34% in the last week, compared to 19% at this time last year.

Although it is still early, it becomes a factor to watch.

Another bullish aspect has to do with exports from Ukraine. Although the agreement for the release of grains was ratified for two months on May 18, Russia is not allowing the departure of ships with Ukrainian wheat from the three ports on the Black Sea.

Grain exports from the United States in the week ending May 25 were higher than previously expected, especially in wheat and corn, which also supported the market at the end of the week.

Wheat closed US$1 per tonne above Friday of last week, surpassing US$227 for the July position, US$232 for September and US$239.5 for December wheat.

Grain market.

Corn gained US$2 per ton compared to the close of the previous week, close to US$240 in the July position and US$210 for September. December wheat closed at US$ 239. Added to the bullish trend were the recovery in the price of oil and the strengthening of the exchange rate of the Brazilian real against the dollar, which put a temporary brake on the downward influence of the availability of grain product from the record second harvest of corn in Brazil, where a ton of corn is trading at US$180.

The Argentine government, for its part, approved this week two new phytosanitary protocols to export corn and sorghum to China., which may mean the opening of the Asian country’s market, something that was not disabled but has not happened in practice. The protocols, which will remain in force for the next two years, include an update of the quarantine pests that worry the Asian country: 15 in the case of corn and another 25 for sorghum.

Argentina has promised that both corn and sorghum exported to China will be free of live insects and will not be contaminated or mixed with “other grains or foreign matter” that could contain pests.

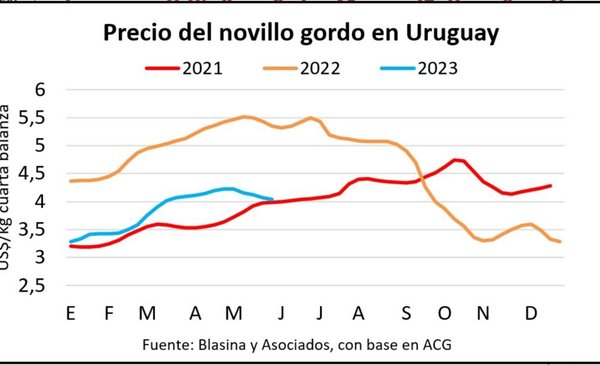

deflated livestock market

In a locked fat cattle market, the position of the industry in general is to lower prices or not to slaughter. Without stimuli from the international markets, the refrigerators opt for a position of caution. With limited buying pressure, limited supply is not enough to support prices.

The demand is cold and the values suffer, with proposals of US$ 4 per kilo for the steer. Some plant that is working with kosher equipment can stretch out a few cents to get very special cattle. Others, such as for several days, intend to buy below US$4.

The cow costs between US$3.70 and US$3.80 in the case of good, heavy cattle. For the light cow with little finish, US$3.50 is proposed and he is fighting to reach US$3.60. The heifer trades between US$3.85 and US$3.90. The entries to the plant are short, with loads from one week to the next.

The producer who has the cattle soon is not satisfied with these values, which has resulted in few business closings. The medium completion lots are the ones that are still being sold today.

Although the offer is minimal, the slackness of foreign markets sets the tone for meatpackers, who are not willing to pay more for cattle that do not appear. “The industry is quite aligned in not continuing to lose money”said Gustavo Basso, Gustavo Basso Rural Business Desk.

The window for the slaughter of free-range cattle for quota 481 ended and the activity began to drop in the last two weeks. There are plants that are not working and have given licenses, and others with less operation. The slaughter data from last Monday showed a decrease of 14%, with 41,422 processed cattle. “Next week we are going to have a very small job,” Basso anticipated.

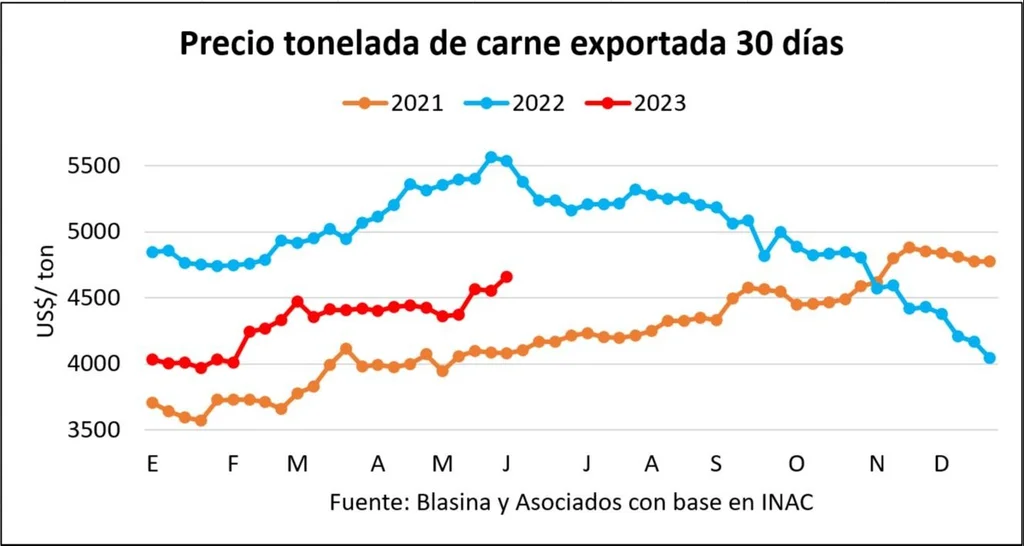

If you look at external markets, the signals are weak. In China, the SIAL fair was expected to be a turning point, in a market that had been adjusting downwards, but that did not happen.

“The prices per ton have continued to drop and in a much more aggressive way, an additional US$500 to US$600 to what they had already been adjusting and with price references that are a bit scary for what China has been in recent years” Juan Lema, director of Agromeals, told Tiempo de Cambio on Rural radio after his return from that country.

The operator does not see strong basic arguments for this drop, beyond market speculation. “A balance should be found in the short term,” he considered.

There are other factors that play their part, such as lower cattle prices in Brazil, with references of US$3.24 in São Paulo, and US$3.80 for steers in an oversupplied Australian market.

In Europe a balance is beginning to be found and the United States appears more firm.

Livestock market.

Locally, the export price of beef was US$ 5,036 per ton last week, according to provisional data from the National Meat Institute (INAC), with a rise possibly linked to shipments within quota 481. This is the best weekly average since the end of September 2022.

The replacement market outside the screens shows firmness for the whole calf, which stands out for the export operation on its feet and distances itself from the castrated calf. It is difficult to find buyers. Although the rain brought some calm and partly eased the selling pressure, the market is in a “very fine balance”Basso considered. Demand is selective and moves cautiously.

The sheep are entering the time of the year with less activity, with very pressured values: the lamb in the axis of US$ 3 and the adult sheep between US$ 2.40 and US$ 2.50. The external market has weakened and is evidenced by the weakness of the export price.

For sheep, “Uruguay in China is the third option.” Sheep from New Zealand and Australia pay better, Lema said.

The exported ton registered last week an average price of US$ 3,640 for sheep meat, its lowest value since the beginning of April and well below that of beef. So far this year it stands at US$3,893, a 25% year-on-year drop considering that in the same period last year it stood at US$5,171.

Wool market.

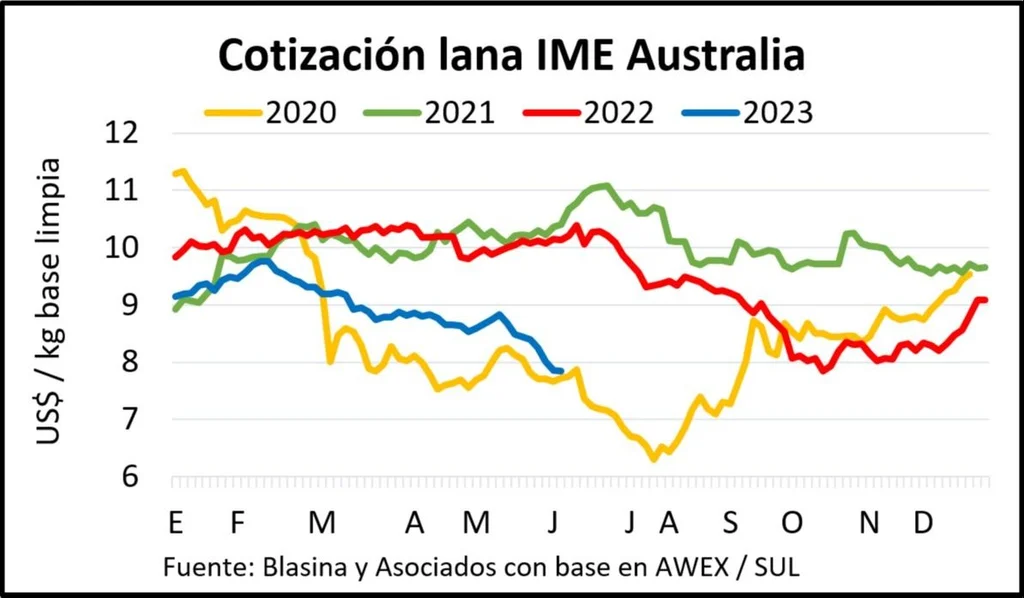

Wool: pandemic prices

For the fourth consecutive week, wool prices fell in the Australian market. In US dollars, the Eastern Markets Indicator (IME) fell 2%, from US$8.01 to US$7.85 per clean basis kilo, pressured by the exchange rate.

Thus, it reached the value registered on October 11, 2022, the minimum for the 2022/2023 harvest, and was 22.5% below the values of a year ago. The current price level is similar to 2020 at this time of year, when it fell from over $10 to under $8 in a few weeks as a result of the covid 19 pandemic.

The drop in the indicator was only 0.4% in local currency, weakened by the strengthening of the US currency after the political agreement in the United States that deactivated the possibility of default by authorizing the increase in the public debt ceiling.

After the sharp drop in values on the opening day, pressured by the irregular quality of the bales, the market rebounded. Strong demand from Chinese buyers and local exporters led to upward corrections in Australian dollars for most fines. Values stabilized and 88% of the offer was placed, a more positive balance than in previous weeks.

The textile industries in the main processing countries continue to deal with high energy prices and difficulties in finding labor that slow down the full recovery of demand.

In the local market, where businesses are held back by the threshold of values proposed by the demand, The Uruguayan Wool Secretariat (SUL) reported an important operation of 120 thousand kilos of 27.5 micron Corriedale wool corresponding to harvests of the last four yearsat a value somewhat higher than in recent weeks: US$ 1.05 per dirty base kilo.