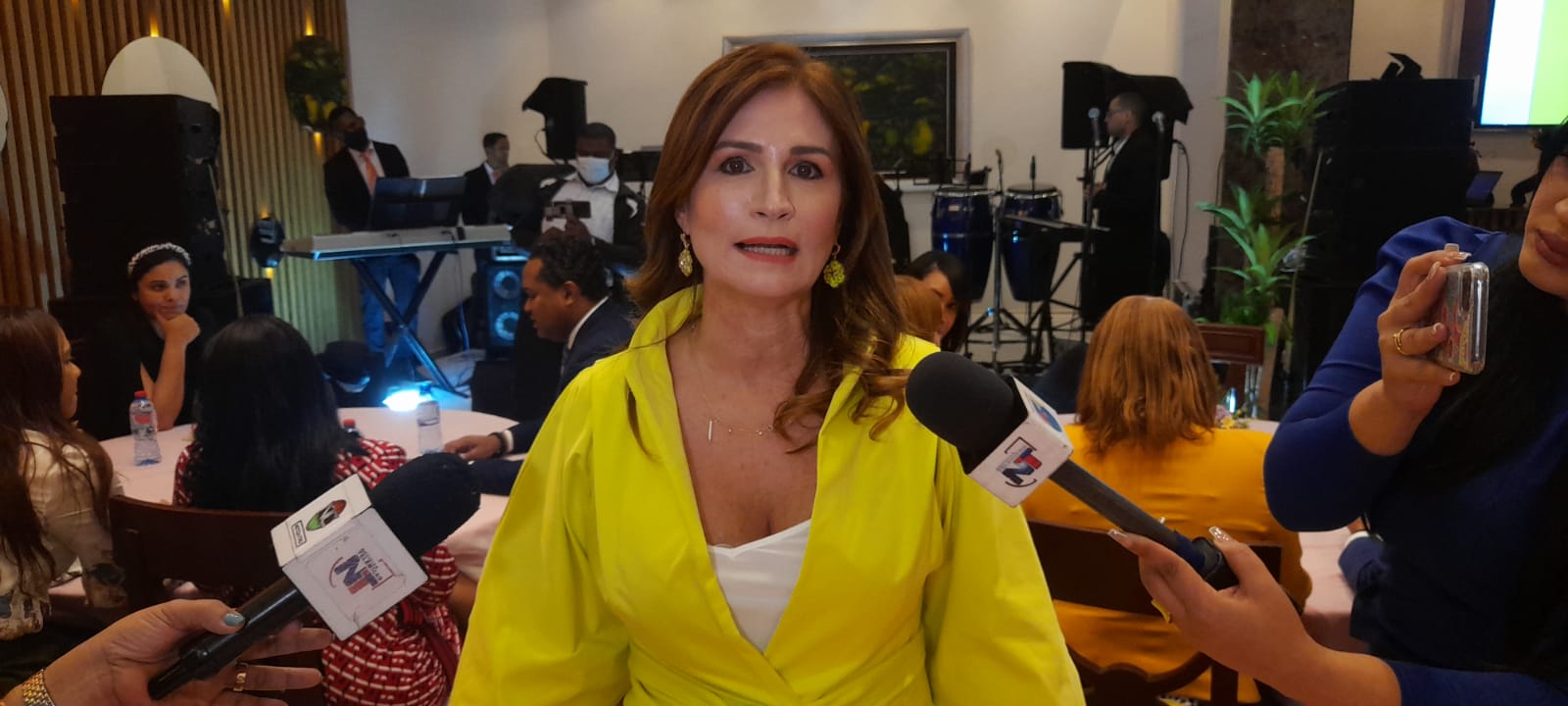

Santo Domingo – Given the instability and high international cost of oil and raw materials, the executive vice president of the Association of Industries of the Dominican Republic (AIRD), Circe Almánzar, understands that the Executive Branch must reformulate the National Budget this year to prevent these increases from being passed on to the population.

“We understand that yes, the President is probably going to have to make a reformulation. Everything will depend on how prices fluctuate, but already, what has happened in the last three weeks implies a diversion of the resources that they were intended for other areas of greater emergency,” said the businesswoman, when journalists asked her if she considers it appropriate to reformulate the 2022 Budget.

In Almánzar’s opinion, in any case, the country must be aware that there are very few actions that can be taken to deal with price volatility, which is why he pondered that a great understanding of what is happening is required to assume a crisis attitude and be more austere.

It is worth mentioning that the total amount of this year’s budget is RD$1,155,565.3 million, made up of RD$871,485.9 million of internal income and RD$284,079.4 million of loans. The global value breaks down into RD$1,046,280.7 million for expenses of State operations and RD$109,284.6 million for debt repayments.

domain extinction

On the other hand, the executive vice president of the Aird said that the domain extinction bill that is being studied in the National Congress will cover everything related to income-generating movements and is not focused on a specific sector but on everything. what concerns the causes for which money is obtained that does not come from a lawful activity. The regulations may apply to any money laundering activity or predicate offences.

“Any type of activity that is not duly clarified as to its lawful origin,” he said.

As the bill is so broad, the businesswoman indicated that the Aird has been analyzing with the bicameral commission in charge of the initiative some aspects that could prevent it from being so broad, so that it could affect the investment climate.