To get out of the crisis in which it finds itself Petroperuthe Executive finally decided to restructure the company, as this newspaper had anticipated.

LOOK: S/2,351 million awarded in works for taxes

Following the Council of Ministers meeting, the head of the cabinet, Gustavo Adrianzén, announced that this reform will be carried out by a private manager specializing in restructuring (PMO). However, this will not mean the privatization of the state oil company. The prime minister indicated that this has been ruled out.

“This PMO will be previously selected in the international market, brought and hired expressly to carry out this task of reviving Petroperú, through a new business vision.“, he said.

He also said that the oil company needs “a line of credit” that will allow it to restart and remain in the market. Perú21 learned that part of the plan to save the state-owned company includes a single injection and that the company will subsequently be self-sustaining.

However, for the restructuring to begin, the Prime Minister’s announcement must be reflected in an emergency decree. Sources from this newspaper indicated that the green light would be given to this regulation today, in an extraordinary session of the Council of Ministers.

LOOK: People take refuge in the dollar and the currency rises to S/3.797

On the other hand, the Prime Minister said that they are evaluating the possibility of maintaining the units that are efficient and profitable. For example, he pointed out that the aim is for the pipeline to have the capacity to transport up to 60,000 barrels of oil per day.

The Talara Refinery is also a government bet to generate profitability. According to the President of the Council of Ministers, next year, when it is 100% operational, this project could guarantee an annual profit of US$800 million.

Be alert

One of the concerns expressed this week by various business associations was a possible change in the board of directors of Petroperú. Although the Minister of Energy and Mines, Rómulo Mucho, rejected this possibility on Tuesday, yesterday Gustavo Adrianzén did not rule out some adjustments.

“We will probably have to make some adjustments to the Petroperú board of directors. This is not yet defined, but we may have to resort to it as a formula.“, he said.

The question now is who would join the board, which has the support of the private sector and the ministers Rómulo Mucho and José Arista (Economy and Finance). One fear is that the questioned Óscar Vera and Pedro Chira, former head of Energy and Mines and former president of the oil company, respectively, will join. Both recently met with President Dina Boluarte.

LOOK: BBVA Research: How does geopolitics affect global economic growth?

Pending changes

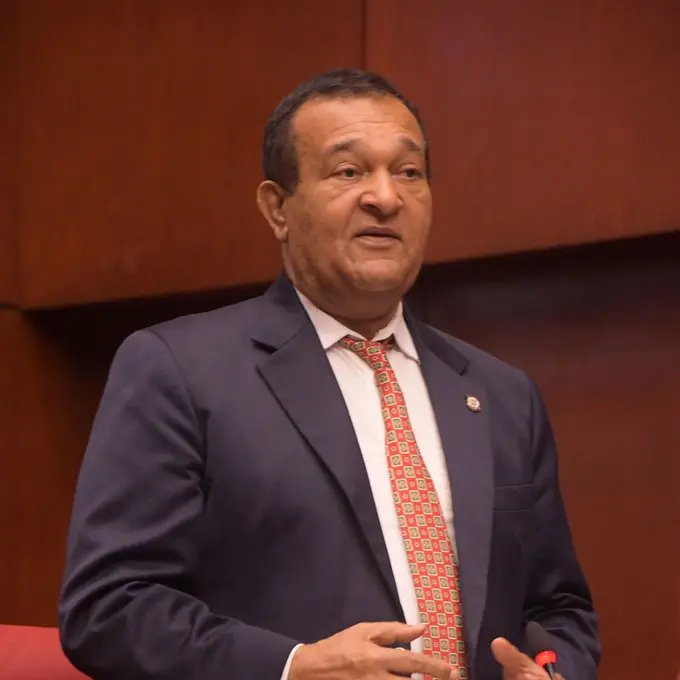

After this information was released, the president of Confiep, Alfonso Bustamante Canny, stated on Perú21TV that it is necessary for the restructuring to also be linked to the size of the company and the number of workers.

He said it is important to make information about the company and the decisions that will be made regarding the reform transparent, so that we can know “where we stand and what is possible to do.”

Data

Gustavo Adrianzén said that Peru must honour its obligations related to the placement of Petroperú sovereign bonds.

Alfonso Bustamante Canny pointed out the need to hire top-level international lawyers to meet debt obligations.

RECOMMENDED VIDEO