The fake kidnapping or urgent help scam, via WhatsApp; the card machine tampered with for the purpose of cloning data; the financial pyramids that are not sustainable; the criminal who impersonates a trusted institution and sends an email or creates a fake website to capture data; the fake motorcycle courier who takes the victim’s credit card; the promises of unrealistic profits on false investments; the scammer who pretends to be from a call center that, in reality, is fake; the fake bill, the card exchange scam.

Finally, crimes committed in the digital environment are increasingly a daily concern for Brazilians and already place the country in second place worldwide in these types of crimes, behind only China, according to the Brazilian Federation of Banks (Febraban).

To curb crimes of this type, the Ministry of Justice and Public Security (MJSP) and Febraban launched, this Wednesday (3), the Joint Action Plan to Combat Digital Banking Fraud. The initiative is the result of the National Alliance to Combat Digital Banking Fraud, signed in February, through a cooperation agreement between the two institutions.

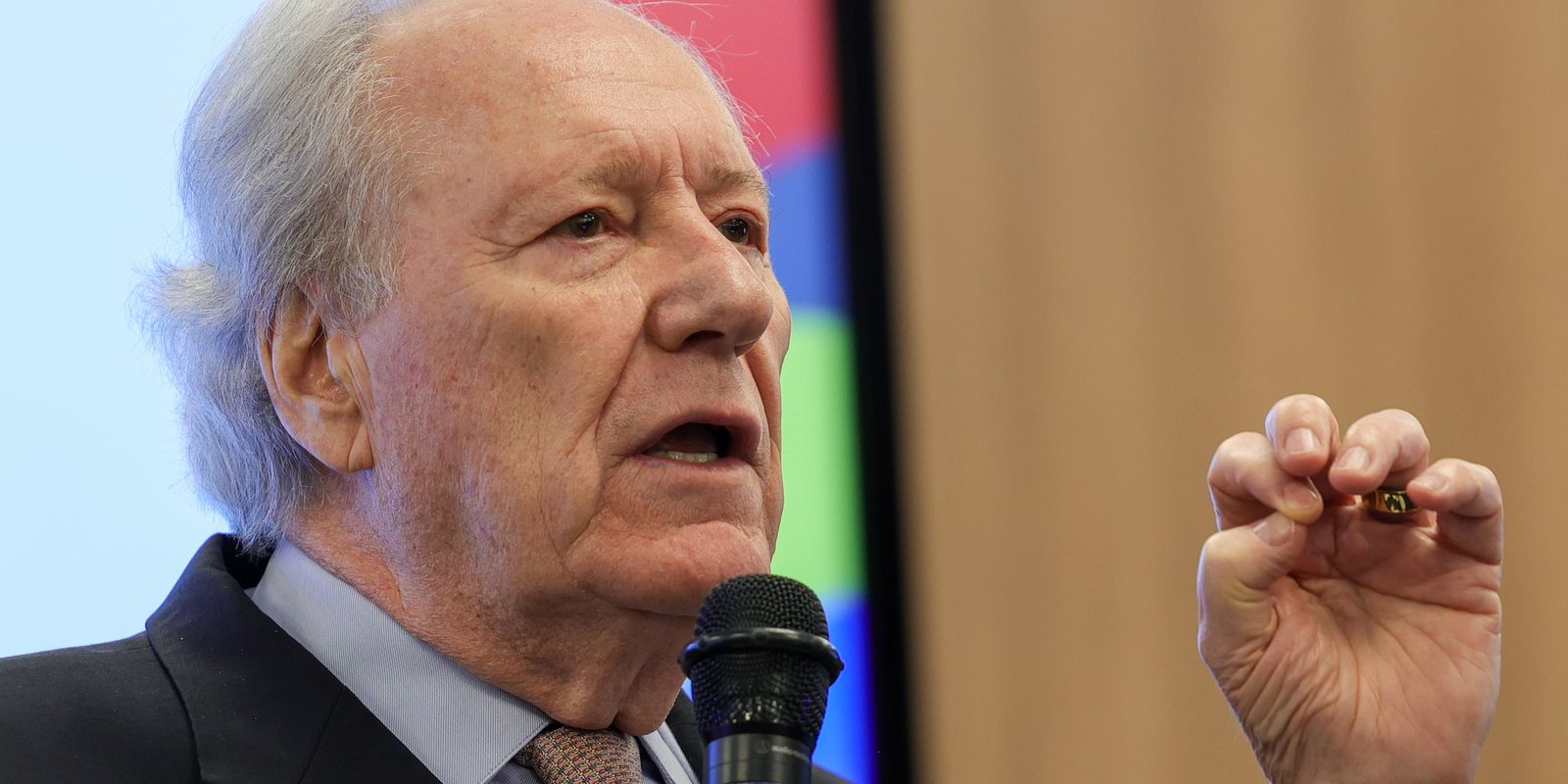

During the launch, the Minister of Justice and Public Security, Ricardo Lewandowski, emphasized the need for a coordinated and intelligent response from the State, with all “energy”, in partnership with civil society, financial entities and companies. “Public security is the duty of the State and everyone’s responsibility.”

“The crime [digital] It is an extremely complex and relatively new phenomenon, in the dimension and nature assumed in recent years, and should be studied in more depth by sociologists, economists, political scientists and authorities, in general, especially by security forces.”

When remembering his role as a criminal judge in São Paulo, the minister highlighted that crimes have changed and migrated from the physical to the virtual world, especially organized crime.

“And this digital world we live in has made crime more sophisticated. Common crimes, such as embezzlement, have ceased to exist and have migrated to the digital world, in a worrying metamorphosis”, he noted.

The president of Febraban, Isaac Sidney, highlighted the importance of unprecedented cooperation between the public and private sectors and organized civil society, as the main differentiator against digital organized crime. “To be strong, the banking sector needs a strong regulator and a strong banking supervisor and we have them. The banking sector needs all the links that make up the financial industry chain to be absolutely aligned, because digital crime seeks exactly the most vulnerable, the most fragile link. With this alliance we have a very positive expectation that we are in the right direction.”

Action plan

The Joint Action Plan to Combat Digital Banking Fraud consolidates 23 priority initiatives for the State and civil society to act on, from prevention and consumer education, through detection and rapid response, to repression and asset recovery.

Minister Lewandowski explained that the plan is not completed and the improvement process will end in five years.

The plan includes, among others, educational videos, a glossary with 41 types of fraud and digital scams. “The lack of standardization hinders the flow and, consequently, the fight [às práticas criminosas]”, explained the minister.

The pillars of the plan are:

• improvement of fraud and scam prevention processes;

• intensification of the fight against and repression against fraud and scam crimes;

• sharing and processing of data and information;

• training of agents, private entities and the population;

• treatment and care for victims;

• population awareness for prevention.

In his speech, Minister Lewandowski mentioned the importance of providing an immediate and clear response to the population.

““Victims don’t know what to do and who to complain to. This website of ours will have simple, didactic language and will officially inform what the victim will have to do to recover what they lost or, at least, minimize their losses.”

Website

At the launch, the Special Advisor of the Ministry of Justice and Public Security (MJSP), Betina Gunther, presented actions that will be implemented and highlighted the new website Suffered a Scam. And now?. The virtual page is hosted within the platform Gov.brwith practical, reliable, technical and organized information for citizens.

The website has ten trails with the most recurrent criminal conduct, with accessible language to guide victims in moments of vulnerability, but also to contribute to the prevention of these crimes. The content may be expanded, depending on the need to update illegal items or the emergence of others.

Among the topics initially covered are those that address recurring crimes: “They took my cell phone”; “They hacked or cloned my social network”; “They invaded my Gov.br”;

“There are ten trails and each of them leads to a series of steps for society. This service provides information and support at a time when each of us or people we know could fall for a scam.”

It was also announced the availability of information tools for citizens with data on the annual occurrence of digital banking fraud, by federation unit, by day of the week and by shift, in addition to the profile of the victims (education, sex, age).

To develop the plan, the National Alliance to Combat Digital Banking Fraud held weekly meetings, with the involvement of 357 specialists from 23 entities, from different areas of activity, in addition to the financial environment, such as telecommunications, retail and technology. The plan recorded more than 230 hours of work.