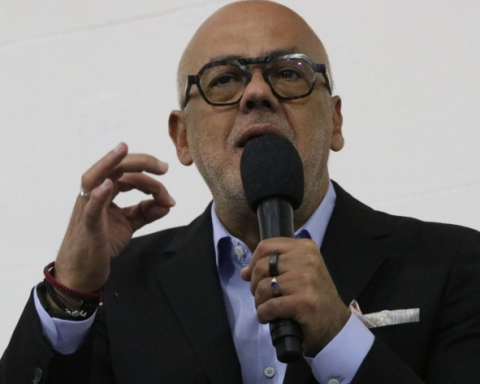

Close to defining a new interest ceiling for payroll loans for retirees and pensioners, the government has identified new problems, such as the revolving (fees charged on the installment of invoices) of this type of credit line, said this Friday (24) the Minister of Finance, Fernando Haddad. According to him, the matter is already being debated by the government.

“Many families are having problems getting out of the payroll rotation”, declared Haddad upon returning from a meeting of the government’s Political Council, at Palácio da Alvorada.

With regard to the new ceiling for payroll to beneficiaries of the National Social Security Institute (INSS), Haddad stated that the government is still analyzing the new level, while discovering new problems. “We’re analysing. Some banks are already offering a rate of less than 2% [ao mês], but we identified other problems that need, that even inspire more care, for example, the payroll loan rotation. So we are raising other issues to give a referral,” he said.

This Friday, government technicians and representatives of banks that offer INSS payroll loans met in São Paulo. Financial institutions presented a proposal for a new level that allows the resumption of granting this type of loan.

Next Tuesday (28), the new ceiling should be defined by the National Social Security Council, as announced this week by the Minister of the Civil House, Rui Costa. According to Haddad, President Luiz Inácio Lula da Silva’s official trip to China will not interfere with the decision because Lula and he will follow the discussions from a distance.

Historic

Last week, the National Social Security Council (CNPS) reduced the interest ceiling on payroll loans from 2.14% to 1.7% per month to INSS retirees and pensioners. The agency also reduced the rate limit for the payroll credit card from 3.06% to 2.62% per month.

At the end of the same week, several private and public banks, including Caixa and Banco do Brasil, suspended the INSS payroll loan offer. According to the Central Bank, only four financial institutions charged fees lower than 1.7% per month: Sicoob (1.68%), Cetelem (1.65%), BRB (1.63%) and CCB Brasil (1.31%). %).

On a visit to Haddad on Tuesday (21), the president of the Brazilian Federation of Banks (Febraban), Sidney Oliveira, said that the government and the banks need to get out of the impasse and reach a plateau that meets the government’s aspirations and also allows the economic viability of payroll loans.