The federal government published today (29), in the Official Diary of the Uniona provisional measure that modifies the rules for charging Corporate Income Tax (IRPJ) and Social Contribution on Net Profits (CSLL) on the so-called Transfer Prices.

Transfer Pricing is a way of controlling commercial or financial operations carried out between companies of the same multinational group that operate in different countries and are therefore subject to different tax rules.

The rules also apply in cases where one of the listed companies is headquartered in a tax haven. The main objective is to prevent the parties, when negotiating with each other, from manipulating the sale prices of goods or offering services.

For at least four years, the Federal Revenue has been developing, in partnership with the Organization for Economic Cooperation and Development (OECD), studies to improve national legislation, adapting it to international rules. In April of this year, the Minister of Economy, Paulo Guedes, confirmed the intention of the federal government to modify Brazilian norms, “adapting them to the best international practices”.

“As we succeed in this convergence, we avoid two evils: the evil of excessive taxation, double taxation that prevents investments; and the evil of evasion, through the transfer of profits to legislations that have more favorable taxation. This is fundamental because we allows for an efficiency gain, with effective allocation of investments throughout this global community that is embracing itself through the convergence of these practices”, said Guedes, on the occasion.

Controlled Transactions

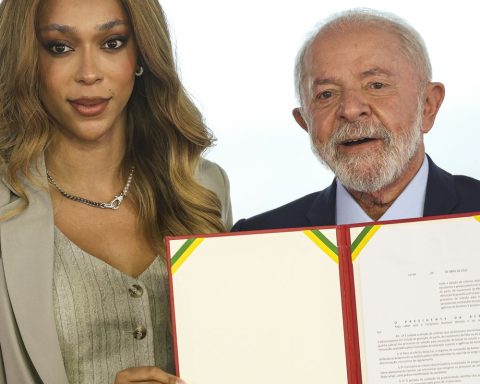

Signed by President Jair Bolsonaro and the Executive Secretary of the Ministry of Economy, Marcelo Pacheco dos Guaranys, the text of Provisional Measure (MP) 1,152 reinforces that the rules apply to controlled commercial or financial transactions, “including contracts or arrangements in any form and series of transactions”, focusing on companies headquartered in Brazil.

The controller and its subsidiaries are considered related parties; the entity and its business unit, when it is treated as a separate taxpayer for the purposes of calculating income taxation, including the parent company and its branches and associates.

Related parties are also entities included in the consolidated financial statements and those that have the right to receive, directly or indirectly, at least 25% of the profits of the other or its assets in the event of liquidation, in addition to entities that are, directly or indirectly , under common control or in which the same partner, shareholder or holder holds 25% or more of the share capital of each one or in which the same partners or shareholders, (or their spouses, partners, relatives, consanguineous or similar, up to the third degree) hold at least 25% of the share capital of each party.

Edited by the Presidents of the Republic in situations considered to be of relevance and urgency, the provisional measures are norms with the force of law, that is, they produce legal effects as soon as they are published in the Official Diary of the Union.

Despite this, they need to be subsequently appreciated by the Chamber of Deputies and the Senate, which can reject the proposal, approve it in full or propose changes to the original text, approving a Conversion Law Project (PLV)

According to the Executive Branch, MP 1,152/2022 seeks to correct “gaps and weaknesses existing in the current system” and “problems resulting from misalignment” with the standard established by the Organization for Economic Cooperation and Development (OECD).

Business environment

Still according to the Planalto Palace, these divergences “harm the business environment, the country’s insertion in global value chains, legal security and the collection of tax revenues”.

According to the Planalto Palace, approval of the measure is urgent due to a recent change in US tax policy. The US government no longer allows the tax credit for taxes paid in Brazil because of existing deviations in the Brazilian transfer pricing system in relation to the so-called Arm’s Length (ALP) principle. In addition, the Executive Power sustains that the approval of the text will allow a greater integration of the Brazilian economy to the international market.

The initial term of validity of an MPV is 60 days and is automatically extended for the same period if the vote is not concluded in both houses of the National Congress. If it is not appreciated within 45 days, counting from its publication, it enters into an urgent regime, suspending all other legislative deliberations of the house in which it is being processed.

*With information from the Senate Agency