The Popular App and its functionality for the self-management of claims were awarded by the Global Finance financial magazine as an “Outstanding Innovation in User Experience” and one of the first applications of this type for Latin Americax.

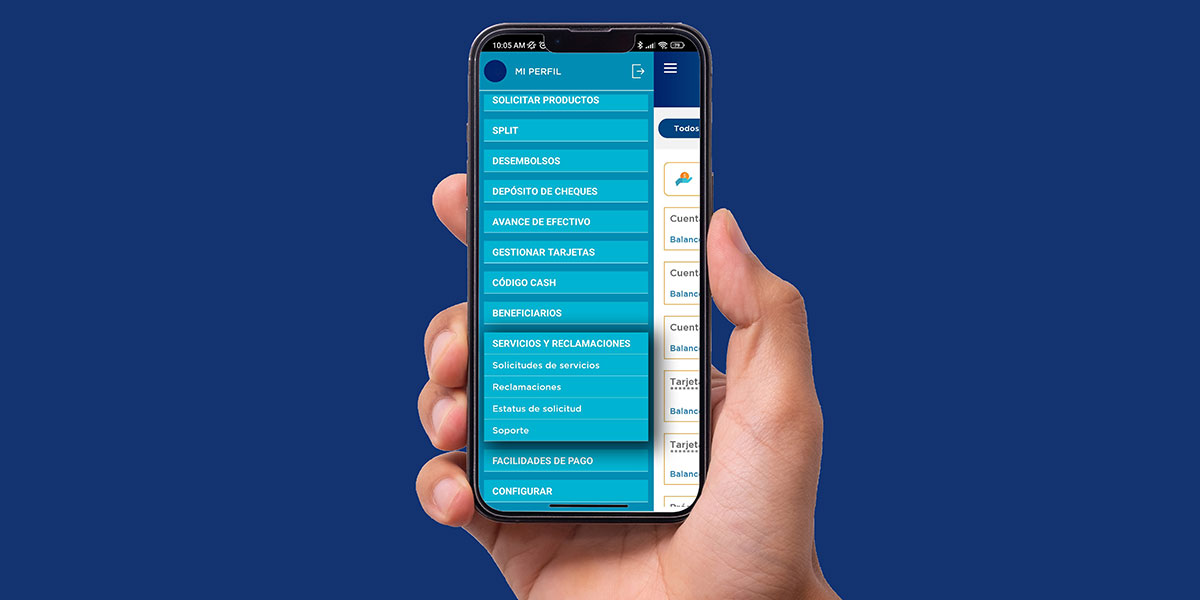

Thus, it enhanced the capacity of Banco Popular Dominicano to make it easier for its clients to process requests for financial products and services through their mobile phone. This digital service, a pioneer of its kind in the country and in the region, was launched in March of 2021 and covers requests for claims on deposits at ATMs, review of charges for arrears or financing, personal current accounts, savings and loans, withdrawals, transactions with credit cards and correction of fees or payments of products.

Results

Thanks to its streamlined design, applying using this functionality of the Popular App takes just five clicks. In turn, the client can follow the process, regardless of whether they filed their claim at a branch or directly through the mobile application. For the magazine, Popular’s mobile digital claims are an example that “there are no more disconnections between the online and offline worlds.” For this ease of service, the bank worked under the AGILE methodology, which prioritizes the needs of customers and their interactions with the offer of financial products and services, offering them a quick response and adding value to Popular’s commercial proposal.

During the past year, digital claims in the Popular App represented more than 45% of the claims made by customers, thus reflecting the high and rapid adoption of the use of this functionality by customers.

Users of this functionality highly appreciate its value, qualifying it as “easy to use and always at hand”, “fast and efficient”, “highly advanced technology” or “very practical and effective”, which demonstrates the positive impact that has had on their relationship with the bank, saving them a lot of time on travel.

APP Popular is one of the main channels

Currently, the Popular App is one of Popular’s main digital channels, registering a monthly average of 3.7 million transactions. In this way, of every 100 transactions carried out through Internet Banking and the Popular App, 70 are made through the application and 30 through the website, the bank said in a press release.