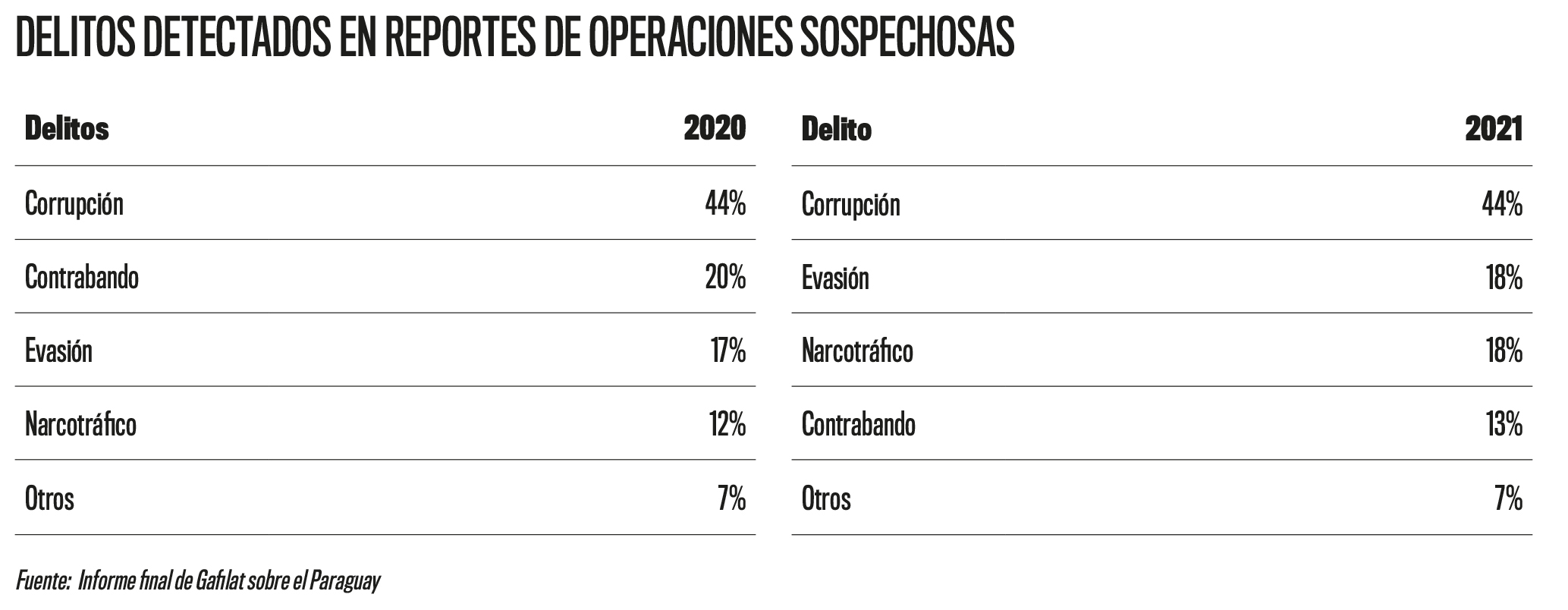

In the Gafilat evaluation report, it was revealed that up to 44% of the total money laundering suspicious transaction reports (STRs) are for cases of corruption and are encrypted directly to the State Attorney General, Sandra Quiñonez. However, in recent years the rate of sentences for money laundering is very low in relation to the intelligence reports received by the Public Ministry.

The final report on the examination that Paraguay gave before the International Financial Action Task Force (Gafilat) reveals that, in the last six years, the Financial Intelligence Unit (FIU) of the Secretariat for the Prevention of Money Laundering (Seprelad) A total of 748 reports were sent to the Public Ministry. The document indicates that of the total documents sent to the Prosecutor’s Office, 70% did not motivate the initiation of a criminal investigation, in most cases what happened is that the data was incorporated into cases that were already underway.

Until last year there were at least 39 cases of money laundering under investigation, of which only 9 convictions had been obtained. A fact that caught the attention of the evaluators is that in the Public Ministry the registration and follow-up of the cases is kept in an “Excel spreadsheet” that does not allow the statistics of the dependencies or prosecutors to which these reports were delivered to be saved. , or even, a feedback record of the follow-up that is being given to the causes. “For that reason, there is no certainty about the number of investigations that have been supported based on this information or their current procedural status,” the examiners noted.

Regarding how the information on the content of these intelligence reports moves, the document indicates that the vast majority reach the Superintendency of Banks of the Central Bank of Paraguay (BCP), but also and to a lesser extent, by other regulators. such as the National Institute of Cooperativism (Incoop), the National Securities Commission (CNV), the National Gambling Commission (Conajzar) and institutions such as the National Directorate of Public Procurement, the Supreme Court of Justice, the National Anticorruption Secretariat and the Superintendence of BCP insurance.

MAIN CASES

Up to 44% of all suspicious transaction reports are for cases of corruption and, in second place, crimes such as smuggling and drug trafficking appear. In the last six years, the number of these reports sent to Seprelad by reporting entities increased from an annual average of 2,840 STRs to a total of 17,107. 90% of these alerts came from the banking system.

The Gafilat highlights that in Paraguay the majority of money laundering investigations derive from the office of the Public Ministry, however, “the low number of open investigations is striking compared to the number of crimes identified as a threat of laundering or linked” . For the evaluators there are two important problems, there is little coordination between the investigation units and the authorities that prosecute these crimes, and, in addition, there are no clear rules to initiate parallel financial investigations.

All the financial intelligence reports that Seprelad sends go directly to the attorney general through an encrypted system and in which only she has the power to refer whoever shares this information so that they proceed to open an investigation.