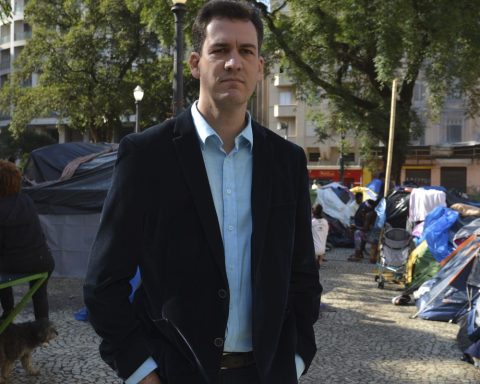

Pressure to tax the super-rich is expected to increase in light of the growing challenges posed by mitigating climate change. This is the bet made by Finance Minister Fernando Haddad. He celebrated the inclusion of the topic in the declarations approved by consensus during the 3rd Meeting of Finance Ministers and Central Bank Governors of the G20, which ended this Friday (26), in Rio de Janeiro.

“The demands for financing and new sources of financing for the ecological transition and the fight against poverty have been growing in the world. I think that the pressure and social mobilization around this agenda will also grow,” he said.

The minister had previously announced that he had reached an understanding that the texts of the declarations would include the recognition that it is necessary to deepen discussions on the taxation of the super-rich. In a new statement, shortly before the publication of the two documents agreed upon – the G20 Finance Track Communiqué and the Ministerial Declaration on Cooperation in Taxation -, he classified the explicit mentions of the topic as a victory.

“It is important that all taxpayers, including ultra-high net worth individuals, contribute their fair share of taxes. Aggressive tax avoidance or tax evasion by ultra-high net worth individuals can undermine the fairness of tax systems, which is accompanied by reduced effectiveness of progressive taxation,” the G20 Finance Track Communiqué says.

Further, the document makes a commitment. “With full respect for tax sovereignty, we will seek to engage cooperatively to ensure that ultra-high net worth individuals are taxed effectively. Cooperation could involve exchanging best practices, encouraging discussions around tax principles, and developing anti-tax avoidance mechanisms, including addressing potentially harmful tax practices. We look forward to continuing to discuss these issues at the G20 and other relevant forums.”

Taxing the super-rich is a priority issue for Brazil, which currently presides over the G20. According to Haddad, the content of the texts approved in consensus exceeded initial expectations and it is an important victory for the country and the international community. “Now the issue is included in an official document of the 20 richest nations in the world. This is no small feat.”

According to the Finance Minister, with the two declarations approved, taxing the super-rich ceases to be an issue for Brazil and becomes an issue for the G20, included in the international agenda. He also said that the Brazilian government will continue to insist on the issue, including in dialogue with South Africa, which will assume the presidency of the group at the end of the year.

“I had meetings with the OECD [Organização para a Cooperação e Desenvolvimento Econômico]Brazil holds meetings with the UN [Organização das Nações Unidas]which has its own working group on fair taxation. And I think we also have to bring together academic knowledge to try to put on the table possible ways of implementing this measure”, he added, citing economists who are international references on the subject.

Haddad also mentioned other issues that are highlighted in the documents, such as the fight against hunger, poverty and inequality; expansion of climate change financing; effectiveness of multilateral development banks; debt relief for the poorest countries; and reforms in global governance.

There are also mentions of the goals set in the 2030 Agenda, which established 17 Sustainable Development Goals (SDGs) adopted by the 193 UN member states at the United Nations Summit on Sustainable Development held in 2015.

“As climate change-related challenges accelerate around the world, the financial costs of building climate resilience in individual countries are increasing. We reiterate the importance of a policy mix consisting of fiscal, market and regulatory mechanisms, including, as appropriate, the use of carbon pricing and non-pricing mechanisms and incentives for carbon neutrality and net zero. The need to mobilize additional resources, private and public, national and international, to help address bottlenecks in the implementation of the 2030 Agenda is widely recognized,” the G20 Finance Track Communiqué says.

In the Ministerial Declaration on Cooperation in Taxation, emphasis was placed on consensus reached around the Global Alliance against Hunger and Povertywhose foundations were presented this week at an event led by Brazilian President Luiz Inácio Lula da Silva. The proposal seeks to bring together and foster the dissemination of successful public policies around the world, in addition to improving them based on knowledge and new technologies.

A third document, focused on geopolitical issues, was also released by Brazil at the end of the 3rd Meeting of Finance Ministers and Central Bank Governors. Moving these issues to a separate statement was a strategy adopted by the Brazilian presidency of the G20 to unlock dialogue.

“In the context of the 3rd Meeting of G20 Finance Ministers and Central Bank Governors, some members and other participants expressed their views on Russia and Ukraine and the situation in Gaza. Some members and other participants considered that these issues have an impact on the global economy and should be addressed at the G20, while others did not believe that the G20 is a forum to discuss these issues. The Brazilian G20 Presidency will lead the discussion on these issues in the coming months, in preparation for the Rio de Janeiro Leaders’ Summit,” the statement said.

The world’s 19 largest economies, as well as the European Union and more recently the African Union, have seats in the G20. The group has established itself as a global forum for dialogue and coordination on economic, social, development and international cooperation issues.

In December last year, Brazil succeeded India as president. This is the first time the country has held this position under the current G20 format, established in 2008. At the end of the year, Rio de Janeiro will host the G20 Summit, and the presidency of the group will be transferred to South Africa.

Pillar Three

Haddad has referred to the agenda of taxing the super-rich as Pillar Three. This is a provocation by the minister to stimulate debate. Within the OECD, there have been discussions for some years about the so-called Pillars One and Two, which involve taxation on multinational companies. Consensus around them has also been a challenge.

Brazil advocates that countries coordinate the adoption of a minimum tax on the super-rich. However, there is resistance. For example, the US Treasury Secretary, Janet Yellen, has said that high-income individuals should pay a fair amount, but that she does not see the need for a global pact, and that it is up to each government to address the issue internally.

Haddad considers that “there is no impediment for individual countries to take domestic measures from the point of view of their tax sovereignty. Spain and Italy, for example, have anticipated Pillar One and have already approved national laws that regulate the taxation of multinationals operating in these two countries. Brazil is also studying this matter. If we cannot sign an international convention quickly, countries will make decisions individually. But the best solution is always to reach consensus because it is more efficient.”

The Brazilian minister has also assessed that, without global coordination, countries end up getting involved in a tax war. “These issues that require consensus building are always very delicate,” he says.