Guillermo Reyes emphasized that forcing the SOAT to be submitted in order to carry out any type of procedure in the Transit and Transportation offices could be an alternative to comply with the insurance.

Colombia News.

It was in the middle of the International Insurance Convention, organized by the Federation of Colombian Insurers (Fasecolda) where the Minister of Transportation gave the statements that have more than one “seriously thinking” about what is coming for Soat in Colombia.

Guillermo Reyes stated that in the face of the crisis that is being experienced today due to the collection and fulfillment of this compulsory insurance, it would not be too much, it is to do it “the hard way”.

In his proposal, the head of said portfolio stated that he seeks to solve the problem of road accidents and access to SOAT.

Reyes emphasized that according to figures from the National Road Safety Agency “of the 17.3 million vehicles in the country, 8.17 million do not have valid insurance.”

Therefore, it ensures that “the only way to demand that the SOAT be in force is that it be required for all procedures that are intended to be carried out before the Transit and Transportation offices.”

This would be accompanied by implementation “of the New National Plan for Road safetyfocused on having safe vehicles, infrastructure, behaviors and speeds.”

6️⃣. For the Government of Life, it is essential to advance in initiatives that care for the integrity of Colombians on the roads, promoting social, economic and environmental justice, which result in a Total Peace positively impacting all communities. pic.twitter.com/UIooFalXJA

— MinTransporte (@MinTransporteCo) September 15, 2022

SOAT in intensive care

They specify that the high accident rate and SOAT fraud have generated this crisis.

According to figures from Fasecolada, the Colombian automotive fleet is 17.6 million vehicles, of these 10.5 million are motorcycles.

But what is striking is that despite being the main means of transportation for Colombians, it is also the one with the most victims.

They add that those who end up being the protagonists of these road incidents are mainly people under 30 years of age, “who in the middle of the productive stage are seriously injured, disabled or, in the worst case, die on the roads of our country.”

It is noteworthy that according to the figures, “for every $100 premium received for the SOAT of a motorcycle, $174 are paid in claims.”

But in addition, “insurance companies detected irregular insurance charges for about $456,000 million that were reported to the competent authorities.”

Situation that has led to catalog as critical what happens with the SOAT.

- “This insurance model made it possible to overcome, for those injured in traffic accidents, the inhuman walk of death, and it increasingly resembles a terminally ill patient that no one wants to take care of. El Soat, the insurance that saves lives, is in intensive care,” said Miguel Gómez, president of Fasecolda.

Evils of SOAT

- Evasion: Of the 17.6 million vehicles circulating in the country, only 9.3 billion have a valid Soat, that is, 47% evade compliance with the obligation to have insurance. 61% of motorcycles do not purchase this insurance.

- Accident rate: 10.5 million motorcycles circulate in Colombia and in 87% of traffic accidents with injuries, there is a motorcycle involved.

According to studies:

“They confirm that the main affected are men under 30 years of age, with a lack of experience and expertise in driving these vehicles, to which is added the null elements of active and passive safety and poor road infrastructure. For the year 2022, our estimates determine a record number in history: This year there will be some 940,000 injured on our streets and more than 7,600 deaths: an ignored national drama that does not receive enough attention from the State. This is a serious public health problem that is the second leading cause of violent death in Colombia.

- Fraud: As stated by Fasecolda, it has been discovered by health service providers “that the SOAT is a silver mine and they inflate the care of the injured to the limits allowed by the coverage.”

“A minor accident ends up consuming the guaranteed levels, making the financial model unviable. There are also all those who, having accidents not related to mobility, lie to obtain the medical care that traffic insurance offers.

- Insufficient rate: Fasecolda emphasizes that in order to learn more about the situation, it is important to understand “that the SOAT rate is subsidized for motorcycles.”

«Motorcyclists pay for insurance 3.7 times less than what corresponds according to their accident rate, on the other hand, family vehicles pay insurance 9.5 times more expensive to cover that subsidy. Since 2013 the number of motorcycles exceeded that of other vehicles in the country, this trend has increased and in 2022, the country is expected to break the record and sell more than one million additional motorcycles.

- Outdated regulations: another of the points that stand out as the cause of the SOAT crisis would be related to the demands and coordinated actions of the entities responsible for health and mobility issues.

- Motorcycles without safety equipment: This is another of the important factors and that even many clients detail.

“Most of the motorcycles sold in Colombia could not be marketed in other countries because they do not meet the minimum safety requirements, for example, ABS braking systems.”

They state that a recent study by Cesvi Colombia that included a sample of more than 600,000 motorcycles sold in Colombia, of which 97% corresponds to motorcycles between 0 and 250cc, showed that:

- «Only 6% of the lines sold between 0 and 125cc have LED brake lights and turn signals; 1% have CBS combined brake system, 23% have LED daytime running light and 76% have front disc brake.”

- «None of the 82 lines analyzed have the equipment required to meet the safety baseline of international standards. In this sense, Colombia has not had a defined regulation to prevent and reduce accidents on the road.

The data

Taking into account the figures of phasecoldaAs of December 2021, the SOAT “recorded losses of $192 billion and in the first half of 2022, it already had a deficit of $138 billion.”

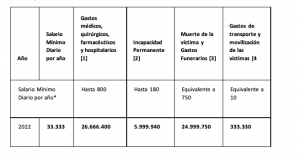

It highlights that this insurance, in addition to covering claims, also “allocates a percentage of the premium for contributions and transfers to State entities”:

«Of every $100 that the citizen pays for his policy, $54.3 are to pay claims and the operation of the insurance and $45.7 for contributions and transfers. The national budget would be affected by $8 billion if the SOAT disappears and all the financing for the care of traffic accident victims remains in the hands of the government.