The National Superintendence of Customs and Tax Administration (Sunat) approved the new income limits that will allow workers to suspend payment of income tax (GO). These changes are made due to the increase of the ITU to S/5,500.

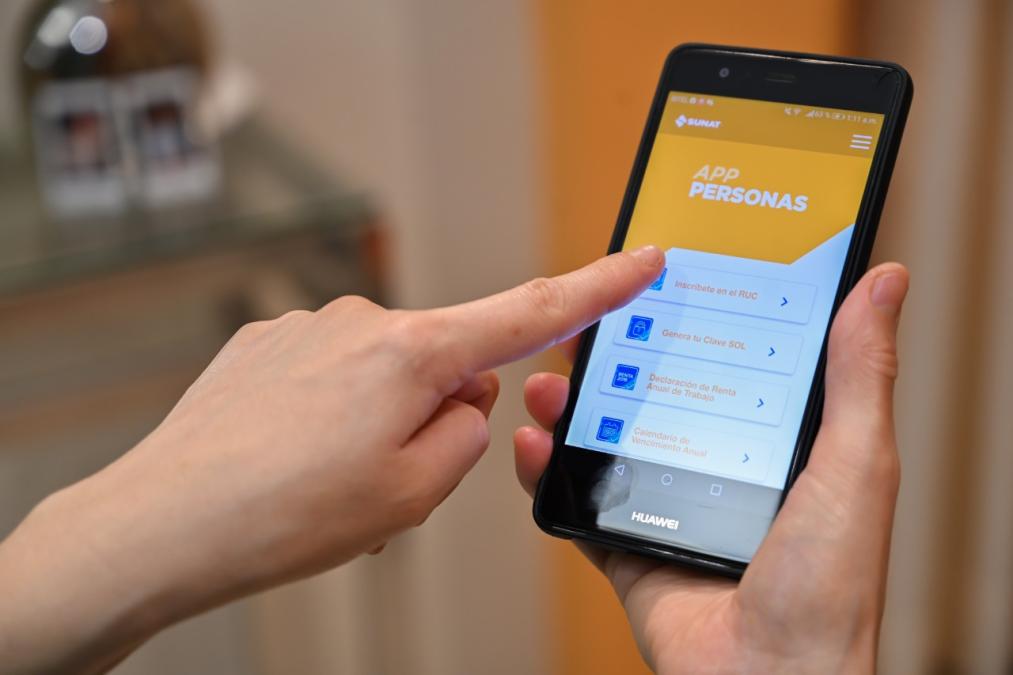

According to Sunat, the procedure is virtual and free. To do so, people must enter www.sunat.gob.pe, locate the “Online Operations” option and select the “My procedures and Consultations” alternative.

In the “Other declarations and Requests” section, you must choose “Request for Suspension of Withholdings 4th Category” (Virtual Form 1609). Subsequently, the date on which the first income for Fourth Category Income was received and the total amount received or projected for the year must be recorded.

Who can benefit from the benefit?

Sunat reported that this benefit is for taxpayers who during 2026 have fourth category income or fourth and fifth category income that does not exceed S/4,010. Additionally, they can qualify if they project annual income that does not exceed S/48,125.

“Those who perform functions such as company directors, trustees, agents, business managers, executors or similar who receive income for said functions and also others of fourth and/or fifth categories may also qualify, as long as their total monthly income does not exceed S/3,208 and their annual income does not exceed S/38,500,” Sunat stated.

Receive your Perú21 by email or WhatsApp. Subscribe to our enriched digital newspaper. Take advantage of the discounts here.

RECOMMENDED VIDEO