The Credit Guarantee Fund (FGC) reported that it had already made payments of R$32.5 billion to 580,000 Banco Master creditors as of early this Thursday afternoon (29).

The volume corresponds to 80.05% of the total amount foreseen for disbursement and reaches 75% of investors entitled to the guarantee.

Payments started on the 19th and gained pace after technical adjustments that improved the performance of the fund’s systems.

The FGC estimates the need for approximately R$40.6 billion net to cover guarantees related to Banco Master, extrajudicially liquidated by the Central Bank in November. The value represents around a third of the resources available in the fund.

According to the FGC, there are around 20 thousand requests being processed, which depend on action from the creditor.

Although, in most cases, release is quick, the fund informs that security and fraud prevention procedures may require additional verification steps, which may affect individual deadlines for releasing funds.

>> Follow the channel Brazil Agency on WhatsApp

Will Bank

In addition to the Master, the FGC will also have to honor guarantees related to Will Bank, which had its settlement decreed this week by the Central Bank. The estimate is an additional disbursement of R$6.3 billion.

The start of these payments depends on the submission of the creditors’ database by the liquidator appointed by the BC and there is still no defined deadline for the release of the amounts.

The fund highlighted that, As Will Bank has been part of the Banco Master conglomerate since August 2024, the coverage limit of R$250,000 per CPF or CNPJ is not doubled. Therefore, customers who have already received the maximum ceiling upon settlement from other institutions in the group will not have additional amounts to receive.

“The creditor who has already received the guarantee limit value of R$ 250 thousand will not have new payments, since all institutions belong to the same financial conglomerate”, informed the FGC last week.

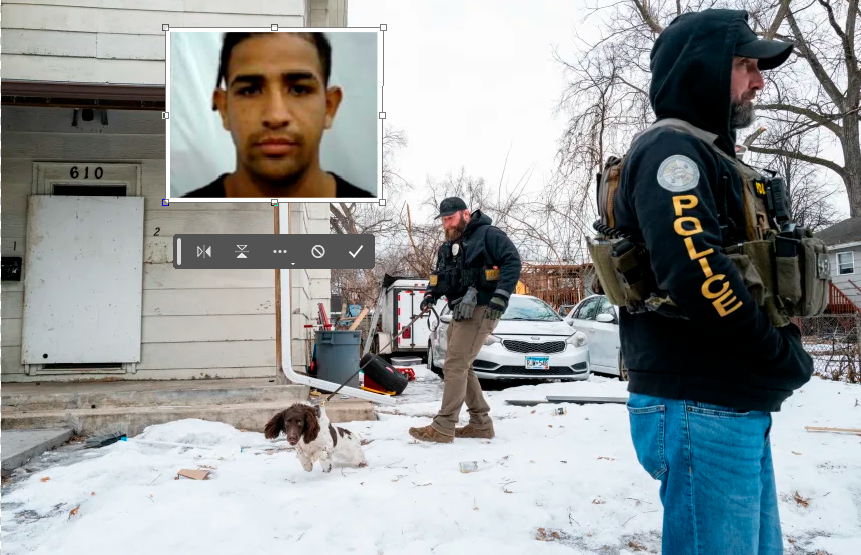

Banco Master was subject to extrajudicial liquidation on November 18on the same day that its controller, Daniel Vorcaro, was arrested in a Federal Police operation investigating suspected billion-dollar fraud. He was later released and remains free to investigate, under precautionary measures.