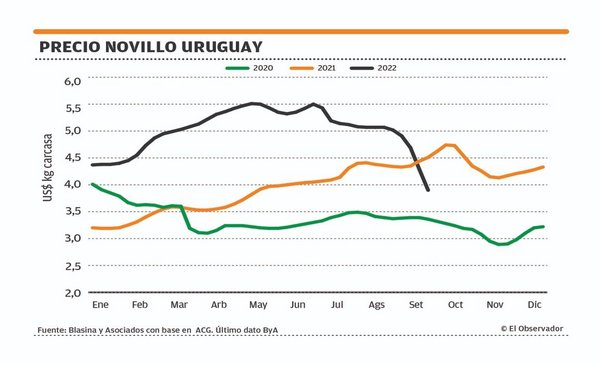

Since May 2021, the steer has not fallen below US$ 4 per kilo. That is what happened this week with the value proposal by some refrigerators. The collapse of fat cattle is accentuated, although with a more moderate adjustment than last week.

What is not moderated is the drop in prices that China is proposing for beef that according brokers and industrialists consulted, this week has shown a decline of up to US$ 500 per ton for some cuts.

In this international scenario, industrial caution increases and the demand for cattle is very restricted.

In Uruguay in one month the price of the steer fell one dollar. There are plants that are already offering between US$3.80 and US$3.90 per kilo on fourth scale. There are plants without operating and others scoring without paying a price. Entries run through the second week of October. If there is any occasional need for the cattle, it is possible to pay a little more in quality batches. “We have not done business for less than US$4,” said Gustavo Basso, from Gustavo Basso Rural Businesses. A little more offer appears, without being bulky. There is resistance to validating this collapse, in a scenario that continues to be clearly bearish.

For the fat cow, the industry’s proposal is between US$3.60 and US$3.70 and it ranges from US$3.70 to US$3.80 for the heifer.

Carlos Pazos

Cattle slaughter at low levels, for several weeks.

industry brake

The slowdown in industrial activity is decisive, which between the first week of June and last week registered a year-on-year drop of 26.4% in the volume of fish. Last week it fell below 40,000 heads: 37,278 cattle.

Although China maintained record levels of beef imports in August, according to Customs data that came out this week, Brazil keeps most of the cake. While in Uruguay exports fell in August, in the northern country they were record. With a steer that continues to trade below Uruguay and that as of September 20 showed the lowest average since December 2021: US$ 3.85 per kilo.

The strong price correction for beef that has been reported by different market operators has not yet been reflected so clearly in the export price published weekly by the National Meat Institute (INAC), with a delayed between closing deals and reported prices. Last week the ton averaged US$5,300, according to INAC. And in the last 30 mobile days it was US $ 5,098.

EO

Very climatic market

In a very climatic market, with smaller volume rains that have arrived mainly to the north, uncertainty increases and affects the decisions of the producer.

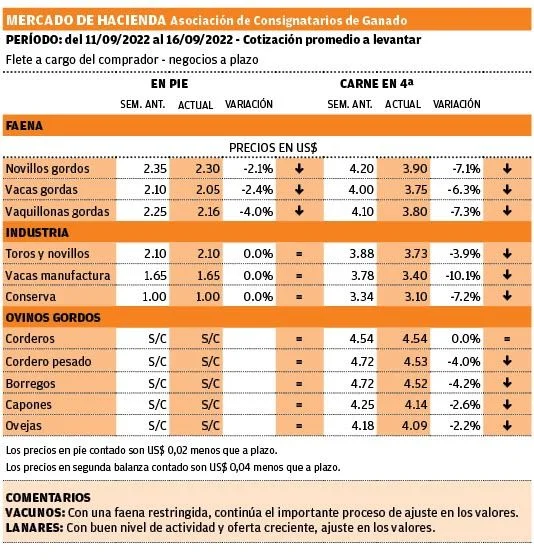

Caution prevails in the replacement market and the fat man drags prices down. All categories had red arrows on this week’s Livestock Shippers Association (ACG) grid. The calf is around US$2.95, the veal was US$2.86 and the wintering cow, US$2.06.

From the feedlotero sector, concern has been expressed about a slowdown in the exit of the cattle from the pens, with delays of up to 30 days, and a sharp rise in costs. “Each day that an animal is ready in the pen is a day of inefficiency and if we add to that a price correction as violent as the one that took place, the experience has been very painful,” Basso pointed out.

In sheep farms there is a seasonal price correction. There is an increase in supply. Prices continue to fall and this week they are around US$3.30 for capons and US$4 for lamb, with arrivals from mid-October onwards.

The value of a ton of exported sheep meat was below that of beef last week, with an average of US$ 4,886 compared to US$ 5,058 the previous week. In the last 30 mobile days the price was US$ 5,145. And so far this year it reaches US$ 5,208, 4.4% above the US$ 4,986 a year ago.