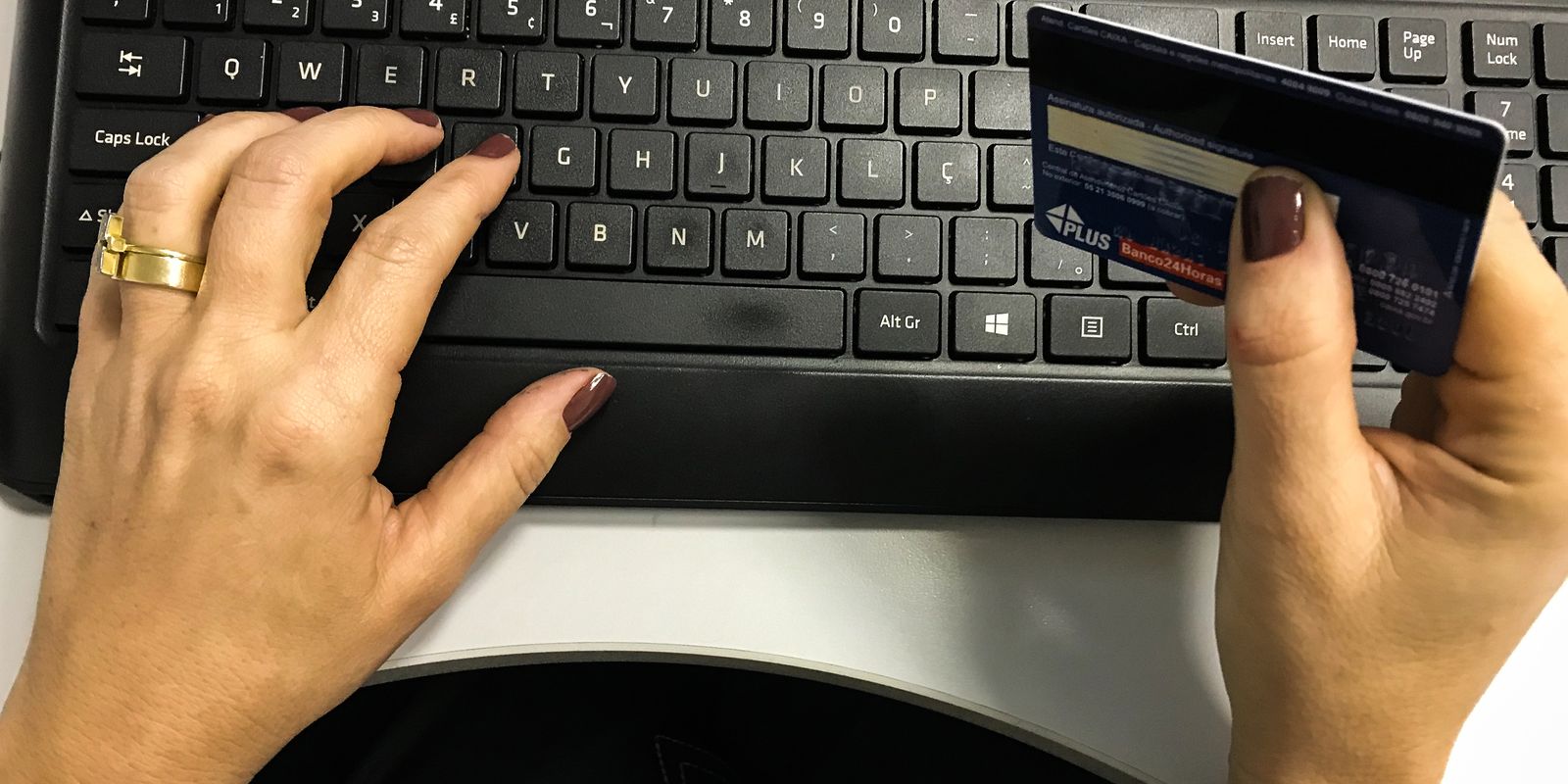

Credit card operators and payment institutions that handle financial resources must provide information to the Federal Revenue Service about taxpayers’ financial transactions. Data will be sent every six months.

The rule came into effect this Wednesday (1st) and is set out in the Normative Instruction 2,219, of 2024 of the federal agency.

In a note, the Federal Revenue states that the measures aim to improve the control and supervision of financial operations, through greater data collection.

“[As medidas] reinforce Brazil’s international commitments, contributing to the fight against tax evasion and promoting transparency in global financial operations”, reinforced the note from the Federal Revenue Service.

The standard updates and expands the obligation to send information to the Federal Revenue via e-Financeira, which is the Federal Revenue’s electronic system that is part of the Public Digital Bookkeeping System (Sped).

e-Financeira monitors and collects information about financial operations. Digital files include registration, opening, closing, financial operations and private pension data.

Institutions

Traditional financial institutions, such as public and private banks, finance companies and credit unions, were already required to send information about their customers’ financial transactions to the Federal Revenue Service, such as current account balances, redemption transactions and investments by account holders, income of applications and savings.

With the change that comes into force in 2025, the obligation to provide information regarding postpaid accounts and electronic currency accounts also falls to credit card operators and payment institutions.

The latter are companies authorized by the Central Bank to offer financial services related to payments, such as transfers, receipts and card issuance. These include payment platforms and applications; virtual banks; and large retailers, such as department stores, selling household appliances; and wholesalers.

Submissions

The new entities listed in the Federal Revenue standard are required to present the information mentioned when the amount handled in the month exceeds R$5,000, for individuals; or R$15 thousand, for legal entities.

The data must be presented via e-Financeira every six months:

· until the last business day of August, containing information relating to the first half of the current year; and

· until the last business day of February, containing information relating to the second half of the previous year.

In this way, payment data via Pix and credit cards greater than the amounts mentioned will be reported to the Federal Revenue – via e-Financeira – in August 2025.