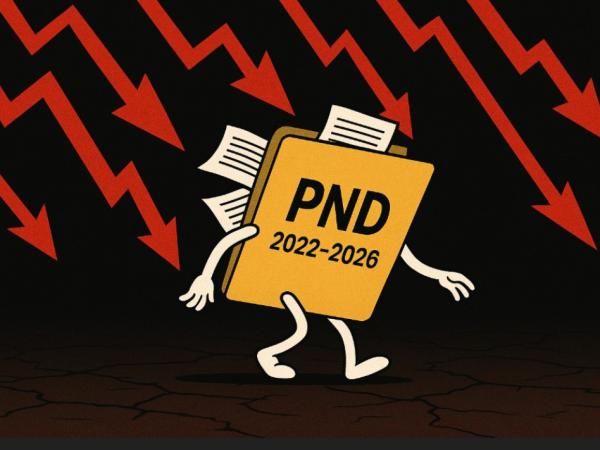

Default between families living in the state capital grew in July, reaching the highest level since April 2024, pointed out a survey by the Federation of Commerce of Goods, Services and Tourism of the State of São Paulo (Fecomerciosp).

According to the Federation, The percentage of delinquent homes went from 21.6% in June to 22.1% in July, with 905.7 thousand homes with late accounts in the city of São Paulothe. There was also an increase in comparison with the same month last year, when 19.9% of default was recorded.

The survey also pointed out increase among homes that will not be able to pay off debts, which went from 8.2% a year to 9.1% in July this year.

Already The number of indebted families in the state capital retreated in July, interrupting a sequence of high.

The percentage of debt homes went from 71.4% to 70.9%, representing about 2.9 million families. According to the Federation, the credit card remains the main indebtedness factorfollowed by real estate financing (15.7%).

Although default is growing, the Fecomerciosp points out that “data indicate that income conditions are gradually improving, with short -term concentrated delays and low income commitment”.

In addition, the federation said, “the warm labor market and the most controlled inflation should help to contain the deterioration of the financial scenario of families.”

Consumer debt and default research (PEIC) is conducted monthly, interviewing about 2,200 consumers in the state capital.

The objective of the research is to analyze indebtedness levels, when the family has some debt, and default, when the debt is in delay.