The companies of the Mexican Stock Exchange (BMV) will suffer a decrease of up to 13% in the value of their sales in Europe during the second quarter of 2022, due to the depreciation of the euro, which this Wednesday broke parity with the dollar

The average price of the euro in the second quarter of 2022 was 21.3535 pesos, while in the same period of 2021 it was 24.1230 pesos, which represents a drop of 12.97 percent

In dollars, the euro traded on average at 1.0645 units in April-June 2022 compared to 1.2050 units in the same period last year, for a drop at an annual rate of 11.66 percent.

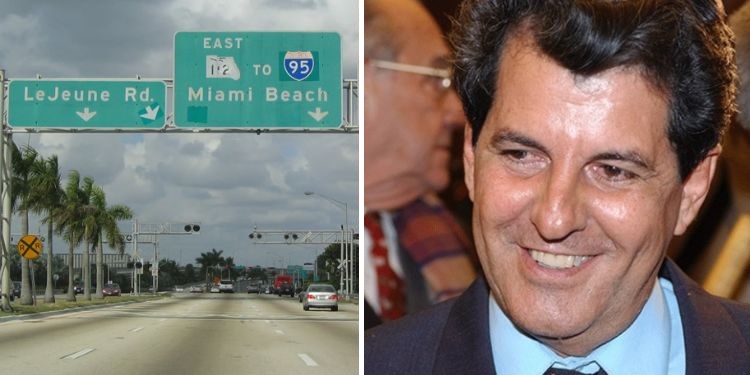

Juan Rich, director of Stock Market Analysis and Strategy at Banco Ve Por Más (Bx+), explained that due to this fall, the euro is now going to “play against” Mexican companies, because for each common European currency received in the period April-June 2022, Mexican companies will obtain 12.97% less pesos or 11.66% less dollars, depending on how they report their results.

Yes, there is an important impact if you have operations in Europe, because the exchange rate is negative”, he stated. “The biggest impact could be seen in the third quarter if the euro maintains current levels.”

So far this year, the European currency depreciated 11.51% due to the strength of the dollar and fears of recession in the euro zone due to the war in Ukraine, for a euro-dollar parity at the close of this Wednesday of 1.0059 units .

During the day, the euro touched a minimum of 0.999 units per dollar, the first time in two decades that it has a lower value than the United States currency.

“It will be a difficult year for Mexican companies with a presence in Europe, not only because of the depreciation of the euro, but also because economic uncertainty, inflation and the war in Ukraine will cause pressure on their results,” said Juan Rich.

Carlos Hermosillo, an independent analyst, assured that the companies that are going to be most affected are those whose total income comes to a greater extent from their sales in the Old Continent.

The restaurant operator Alsea would be the most affected company on the BMV, since 34.2% of its total income comes from the European market, a figure greater than that of any other issuer, according to its latest financial results.

The second most affected firm will be the producer of synthetic polymers Orbia, whose sales in Europe represent 33.3% of its sales, and the auto parts manufacturer Nemak, which in the second quarter of 2022 obtained 32.92% of its total income from that area. .

The fourth most affected would be the Monterrey conglomerate Alfa, whose sales in Europe represent 29.9% of the total, followed by Cemex (22%).

Other companies that would also suffer the impact are the telecommunications giant América Móvil, owned by Carlos Slim, whose revenues in Europe accounted for 11.72% of the total in the second quarter of the year, as well as Gruma, for which the European market represents 9.2%. of all your sales.

The largest tequila maker, José Cuervo, as well as the Bimbo bakery, also derive a portion of their total revenue from Europe.

European currency resists against the dollar

The dollar fell from a 20-year high on Wednesday and the euro returned above parity, after a brief slide, after data showed US consumer price inflation spiked in June to a high of more than 40 years old.

Following the US inflation data, the euro fell to $0.9998 per European currency, breaking the $1 level for the first time since December 2002, before recovering to trade at $1.0059.

Analysts consider that the single European currency has a support in the area of 1 dollar.

The dollar index reached 108.59 points, the highest since October 2002, before falling back to 107.95 points.

The euro has depreciated almost 12% this year and fell to a 20-year low on Tuesday, as the war in Ukraine triggered an energy crisis that hurt euro zone growth prospects.

Germany has moved into the second stage of a three-tier emergency gas supply plan and has warned of a recession if the flow of Russian gas is stopped.

Atlanta Fed President Raphael Bostic said on Wednesday that higher-than-expected June inflation could require monetary authorities to consider a 100 basis point hike at their policy meeting this month.

(With information from Reuters)