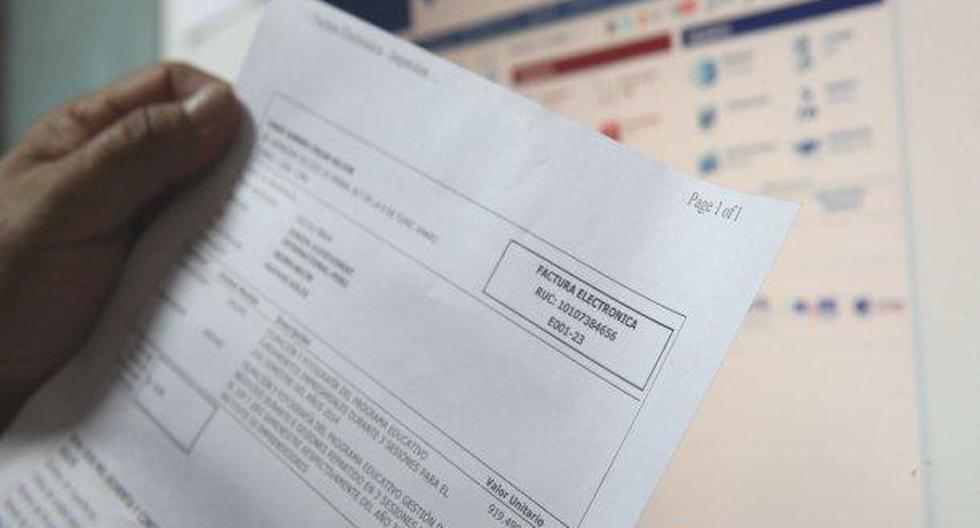

According to Superintendency Resolution No. 128-2021/Sunat, as of today, Wednesday, June 1, all group companies with revenues of less than 23 UIT (S/ 105,800) must invoice and/or issue sales receipts electronically.

“We are talking about about 400,000 micro and small companies (mypes) that have an annual turnover of less than S / 105,800”, points out the general manager of the Tandia electronic sales and invoicing system, Álvaro Ravichagua.

“According to the Tax Code, the penalty for not issuing electronic payment receipts can be equivalent to 50% of 1 UIT (S/ 2,300) and reach up to 2 UIT (S/ 9,200). This in the first recognized fault. From the second fault, the closure of the company is applied “, add.

So how can you quickly move to electronic invoicing? Although Sunat has its own electronic invoicing system, its use can be complicated and slow for many entrepreneurs, not to mention that this platform has frequent crashes. The other way is to register in a sales system, which allows you to process electronic invoices and bills easily and quickly.

“These specialized platforms allow you to create receipts in three steps, even without an internet connection. In addition, they have other functionalities, such as registration of sales through cash, cards, Yape and Plin, cash control, inventories, registration of accounts receivable and real-time reports, which mean a solution for entrepreneurs and mypes. Moving to electronic invoicing is an urgent step towards digitization”Ravichagua points out.

It should be remembered that the process of making electronic invoicing mandatory in Peru began in 2018 and, although the pandemic slowed its progression, we currently have more than 230,000 companies that already use electronic proof of payment.

“With the implementation of the electronic invoice and the bill of sale in mypes, the number of companies that use electronic payment receipts on a daily basis will increase to more than 400,000 before the end of the year”, concludes the specialist.

According to the Ministry of Production, more than 1.7 million formal MSMEs operate in Peru. This segment represents 99.5% of all formal companies: 95.2% are micro-enterprises, 4.1% small and 0.2% medium-sized, of which few are aware of other alternatives for invoicing electronically, in addition to Sunat.