Different economists from Argentina, and with projection on Wall Street and the academic world, supported the agreement with the International Monetary Fund (IMF), even in the new geopolitical and economic context that suddenly installed the war between Russia and Ukraine, and highlighted the approval of the project in the Chamber of Deputies.

The partner of AdCap Grupo Financiero, Javier Timermanexpressed that “the agreement has two very positive things: on the one hand, it is a realistic agreement that allows both the IMF and Argentina to give each other an opportunity to generate mutual trust.”

In this sense, he explained that “an agreement with very long-term objectives would be very difficult to meet, instead with objectives subject to revisions of a two-year program, until the entire package is renegotiated, and demonstrate compliance given history with the Fund is positive,” Timerman considered in a dialogue with Télam.

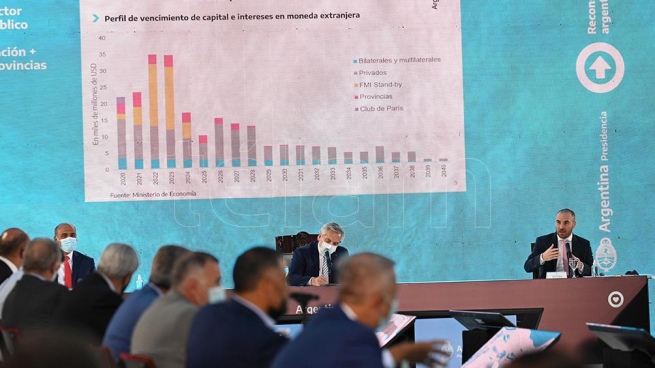

In addition, he highlighted the result of the vote in Deputies in favor of the agreement with the fund for refinance the debt of US$ 44,500 million contracted by the government of Mauricio Macri.

“An agreement with very long-term objectives would be very difficult to meet, instead with objectives subject to revisions of a two-year program, until then the whole package is renegotiated again, and demonstrate compliance given the history with the Fund, is positive”Javier Timerman

“What enhances the positivity is that for the first time there is a political commitment between two very opposing forces, not so much in terms of policies but in terms of manners, and that shows maturity in Argentine politics, which is the most important thing for investors, who see that mistrust goes through politics, and not so much through the economy,” Timerman said regarding the result of the vote in the lower house.

In this way, he considered that “the market is seeing a positive change since yesterday (for Thursday), the possibility of dialogue between two political forces that gather 90% of the votes, a dialogue that will be needed for the next 20 years “.

When asked about the reality imposed by the situation of the war between Russia and Ukraine and the risks of not meeting the proposed objectives, he minimized that this causes short circuits with the Fund regarding the progress of the program and disbursements.

“If anything characterizes the new world financial engineering, it is the ability to adjust to external shocks and to get out of orthodoxy, and the Fund’s technical team will know how to evaluate the shocks of the war, as it did with the pandemic,” he assessed. .

While Nobel Laureate in Economics, Joseph Stiglitzreaffirmed his support for the agreement reached by the Executive Power, beyond warning that the war “inevitably will experience shocks” for Argentina “positive and negative.”

“Given that Covid-19 remains omnipresent and in view of the ongoing geopolitical conflicts, the risk of negative incidences is real,” the Nobel Prize winner deepened.

“After promoting failed adjustment policies for a long time, the International Monetary Fund has accepted an agreement that will allow the government of Argentina to follow a pro-growth strategy. The task now will be to manage the inevitable shocks that will arise from the tumultuous global economic environment. current,” Stiglitz considered in a joint publication with the co-director of the Center for Economic and Political Research in Washington, and an expert on the Argentine case, Mark Weisbrot, in the publication Project Syndicate.

“Argentina, for its part, has demonstrated the benefits of an alternative, growth-focused strategy. When the economy is allowed to expand, tax revenues can rise rapidly,” the economists noted, while criticizing the loan granted to Argentina. Mauricio Macri “without conditions”, which caused “capital flight, economic contraction and dizzying inflation, which reached 53.8% in 2019”, they pointed out.

“After promoting failed adjustment policies for a long time, the International Monetary Fund has accepted an agreement that will allow the government of Argentina to follow a pro-growth strategy. The task now will be to manage the inevitable shocks that will arise from the tumultuous global economic environment. current”Joseph Stiglitz

For its part, the economist of the consulting firm PXQ and former Vice Minister of Economy of Cristina Fernández de Kirchner, Emanuel Álvarez Agishighlighted that the understanding allows stabilizing the negative dynamics that the balance of payments brought.

Álvarez Agis described as “a great achievement” to have reached an agreement where the Fund tends to guarantee the goals of international reserves to stabilize the economy, during a conference organized by the MegaQM Space.

According to the economist, in general in the agreements “the Fund usually asks you to accumulate reserves, and in this case it pays us to make a reasonable monetary policy; that you do not delay the exchange rate, you raise the rate to positive levels in real terms , helping to calm expectations and improve yields”.

In this case, “the Fund says just in case I put the money and see if that helps to stabilize,” he added.

However, he warned that the current geopolitical context of the Russian-Ukrainian war seriously changed the economic dynamics.

“The Fund usually asks you to accumulate reserves, and in this case it pays us to make a reasonable monetary policy; not to delay the exchange rate, raise the rate to positive levels in real terms, helping to calm expectations and improve yields”Emanuel Alvarez Agis

“Meeting these goals is a before and after, of the Russian invasion of Ukraine,” with an assumption of an import price of LNG of 20 dollars, and all this dynamic changed dramatically as a result of the conflict, he said.

However, he also clarified, like Timerman, the impact on the relationship with the IMF, since in the event, “we would not be dealing with non-compliance but with exogenous shocks,” Álvarez Agis pondered.