Experts and representatives of the productive sector, including workers, classify as advance the approval by the House of Representativesof the bill exempting from Income Tax Collection (IR) who receives up to R $ 5,000 and reduces the amount charged from employees who have salaries of up to R $ 7,350.

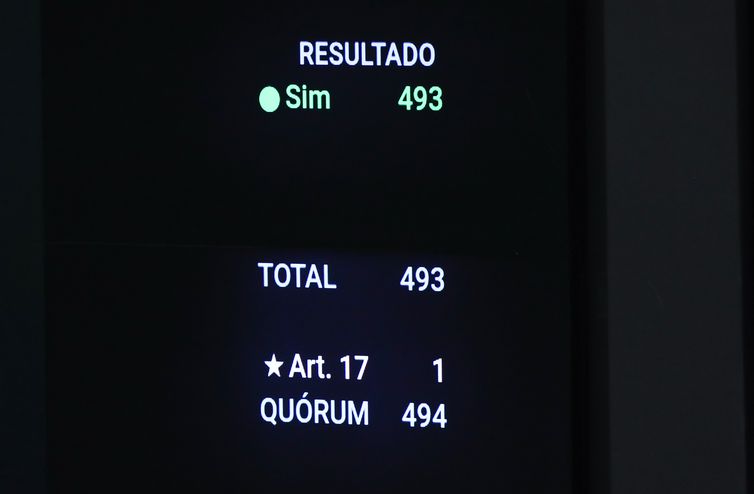

THE Brazil agency consulted economists and business and labor entities on the Bill (PL) 1087/25which goes to the Senate after being unanimously approved on Wednesday night (1st). If the whole process is completed later this year, with approval in the Senate and Presidential Sanction, the relief in the paycheck the workers will be effective from January 2026.

“The approval was historical and shows that the theme of taxation mobilizes society and has a political space to advance with more proposals,” says economist Pedro Rossi, from the State University of Campinas (Unicamp).

“It was a gigantic step, a very large victory for the working class”, celebrates the national president of (Single Workers’ Central) CUT, Sérgio Nobre

Tax justice

Unicamp economist Luiz Gonzaga de Mello Belluzzo points out that, in addition to the collection issue, tax collection systems have the function of acting on income distribution.

“[A aprovação] Marks the distributive character of the tax system, ”he says to Brazil agency. “The main purpose is to interfere with the distribution of income, which, if left to luck, will expand inequality,” he says.

Belluzzo, who has a career passing through public, private and governments, points out that another effect of exemption will be felt on the economy.

“Necessarily, you will have a boost for the growth of the economy,” he says. For him, In addition to increasing consumption, the country should experience investment expansion, which will mitigate inflationary effects.

“Investments provide advancement in production capacity,” he adds. Thus, the largest demand for products would be accompanied by increased production without pressing up prices.

Breath

The researcher Institute of Applied Economic Research (Ipea) Pedro Humberto de Carvalho estimates that The lower middle class should have a monthly breath of $ 350 to $ 550, on average.

“An impact that can be spent – this budget clearance – on food and services. It will positively benefit the economy.”

Nevertheless, Carvalho recognizes that there may be an impact on service sector inflation. “Increased middle class income increases consumption by services and therefore should have an inflationary impact.”

For the measure, Who earns $ 5,000, for example, will have a monthly refreshment of $ 312.89 (or $ 4,067 per year).

Salaries over R $ 5,000 to R $ 7,350 will have proportional discounts on the portion charged. For example, An employee with compensation of R $ 6.5 thousand will feel monthly relief of R $ 113.18according to table prepared by the confirp accounting company.

>> Simulate the effects of the measure on your salary

Currently, the IR table foresees exemption only for those who earn up to R $ 3,036. According to the House of Representatives, the exemption and reducing of collection should directly benefit 15.5 million people and lead to a tax waiver (tax that will not be collected) of R $ 25.4 billion, about 10% of the nearly R $ 227 billion collected with the tax.

Taxation on the richest

To compensate for the tax waiver, The PL institutes additional charge for those who have taxable income over R $ 600 thousand per yearwhich can only reach about 141.4 thousand taxpayers of high income individuals.

Currently, this select group is subjected on average to an effective 2.5% IR rate on their total income, including profit distribution and dividends. Already workers generally pay, on average, 9% to 11% of going on their earnings.

Less indebtedness

For economist Gilberto Braga, professor at IBMEC, any change in taxation that makes more income available to the population is reflected in the improvement of purchasing power. It also emphasizes reduction in family indebtedness.

“This money, especially in the lower classes of the IR table, will certainly be directed to consumption and payment of debts,” he predicts.

“Therefore, this injects money into the economy, and the regularization of indebtedness causes these people to accredit new installments and financing, and may cause the economy to increase their operation forward,” he adds.

For the expert, the inflationary effect is secondary, but exists. “But it is not believed that this is a collateral consequence right now.”

Workers’ claim

CUT’s national president, Sérgio Nobre, reminded the Brazil agency that the expansion of the IR exemption range is an old workers’ election.

Noble points out that Exempt those who receive up to R $ 5,000 represents benefiting the largest portion of the working class. “You will feel now, when you have a lower discount or do not have the discount on your payroll from next year.” He compared the benefit to a 14th salary.

“For many categories, this will represent a month more than salary, it is as if earning the fourteenth salary,” which will be, according to Noble, can be reversed in more consumption, more production and more employment.

Despite support for approval, the representative of the central trade union note that the exemption on profit sharing and results (PLR) was not included in the PL, bonuses that some categories receive.

“It is a new struggle we have,” he anticipates, adding flags as a progressive IR (larger rates for higher incomes), annual correction for inflation and end of the 6×1 scale.

Regarding the non -inclusion of PLR exemption and annual correction of the floor for collection, noble understands that it was a way to ensure the approval of the PL in a quick way.

“If it was not voted now, it would be at risk of not having effectiveness for next year, which would be a huge damage to workers,” he concludes.

More advances

Economist Pedro Rossi, from Unicamp, also points out that the project approved in the House could bring more advances.

“The taxation of the richest is an extraordinary advance, but is still shy in the face of tax distortions in Brazil,” he says.

He mentions that Dividend transfer, for example, remains free for those who receive less than $ 50,000 per month. The economist also demands the creation of new IR tax rates for higher income ranges, “in addition to the need to reduce indirect taxes on goods and services and compensate for income taxation and equity.”

Rossi argues that proposals for the correction of tax distortions “can come with more public spending on health and education and even climate schedule.”

Ipea Pedro Humberto de Carvalho researcher recalls that Brazil is one of the few countries in the world that do not yet tax dividends in general.

“With this PL, there will be a low but effective taxation of dividends.”

In his analysis, the small investor of the financial market that receives dividends and small entrepreneurs, who have a small company with the low profit margin, will not have the dividends affected.

“They will be [afetados] Really the super rich, those who have income over $ 100,000 per month. Although PL predicts income over $ 50,000, this group in this range already pays income tax ”, projects the researcher of the Institute linked to the Ministry of Planning and Budget.

Productive sector

The chief economist of the National Confederation of Trade in Goods, Services and Tourism (CNC), Fabio Bentes, told Brazil agency that the entity classifies the expansion of the exemption of IR as positively and socially fair, “because it benefits the population of lower income and observes the taxpayer’s economic capacity.”

However, CNC expressed concern about the financing of this measure. The entity has a position contrary to the taxation of companies, without compensatory measures. “This could increase the total tax burden, penalize small entrepreneurs that depend on these profits such as family income and encourage informality,” he argues.

CNC points out that Brazil already has one of the highest tax burdens among developing countries, concentrated in consumption and, for the confederation, “the taxation of dividends would aggravate this scenario.”

For CNC, expansion of IR exemption should be “accompanied by adjustments that do not impair the competitiveness of companies or increase the tax burden on the productive sector”.

Slag correction

The Director of Economics of the National Confederation of Industry (CNI), Mário Sérgio Telles, points out that the industrial sector has a favorable position for the exemption that, according to him, corrects years of lag.

“People started paying more income tax, not because they were rising on the scale of income, but simply because the incomes were corrected by inflation, and the table was not corrected at the same pace.”

He evaluates that the lowest tax collection, if law, will be incentive for demand. “People in this range of performance tend to have a propensity to consume greater.”

Thus, CNI warns that if the country combines other forms of incentive consumption, such as public spending, there is a risk of hindering the process of reducing inflation and, thus, the Central Bank does not advance the reduction of interest.

Official inflation is 5.13% per year, above the Government’s goal that will at most 4.5%.

“We understand that the interest rate reduction process has to happen as soon as possible,” he argues. “It should have already started.”

To make inflation retreat, the Central Bank Monetary Policy Committee (BC) has been maintaining Selic at 15% per year since June. It is the highest level since July 2006 (15.25%).