The price of wool has been rising for seven weeks. It recovered 24% of its value from the price floor in October and expectations of reactivation of the textile industry and consumption in China are consolidated, a fact that transcends the wool market. Added to the positive week for commodities is the rise from dairyhe upward adjustment of the price of cattle in Uruguay and in Brazil, and the kernel robustness following USDA report on Wednesday, which confirmed the drop in Argentine production.

Grain market.

Firmness in grains

The grain market remained firm in a week in which the United States Department of Agriculture (USDA) updated its projections and confirmed the very poor harvest that Argentina will have in soybeans. It will most likely take it below 40 million tons from an initial expectation of 54 million. The drought in the region is an important support for prices. The rise in the price of oil was added this Friday, after Vladimir Putin’s decision to reduce Russian production by 500,000 barrels per day to rekindle the flames of inflation in the West.

The substitution of diesel for fuels derived from oilseeds consolidates as a trend, a slight increase over the record area of last year. In a Niño year, as the second half of 2023 is supposed to be, excess water is less of a risk in oilseeds than in wheat and barley.

The prices of summer crops remain high, within a logic of stability and even this week there were slight drops for soybeans. Argentina’s soybean production continues to be the key variable. The new report from the United States Department of Agriculture (USDA) officially brought the projection from 44.5 to 41 million tons. But there is also an unofficial report from the USDA at 36 million and the Rosario stock market estimates only 34.5 million, while the Buenos Aires stock market currently handles 38 million as a projection. In Argentina there is already talk of a third “soybean dollar” starting in July of next year so that producers sell what little they will have before the elections in the neighboring country.

But that is offset by the persistence of an unprecedented crop in Brazil, of 153 million tons, a record by far and with a friendlier dollar this week. But the harvest is blocked -paradoxically- by the persistent rains in the center of the country.

The picture in corn becomes more complex day by day. Uruguayan regulations discourage Argentine freight forwarders from coming to Uruguay; the corn available is very little and each week of drought accentuates the scarcity. Trucks with by-products have arrived to meet a demand that seeks to cushion the effects of the drought at any cost. In the local market, you pay US$300 to raise the farm and prices US$20 above the destination. Prices that for now leave corrals out of the buying market.

In winter crops, the references are also sustained and there are warnings of an incipient situation of drought in Russia that could be important if it persists in the spring.

The reference prices at the end of the week are around US$547 for soybeans placed in Nueva Palmira, US$270 for malting barley and US$290 for industrial barley, while wheat is trading at US$285. by Ton.

Wool market.

Wool: rise of 2.1%

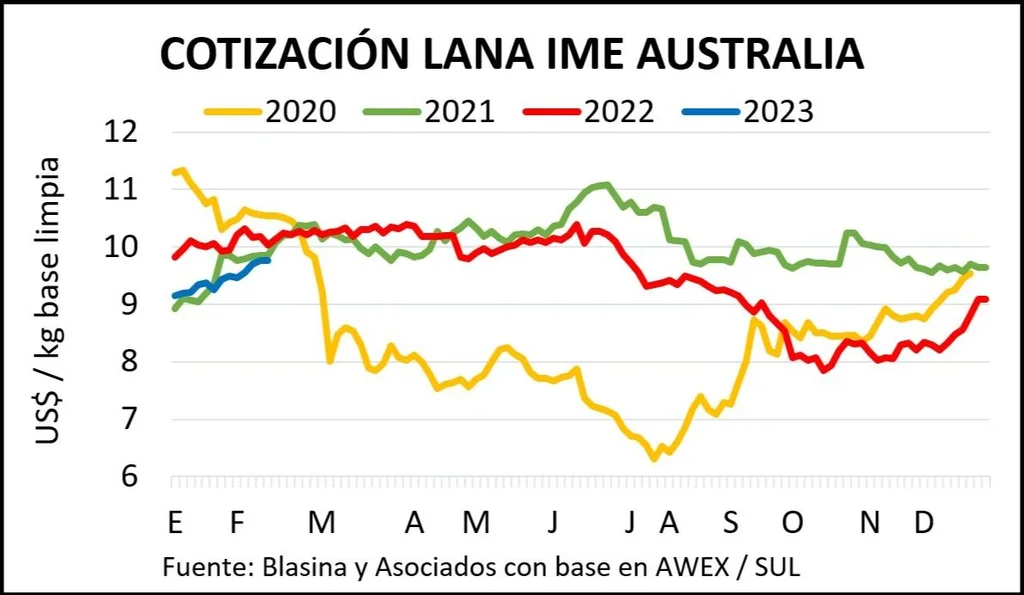

The price of wool in Australia rose 2.1% in dollars this week, adding 20 cents to the Eastern Markets Indicator (IME): from US$9.56 to US$9.76 per kilo on a clean basis.

Enthusiasm and optimism settled in the wool market.

The indicator is only 2.8% below the value of a year ago. From its price floor in the current harvest, US$7.85 in October, it recovered almost US$2 per kilo: an increase of 24% in less than four months.

The offer at auctions in Australia was lower this week and the demand on Monday the 7th was the highest since June 2021: 96.3% of sales.

The corrections have a positive impact on local operations and pricesreactivating the demand for mixed and coarse wools and improving the prices of fine wools that for bales of less than 18 microns average US$ 9.6 per kilo of dirty base.

John Samuelle

Improves spirits in the wool market.

This outlook improves expectations after a year 2022 with declines in value and volume exported, and a January 2023 in which the contraction persisted.

Wool exports from Uruguay fell 13% in volume and 20% in dollars in January 2023 compared to the same month of the previous year. The biggest drop was in washed wool: it fell 58% in volume and 64% in dollars. In total, 2 million kilos were exported for US$ 10.9 million, with Italy as the main buyer with 25% of the amount and China in second place with 18%.

The export of tops in January rose 2.6% in volume -1,310,297 kilos- although it contracted 15% in turnover.

In all of 2022, wool exports fell 8% in dollars, from US$175 million in 2021 to US$161.5 million.

Livestock market.

Raise the fat cattle

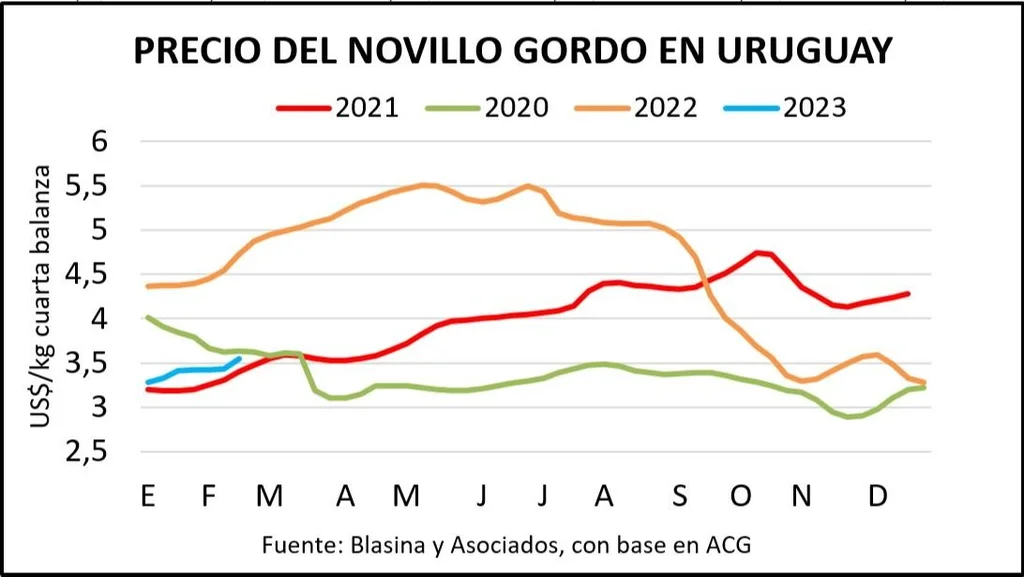

The fat cattle gained between five and ten cents in the last few dayswith little supply of specialty cattle and some positive external signs driving demand. Market operators foresee a shortage of cattle for the coming months.

The offer that appears mostly is lower termination. Increases the buying pressure of slaughterhouses, even with a greater participation of free-range cattle for quota, and It brings the special fat steer to between US$ 3.50 and US$ 3.60 per kilo in fourth scale. The fat cow also registers an improvement, with deals between US$3.20 and US$3.30 as an exceptional price, and the heifer between US$3.35 and US$3.40. Values vary batch to batch, depending on volume and quality. There is good movement of the supply. Entries are short, about a week.

“The fat man was affirmed quite a lot, basically as a result of the lawsuit,” said Santiago Sánchez, of Victorica y Asociados. The market has become more dynamic, with plants that came with little movement and have gone out to buy.

The work is intensifying. It jumped 18% last week to 51,797 cattle. It was the third weekly slaughter of more than 50,000 animals since the beginning of June last year.

Market operators project a diminished supply of cattle ready for slaughter.

Some positive signs appear from the outside. China slowly wakes up from her nap. There weren’t any big moves in the last week, but you’re trying to get better values in that market.

In Europe, the Hilton continues firm, with values of US$ 15,500 per ton for Argentina and over US$ 14,000 for Uruguay. For now, the United States does not show a price rise, but there is expectation going forward in that market, where the herd of beef cows fell to a minimum since 1962 and will impact on a lower supply of meat in the coming years.

The export price of beef fell compared to the previous week, to US$ 4,007 per ton, and there was also a downward correction of previous prices. Even so, the average of the last 30 days continues to rise slightly and stood at US$ 4,040.

With the fat on the rise, and some irregular rains – still insufficient – the replacement market continues to gain ground. Prices of various categories of calves and veals rose between 10 and 20 cents according to the latest ACG update, above the movements of fat cattle on the grid. This brought the replenishment ratio to 1.28, the highest in the last four months.

The market for wool is also affirmed, with buying industries and reduced supply. The heavy lamb reaches US$3.18, the lamb up to 35 kilos US$3.12. Capons are around US$2.92, sheep US$3.09 and sheep US$2.67. The heavy casings continue with greater difficulties of placement.