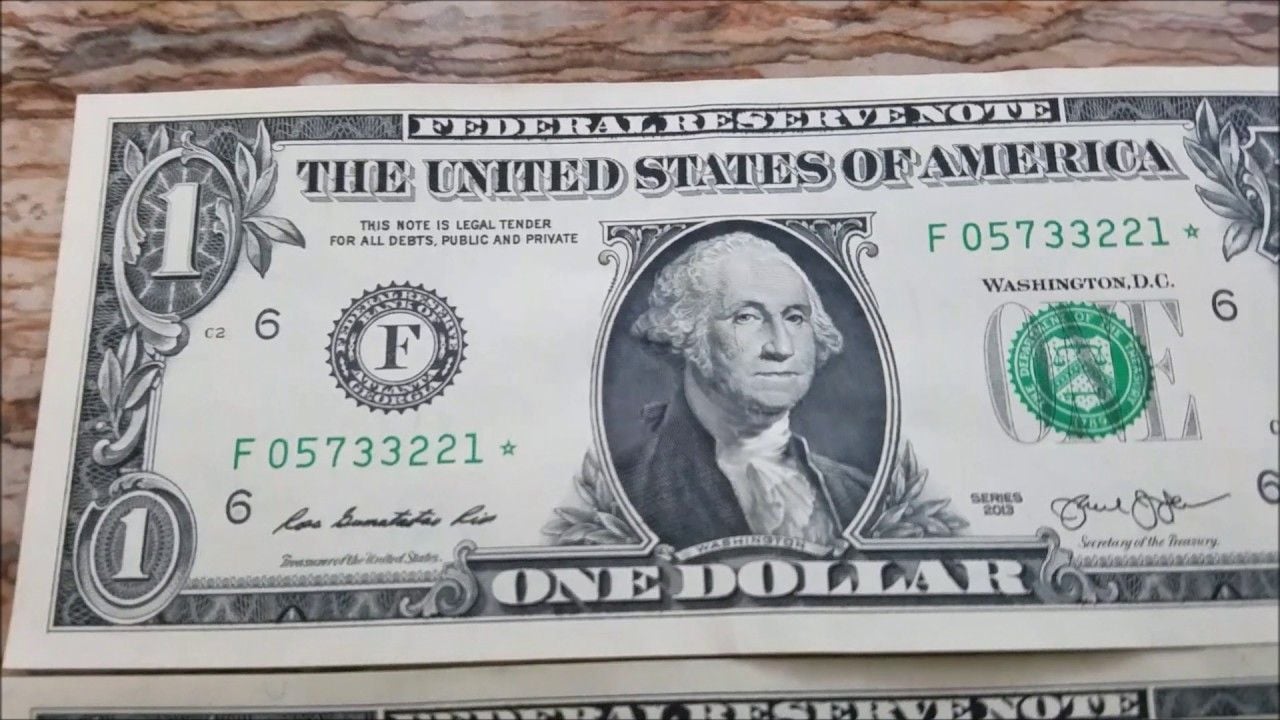

During the week, the price of dollar presented significant variations in both the official and parallel markets, known as the blue dollar. This phenomenon is of great interest to Argentines, since the value of the dollar directly impacts the daily economy, from the prices of goods and services to investment and savings decisions.

He dollar official, which is the exchange rate controlled by the Central Bank of the Argentine Republic (BCRA), remained relatively stable compared to previous days. According to data provided by various sources, the official dollar was quoted at $974.50 for purchase and $1014.50 for sale.

This exchange rate is mainly used for regulated commercial and financial operations, and its stability is crucial to maintaining a certain degree of predictability in the economy. On the other hand, the dollar blue, which is traded on the informal market, showed a quote of $1,100.00 for purchase and $1,120.00 for sale.

This exchange rate is usually more volatile and reflects the market’s perception of the economy and government policies. The gap between dollar official and the blue dollar is an indicator of confidence in the economy and in the measures adopted by the government.

In addition to the official dollar and the blue dollar, there are other exchange rates that are relevant for different sectors of the economy. He dollar MEP (Electronic Payment Market) and the CCL (Cash with Settlement) dollar are mainly used by investors seeking to dollarize their portfolios through stock market operations

The MEP dollar was quoted at $1,135.99, while the CCL dollar was at $1,161.34. These exchange rates are usually more aligned with the blue dollar, although they may present differences due to specific financial market conditions.

Impact

The quote of dollar It has a direct impact on the Argentine economy and the daily lives of its citizens. A more expensive dollar can lead to an increase in the prices of imported goods, which contributes to inflation. This affects the purchasing power of Argentines and can lead to a decrease in consumption.

Furthermore, the volatility in the price of dollar It can generate uncertainty in the market, affecting the investment decisions of both companies and individuals. Companies that depend on imported inputs may see their costs increase, which in turn may affect their competitiveness and profitability.

follow us on Google News and on our channel instagramto continue enjoying the latest news and our best content.