The dollar fell 8% in Uruguay since the beginning of the year. At the end of 2021, the greenback was trading at $44.7 while today it is around $41. This Thursday the US currency ended its nine-session losing streak, advanced 0.36% and left the $40 range in the wholesale price to settle at $41.12 in the average of transactions through Bevsa.

The high prices experienced by the country’s most exported products in the international market have generated a torrent of dollars to the local market and is one of the variables that explains the weakness experienced by the world’s main currency. What happened in the other relevant countries for Uruguay’s foreign insertion?

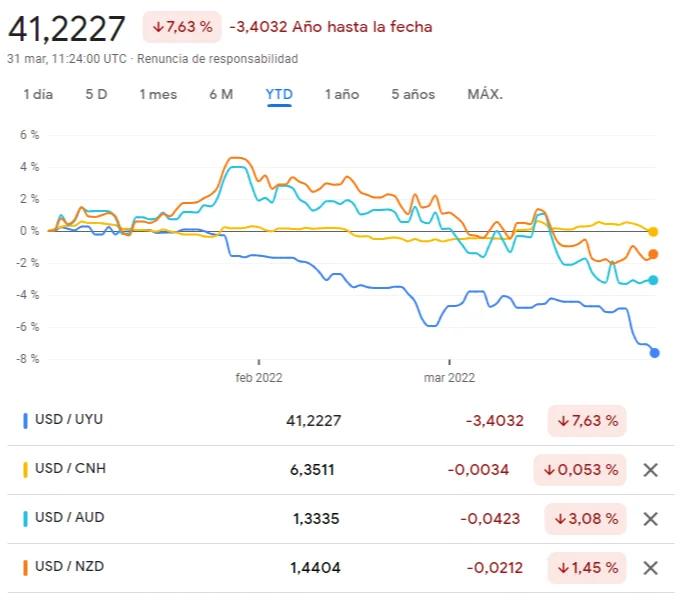

In the region, the exchange rates of the Colombian currency (purple in the graph), the Chilean currency (orange) and the Peruvian currency (light blue) had marked decreases with respect to the US currency and in magnitudes very similar to the Uruguayan peso.

Instead, the Brazilian real appreciated considerably more against the dollar, a convenient phenomenon for Uruguay’s commercial exchange with that country and to compete more advantageously for the same export markets. In the northern country, the aggressive policy of raising interest rates to combat inflation attracted foreign capital that pushed the dollar down, AFP explained.

On March 23, the dollar traded below 5 reais after almost 9 months, and today it trades at 4.75 reais according to Value. Throughout the year, the fall of the US currency in Brazil it reached almost 15%, nearly double that of Uruguay.

On the other side of the Pacific Ocean, China The parity between the yuan and the dollar remained almost the same, which disadvantages Uruguayan exporters in the commercial exchange with the Asian giant. However, the behavior of the dollar in the country does suit importers who bring merchandise from China.

On the other hand, dairy, meat and wool competitors such as Australia and New Zealand they saw the dollar fall to a lesser extent than Uruguay, which puts them ahead to compete with Uruguay in export destinations.

The case of the other engine of Mercosur, Argentinais more difficult to measure due to disparities between official and parallel exchange rate, the intense inflation and the different withholding measures to exports that hinder the bilateral comparison.

The competitiveness and real exchange rate of the BCU

Due to the appreciation of the peso against the dollar, have been made claims from the export sector due to loss of competitiveness of the country with respect to its main commercial partners or nations that place their products in the same destinations as Uruguayan merchandise.

However, to talk about loss of competitiveness it is necessary to see what happened with the price of the dollar both in Uruguay and in other countries and the same with the inflation, which is currently relatively high in Uruguay. With these inputs it is possible to calculate the real exchange rate (RER)the indicator that really serves to observe competitiveness.

This Thursday the Central Bank published the Uruguayan RER regarding its main trading partners and the report showed that ehe global index fell in February and in the accumulated figure for the year.

The decline in the first two months of 2022 was made up of a moderate decline in extra-regional competitiveness —from 124.7 to 119.7 in the BCU index— and a slight improvement in the regional effective indicator —from 84.2 to 85.1—, which was driven by Brazil and moderated by Argentina.