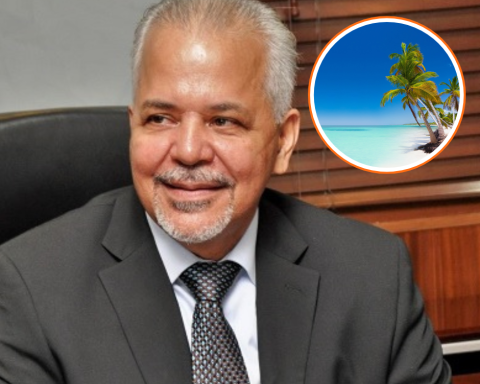

In July 2025, Caja Piura reached S/ 17.5 million in monthly profits and accumulated S/ 27.8 million so far this year, said Javier Bereche, president of the Board of Directors, the entity, with 43 years in the Peruvian microfinance system and positioned throughout Peru.

Bereche reported that a strategy was initiated in September 2024 is held in six management axes: recovery of ASA certification, placement reactivation, surplus profitable, containment of expenses, administration of the heritage block of the former Sullana box and reduction of the high -risk portfolio.

In 2025, assets of patrimonial strengthening and liabilities restructuring were added, which allowed to specify agreements with IDB Invest (United States) for sustainable financing and with the French Development Agency (AFD) for green credits and reorganization of debts. Currently, negotiations with Rabobank (Holland) are maintained to expand the sources of funding with competitive rates.

“In the plane of innovation and digital transformation, customer service was sought by working the ALPHA project, where we implemented 100% digital credits, electronic promissory notes and high security standards, bringing agile and safe solutions to all corners of the country,” said the manager.

Caja Piura continues to develop products with social impact such as water credit, biovo, Peruvian Amazon, circular economy and grows woman, aimed at microentrepreneurs, farmers and entrepreneurial women, with emphasis on rural areas and environmental sustainability projects.

The Caja Piura projection is to close 2025 exceeding S/ 6,000 million in plans and deposits, maintaining its position as one of the main microfinance entities in the country.

“This result reflects efficient management and financial discipline maintained in the first half of 2025, despite higher regulatory expenses and demands. The reduction of the high -risk portfolio, the strengthening of provisions and the containment of the expense, together with the handling of the heritage block of the former Sullana Box, which went from being a challenge to an opportunity, reinforced the position of Caja Piura in the market.

Receive your Peru21 by email or by WhatsApp. Subscribe to our enriched digital newspaper. Take advantage of discounts here.

Recommended video: