The total gross collection of the General Tax Directorate (DGI) it was $53,931 million in January, and had a real year-on-year growth of 1.3%, as reported by the agency on Monday.

For its part, net collection, that is, discounting the tax refund, totaled $47,442 million with a real year-on-year fall of 0.1%.

The difference between gross and net collection corresponds to the tax refund, which can be made through payments made with credit certificates issued by the DGI or by cash/bank refunds.

consumption taxes

consumption taxes they were the main source of income for the state fund and totaled $31,020 million, with a 1% drop compared to last January.

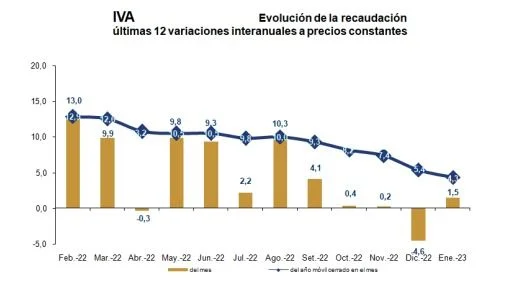

The proceeds for VAT totaled $26,296 million with a positive real variation of 1.5% year-on-year.

Meanwhile, the collection of imesi it was $4,725 million and registered a year-on-year drop of 13.1%.

There was a drop in the majority of goods that are taxed by IMESI last month (fuels -25%, automobiles -5.7 and remains of Imesi -16.4%, beverages grew, and cigarettes and tobacco had no changes.

For the comparison of fuels, the collection of January of last year for this concept ($2,277 million) is taken into account, with the total of January 2023, which is made up of two items (fuels and CO2 emissions, which add up to $1,711 million).

Income Taxes

The collection of the Income Tax from Economic Activities (IRAE) reached $6,536 million and had a real year-on-year growth of 0.1%.

Finally, the collection of Personal Income Tax (income tax) reached $10,251 million, and grew 9% real year-on-year.

The collection of income tax category II (paid by workers) increased 10.7%, while category I (to capital) grew 1% in the interannual comparison.