Economy and Business > State Fund

The collection data reflects the cooling of the economy that different indicators showed in the last months of 2022

Reading time: –‘

February 03, 2023 at 12:58

The total gross collection of the General Tax Directorate (DGI) reached $50,950 million in December, and had a real year-on-year decrease of 0.2%, according to the agency this Friday.

For his part, net collectionthat is, discounting the tax refund, reached $44,549 million with a real year-on-year fall of 1.1%.

The difference between gross and net collection corresponds to the tax refund, which can be made through payments made with credit certificates issued by the DGI or by cash/bank refunds.

Collection data for the last month once again reflects the cooling of the economy that various indicators have shown during the second half of last year. The information on national accounts for the last quarter of 2022 will only be known in March.

DGi

consumption taxes

Consumption taxes were the main source of income for the State fund and totaled $29,283 million, a decrease of 1.7%.

VAT revenue totaled $23,744 million with a real negative variation of 4.6% year-on-year. The income from this tax has not fallen since April 2022.

DGI

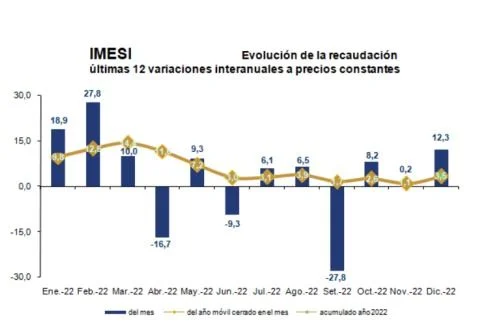

Meanwhile, Imesi’s collection reached $5,513 million with an interannual growth of 12.3%.

DGI

Income Taxes

The collection of Income Tax on Economic Activities (IRAE) it reached $6,089 million and had a real year-on-year decrease of 1.4%.

Finally, the collection of Personal Income Tax (IRPF) reached $8,825 million, and grew 2% in real terms.

Login

Still don’t have an account? Register now.

To continue with your purchase,

login is required.

or log in with your account at:

Enjoy The Observer. Access news from any device and receive headlines by email according to the interests you choose.

Thanks for signing up.

Name

exclusive content of

Be a part, go from informing yourself to forming your opinion.

If you are already a Member subscriber, log in here

Charging…