Havana/Cuban television presented this Friday a report where several Spanish businessmen celebrated their presence at the Havana International Fair (Fihav) 2025 and spoke about opportunities, dynamism and confidence in the Cuban market. The staging was impeccable, with smiles, stands newly assembled and optimistic statements. But it is enough to contrast this speech with the real data to understand that the situation is far from being encouraging.

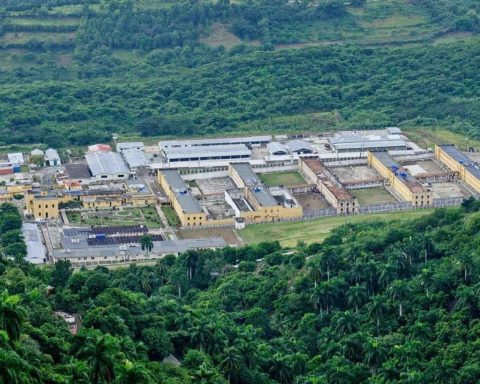

Spain participates this year with four pavilions – numbers 3, 4, 5 and 6 – and only 38 counters. These are modest figures when compared to previous editions. In 2017 there were more than 150 Spanish companies exhibiting at Fihav, and in 2024 there were 63 companies distributed in five pavilions. Although the Cuban Government insists that Spain is “the most represented country,” the historical trend clearly points to a reduction in real business participation.

The contrast is even greater if one listens to the statements of the president of the Association of Spanish Entrepreneurs in Cuba (AEEC), Joaquín Sampeiro Sañudo, who assured that Cuba “has always been a market of opportunities” and highlighted that Spanish companies already work “a lot” with new private actors. The television report spoke of “close to 300 citizens and companies” making up the AEEC. That number coincides with the recent evolution of the association, but does not reflect the true state of the Spanish business community in Cuba, a sector in debt, trapped in financial restrictions and hit by an economic system that makes the daily operation of any foreign company difficult.

According to Foment del Treball, Cuba owes more than 350 million euros to almost 300 Spanish companies, mostly SMEs exporting food, medical supplies, hardware, spare parts and industrial products. The affected platform itself assures that more than 15% of these companies are at risk of closure due to the impossibility of collecting payments since 2018. Even the Secretary of State for Economy and Business Support of Spain, Israel Arroyo, admitted the amount of debts accumulated. Even so, on Cuban television Sampeiro limited himself to declaring that they are “willing to dialogue, to cooperate and to be taken into account,” without mentioning that hundreds of companies have been demanding exactly that for years, without results.

Added to the chronic debt is the recent imposition of a “currency corralito” by the Cuban Government

In parallel, Cuba’s debt with Spain is almost 2 billion eurosofficially recognized by Madrid as “difficult to solve.” To try to manage it, the Government launched a Debt Conversion Program in 2025 that will allow up to 375 million euros to be used to finance projects on the Island. Although it is presented as a cooperation measure, it does not resolve the situation of Spanish private companies, which are still unable to recover the money owed to them by the Cuban State.

Added to this chronic debt is the recent imposition of a “currency corralito” by the Cuban Government, which faces a serious liquidity crisis. Foreign companies cannot extract or transfer abroad the foreign currency they have in banks on the Island. They are forced to open “real accounts,” which can only be used with new foreign currency sent from abroad and whose movement is strictly controlled by the State. In practice, no company can repatriate profits and many cannot even use the money generated within Cuba.

This internal financial blockade fully affects the Spanish hotel chains, historically champions of investment on the Island. Meliá Hotels International – the largest foreign operator on the Island – has recognized losses in your operations in Cuba. In 2024, according to data published by the Spanish economic press, its activity on the Island registered negative results, with occupancy rates well below those necessary to make profitable the hotels it manages and which all belong to the Cuban State. Iberostar is going through a similar situation. While both groups recover profits in other parts of the world, Cuba has become their least profitable market.

The Apolo company also appeared in the television report, with 40 years of presence in construction in Cuba. Its president, Marta Puigmartí, assured that “we are not leaving here” and highlighted her participation in great works in the country. However, public business information available in Spain indicates that its parent company – Anónima Española de Comercio y Economía SA (Aecesa) – is an SME with sales in the lower end of the construction materials distribution market. Data from business databases such as Informa or Axesor place its estimated turnover in moderate ranges and a small size in number of employees. Although it is not possible to determine from the outside how much of its performance is directly linked to Cuba, the company is not a giant in the sector and operates in a market context that has shown signs of contraction in recent years.

Only 1% of Spanish businessmen consider Cuba as a priority investment destination

Another example cited on television was Redelco, dedicated to naval spare parts and hardware. Its president, Santiago del Río, boasted of having introduced ferries in Cuba and described an opening of “many possibilities” in recent years. However, its company in Spain –Representaciones Delcos SLU– was only incorporated in 2023 and, although it has increased its share capital since its creation, it does not yet have an extensive financial history that allows it to evaluate its real performance. The only thing that is clear is that it is a young company that operates in one of the most complex and volatile markets in the Caribbean.

The Redelco representative mentioned with pride that it was his company “that brought to Cuba the ferry Perseverance”. He forgot to mention that just two months after coming into operation, the ship suspended his trips between the Isle of Youth and the port of Batabanó (Mayabeque), due to “clearly unpostponable issues” and the “conjunctural situation” that the country is going through.

Despite the difficulties, the official discourse continues to present Cuba as an attractive destination. This enthusiasm, however, contrasts with various studies of the business climate in Latin America which indicate that only 1% of Spanish businessmen consider Cuba as a priority investment destination. And the year 2025 shows no signs of improvement. Fihav remains a useful showcase to show political relations, but it is no longer the thermometer that once measured the health of Spanish investment in Cuba. The reduction in the number of exhibitors, the advance of the financial corralito, the losses of hotel chains and the accumulation of unpaid debts reveal a country that attracts more speeches than investments. Despite the will –sincere or rhetorical– of some businessmen to “want to stay here”, the economic reality shows that Cuba is today one of the riskiest destinations for Spanish businessmen.