The Cuban Government announced this Tuesday that it will soon begin to “actively” promote the participation of “foreign capital” in the national banking and financial sectoralthough it did not detail the scope of the measure.

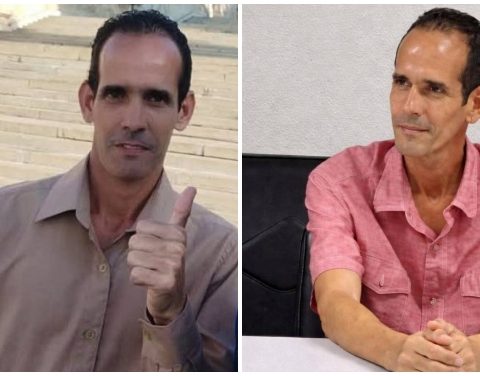

The Deputy Prime Minister and Minister of Foreign Trade and Foreign Investment, Oscar Pérez-Oliva, made this announcement within the framework of the Havana International Fair (FIHAV), when presenting a package of measures to facilitate international investment on the island.

“We are actively promoting participation and making investments in the banking-financial sector with the participation of foreign capital,” he stated.

In his opinion, “this can have an impact both on the development of businesses with foreign capital but also, in a general sense, on the banking-financial development of our economy.”

Cuban government announces flexibility in foreign investment

The measure comes at a time of “financial difficulties” for the country and its state banking sector, as Pérez-Oliva himself recognized the day before when inaugurating the FIHAV.

The decline in tourism and the entry of remittances through formal channels has reduced the Cuban State’s access to foreign currency, which at the same time has a large trade deficit because the island imports 80% of what it consumes.

In fact, the authorities have informed foreign companies and embassies in the country that their deposits in foreign currency bank accounts are not available for transfers abroad or cash withdrawals.

For months there have been significant restrictions on cash withdrawals, both in Cuban pesos and US dollars, in Cuban banks.

Government of Cuba extends restrictions on the foreign currency accounts of foreign companies

Cuba has been suffering a deep crisis for more than five years. The pandemic, the tightening of US sanctions and failed economic policies have aggravated structural problems in the island economy.

Added to the economic contraction with high inflation is the shortage of basic goods (food, medicine, fuel), prolonged daily blackouts, growing dollarization and mass migration.