The NGO emphasizes that the Cuban ruler “has submitted himself like a puppet to the interests of GAESA.”

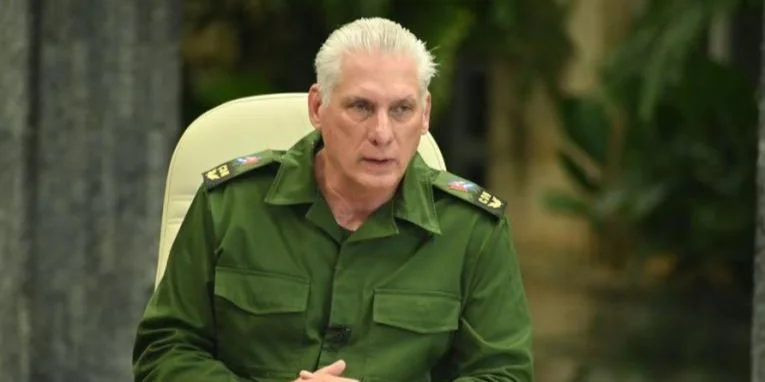

MIAMI, United States. – A new dossier from the Cuba Siglo 21 thought laboratory, based in Madrid, holds the military conglomerate GAESA and the ruler Miguel Díaz-Canel directly responsible for having led Cuba “to the worst financial crisis in its history”, through the opaque control of most of the economy, the looting of income from medical missions abroad and decisions that have triggered inflation and poverty on the Island.

The study, titled “GAESA: Thief State” and signed by economist Emilio Morales, president of the consulting firm Havana Consulting Group and vice president of Cuba Siglo 21, maintains that “under the label of socialism, a military oligarchy controls more than 70% of the economy and 95% of national finances, while the civil government acts as a simple puppet.”

According to the report, “the Government led by Miguel Díaz-Canel in practice does not have control of the country’s finances” and the Central Bank of Cuba “is completely subordinated and subject to the interests of GAESA.”

Record inflation and peso collapse

The dossier begins by describing an unprecedented inflationary escalation. On October 19, the Cuban informal market registered a price of 472 Cuban pesos per dollar and 525 per euro, according to the digital media theTouchfigures that the report presents as a symbol of a “sunken” economy and increasing poverty.

Morales identifies as immediate causes the “shortage of dollars on the Island”, caused by “the drastic reduction in remittances and the profound decline in the arrival of international tourists”, as well as the fall in national production of goods, including the agri-food sector. Added to this is “the considerable increase in external debt, the loss of credit lines due to non-compliance with debtors and practically no foreign investment in the country.”

However, the author insists that “the true genesis of the financial crisis” is the “hegemonic control” of GAESA over the country’s finances, the subordination of the Government to that business group and the absence of a real plan for economic reforms. The report describes an executive “bogged down in improvisation, mediocrity and ideological entrenchment,” which would have led to “the breakdown of the financial system” and “the brutal increase in the prices of products and services that are vital for the population.”

GAESA, owner of everything

The dossier attributes to GAESA and the ruling leadership the responsibility for a series of economic decisions that accelerated inflation and the devaluation of the Cuban peso: the creation of stores in Freely Convertible Currency (MLC), the so-called “Ordering Task”the prohibition of depositing dollars in cash in Cuban banks and the implementation of a new state exchange market.

These measures, applied “to the convenience and lucrative interests of the GAESA oligarchs,” would have left the State itself without resources, and caused the “collapse” of strategic sectors such as the food industry, the energy system, the transportation network, health services, the sugar industry, the supply of drinking water and education, “due to lack of financial resources and the absence of an investment policy consistent with the true needs and strategic priorities of the country.”

The report highlights that GAESA “is not auditable by the Comptroller General of the Republic or by any other economic or political institution of Cuba, not even by the Armed Forces to which it is nominally attached,” which, according to Morales, accentuates the lack of transparency and institutional controls over the military conglomerate.

Díaz-Canel, “czar of the inflationary explosion”

The analysis dedicates a section to Miguel Díaz-Canel, whom he describes as “the tsar of the inflationary explosion.” According to the data he provides, when he was appointed president, the dollar was quoted at 1 for 24 Cuban pesos (CUP) and on October 19 of this year it reached 1 for 472 CUP in the informal market, which implies “an increase of 1,966.66% in the number of CUP per dollar.”

“The president has been incapable of putting financial order and establishing transparency in the management of the country’s finances. He has submitted himself like a puppet to the interests of GAESA,” says the text, which describes the management of the government team led by Díaz-Canel as “a great failure.”

The “Ordering Task” is presented as a “disaster”, implemented “in the midst of one of the worst crises” of liquidity, exports and tourism, in addition to the COVID-19 pandemic and the drop in remittances. A week after its entry into force, on January 1, 2021, the dollar was already trading at 50 CUP in the informal market, the document states.

The salary increase linked to this reform, without liberalization of the productive forces or price reform, is described as a “devastating strategic error” that skyrocketed the cost of food, electricity, transportation, telephone and other services, above the purchasing power of the population.

Morales directly links the “Ordering Task” with “the increase in popular frustration” and with an “unusual public protest movement” that had its climax on July 11, 2021, when “thousands of Cubans took to the streets to demand freedom and an end to communism.” The report states that these protests “were brutally repressed by order of Miguel Díaz-Canel.”

The dossier also maintains that “foreign investment on the Island is totally stagnant.” Cuba, he affirms, “has become one of the highest investment risk markets in the world.”

The text describes an “undercapitalized” economy, with a sugar industry “practically destroyed” to the point that the country imports sugar, and with an energy infrastructure in crisis, which generates an electricity deficit that ranges between 45 and 60% of daily demand and causes prolonged blackouts.

Morales also points out an “internal blockade” that would prevent the development of a true private sector: citizens cannot create companies freely, but only with state authorization, and those that manage to function depend on state companies to import and export, even when they have accounts in dollars. “In short, a trick to prevent the existence of a true private sector,” the report summarizes.

Although the report maintains that the origin of the crisis is mainly internal, it also dedicates space to the impact of US sanctions. The author recalls that, between 2004 and 2018, 13 financial entities received fines for a total amount of 14,002 million dollars for carrying out transactions with Cuban companies, with an annual average of just over 1,000 million.

The author also highlights the “persuasive effect” of Title III of the Helms-Burton law, activated by Washington, which has “very effectively blocked investments in the country” and has turned investing in the island into “a suicidal act for investors,” by exposing them to lawsuits for nationalized properties.

Embezzlement from the health system

One of the toughest chapters of the dossier focuses on what it calls “GAESA’s financial embezzlement of public health.” Morales describes a “sophisticated mechanism” through which all income generated by medical and paramedical personnel contracts abroad, managed by the Comercializadora de Servicios Médicos SA (MINSAP) and by ANTEX SA (GAESA structure), are transferred to the Banco Financiero Internacional (BFI SA), a banking entity belonging to GAESA.

In his calculation, carried out “based on statistics published by the Cuban Government through the National Office of Statistics and Information (ONEI)”, the author estimates that between 2008 and 2022, exports of medical services generated 108,530.7 million dollars. Of that figure, 30% (30,693.2 million) would have gone to the salaries of health workers and the remaining 70%, some 69,866.4 million, would have been pocketed by GAESA.

The report asks: “If the Cuban Government spent 24.2 billion dollars on hotel construction, 1.7 billion dollars on health (that is, a total of 25.9 billion in these two expenses) and paid doctors 30.7 billion dollars, there remains a not inconsiderable ‘surplus’ of 43.8 billion. What was the destination of this ‘surplus’?”

Morales describes this scheme as “a deplorable act of violation of the labor and human rights of Cuban health workers” and “an act of hostility and slave subjugation to the Cuban population in the 21st century.”

The author maintains that this embezzlement “has cost the Cuban population hundreds of thousands of lives,” especially during the COVID-19 pandemic, due to the lack of medicines, oxygen and equipment, while hotel construction was prioritized.

In its conclusions, the dossier states that the Cuban economy “is bogged down in the worst financial crisis in its history” and that “those most responsible” are not the embargo or the United States sanctions, but GAESA and the ruler Miguel Díaz-Canel.

“The impunity with which GAESA has managed the country’s finances” and “the passivity of Miguel Díaz-Canel as president” would have led Cuba to “a kind of financial anarchy that seems irreversible.”

Likewise, the report concludes that the inflation crisis “has pulverized the poor salaries” of workers and pensioners, to the point that “the monthly salary is barely enough to barely survive a week”; He assures that the actions of the Government “have plunged more than 10 million Cubans into poverty” and that many are condemned “mostly to one meal a day.”

For Morales, “the only way to abort this financial crisis that has practically paralyzed the country and has plunged the population into extreme poverty is to eliminate the governance system that created it.” The change that Cuba requires, he concludes, “is not only a structural reform of the economy but also a political change that sweeps away the current governance system, reestablishes democracy in the country and ensures the separation of powers and returns political and business freedom to citizens.”