Cuba is negotiating with China The restructuring of its banking, financial and business debts, explained the Minister of Foreign Trade and Foreign Investment of the Island, Oscar Pérez-Oliva.

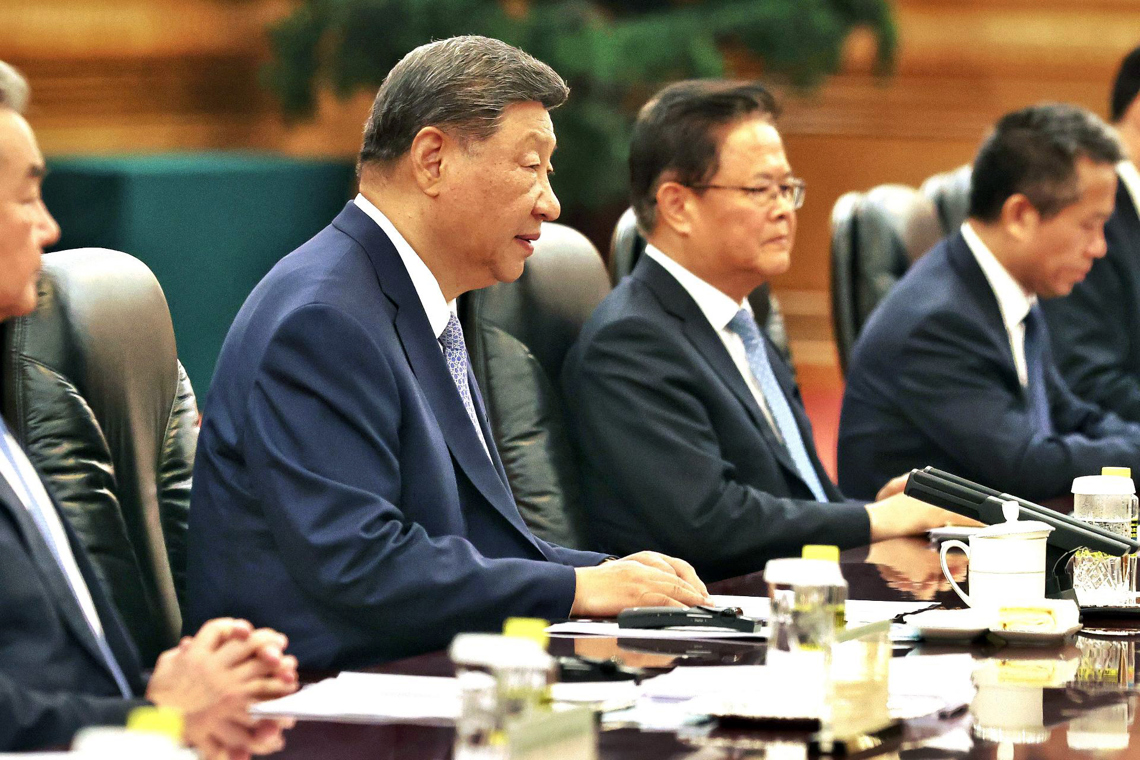

In an interview released on Monday in official media, the minister spoke about economic relations between his country and the Asian giant at the end of the official Cuban visit to China, headed by the president of the country, Miguel Díaz-Canel.

Pérez-Oliva indicated that government debt already “was rearranged” and that both governments now work on “the last details to sign the reorganization of bank and financial debt.”

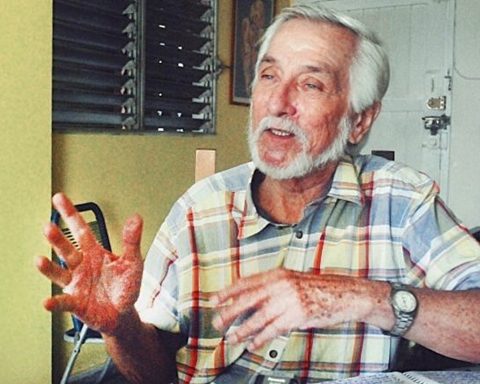

️ | The Minister of Foreign Trade and Foreign Investment @Mincex_cubaOscar Pérez-Oliva Fraga, shares his impressions about the main results in that sector, of the president’s visit to China @Diazcanelb pic.twitter.com/1j8kgcwe3e

– Foreign Ministry of Cuba (@cubaminrex) SEPTEMBER 8, 2025

In addition, the minister added, “the conditions to initiate, in a gradual way, the rearrangement of the business debt,” which he described as high, are also created.

The head of Foreign Trade and Foreign Investment did not explain what the restructuring of these debts consists of: if there will be removes, the return deadlines will continue or the interests established initially will be reduced.

In his opinion, this financial process will put the island “in better conditions” to continue working with Chinese entrepreneurs and have “a more important participation in the country’s development programs.”

“We recognized that even in conditions of high indebtedness levels, Chinese businessmen continue to bet on Cuba and working with Cuba,” added the minister, who spoke of “the difficult circumstances” of the island “in the financial order.”

Pérez-Oliva also pointed out that China and Cuba “have been finalizing the steps for the integration of Cuban commercial banks into the interbank system of cross-border payments (CIPs)”, a Chinese system of international transactions in Yuanes.

This, he added, would place Cuba “in better conditions” to carry out international banking operations “without the interference caused by the blockade of the United States.”

“The use of CIPS and Renminbi (Yuan), are two factors that offer different security and expectations for companies of both countries in relation to their commercial cooperation and investments,” added Pérez-Oliva.

Cuba has a long tradition of restructuring its debts with other states and foreign companies.

Russia conded 90 % of its sovereign debt of the time of the Soviet Union years and has recently accepted the business debt several times.

The Paris Club, which brings together different countries such as Spain, France and Japan, also accepted a remove and reorder the Cuban debt, but Havana has not been able to fulfill the new terms of return in recent years.