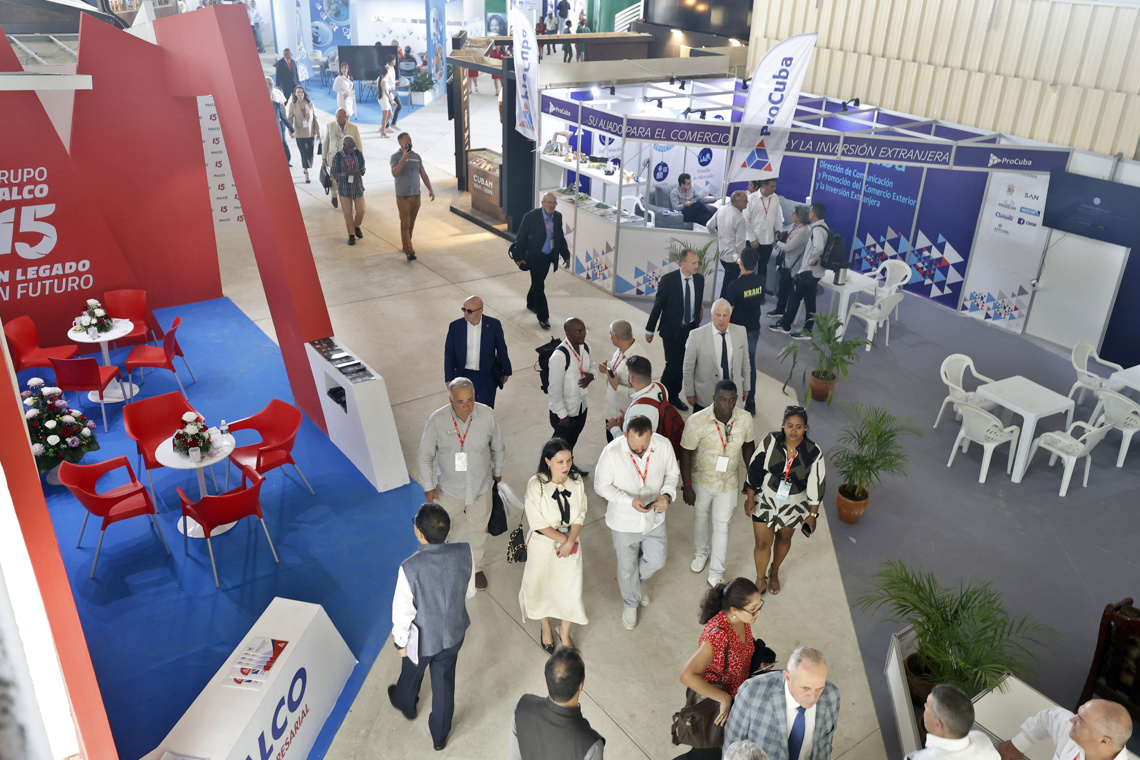

The Cuban government announced measures to boost foreign investment, but ruled out liberalization of the labor market, opting to evaluate “exceptionally” and on a case-by-case basis the direct access of foreign companies to the workforce. as confirmed by Yanet Vázquez, vice minister of Foreign Trade and Foreign Investment, at the Havana International Fair (FIHAV 2025).

In an attempt to reactivate an economy suffocated by the crisis, strategic design errors and the skein of US sanctions, Cuba announced adjustments to speed up the arrival of foreign capital, although maintaining state control in sensitive areas such as labor hiring.

Vice Minister Vázquez explained that some measures will require legal changes, while others will be implemented under the current regulatory framework.

Reduction of procedures and highly discretionary labor contracting

In the short term, he said, Decree 325 (regulation of the Foreign Investment Law) will be reformed to reduce bureaucratic procedures, taking advantage of the tools of the current Law 118. However, more profound changes, such as a new law, will not arrive before December 2026, when the project will be presented to the National Assembly.

One of the points most anticipated by foreign businessmen—the freedom to hire Cuban workers without state intermediation—will not be granted in a general way. Vázquez clarified that, for now, companies must continue turning to state employment agencies, although specific “exceptions” will be studied.

“The measure will be implemented exceptionally and on a case-by-case basis, using the possibilities offered by the current Law 118. The experience collected during this year of implementation will be vital to define the definitive treatment in the future law,” said Vázquez.

Currently, the Cuban State acts as the sole employer, retaining up to 80% of the salary paid by foreign companies, in foreign currency. Workers’ salaries are made in Cuban pesos.

New forms of association

In a significant turn, the government is preparing a Decree Law – in consultation with the Council of State – to allow partnerships between state companies and the non-state sector (cooperatives and SMEs). Two figures would be created: economic association contracts and limited liability companies.

A limited liability company (SRL or SL) is a company where the partners are only liable for debts up to the amount of capital they contributed, not with their personal assets.

External debt: no to swaps, yes to sustainable businesses

Regarding the debt with foreign creditors – estimated in billions – the vice minister was categorical in ruling out future SWAP operations (exchange of debt for assets): “We are not going to apply shot of debt. “We would not be exchanging assets for debt,” he assured.

Instead, Cuba will propose using assets to generate business that, in the medium term, will allow it to settle obligations with foreign companies.

A shot Debt is an informal financial term that refers to a strategy or action in which a company, government or individual significantly increases its level of debt quickly and aggressively, generally with a specific objective, whether to finance large projects, pay existing debts with less favorable conditions or achieve immediate liquidity to cover urgent needs.

Vázquez stressed that in this process “we do not negotiate sovereignty,” since the future projection of the business is what maximizes the value of Cuban assets, the report stated. Cubadebate.

The statements come after Deputy Prime Minister Oscar Pérez-Oliva reiterated that foreign investment, a portfolio he directs, is “fundamental” for economic development, in a scenario of permanent crisis and on the verge of another year of GDP decline.

Decrease in sight and payments in default

The Economic Commission for Latin America and the Caribbean (ECLAC) projects that Cuba’s GDP will decrease around -1.5% in 2025.

The country lives under a “financial corralito” that prevents foreign companies based on the island from repatriating their profits. Added to this is a dramatic collapse in foreign investments.

Until last June, Cuba accumulated 374 foreign investmentsbetween International Economic Partnership Contracts (CAEI), joint ventures and foreign companies entirely, according to the Institutional Organization report. Main entities of the National Office of Statistics and Information (ONEI).