The bankruptcy process will be subject to talks. The company, which offers payroll loans and unsecured credit, did not immediately respond to a request for comment from Reuters.

Real credit collapsed in February after defaulting on a $176 million bond, causing the shares to fall to 99% of their value.

The lender has ruled out litigating its case under Chapter 11, which would force it to leave the Mexican jurisdiction where the settlement has focused, first with local banks. Foreign bondholders are appealing and considering new legal actions in Mexico to recover their losses.

Large groups such as British asset manager Abrdn and Los Angeles, California-based DoubleLine Capital are among those holding bonds in the company, according to Refinitiv data.

Bondholders face an uphill battle as the most exposed group of unsecured creditors.

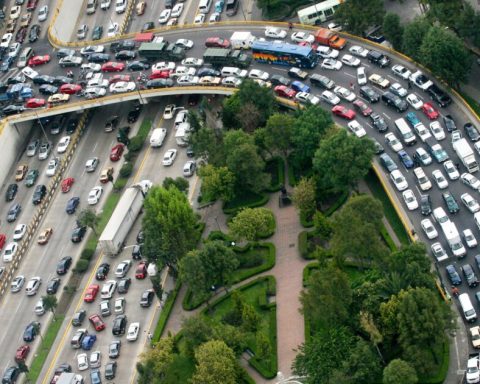

The default of Crédito Real, along with AlphaCredit and Unifin, has made banks less willing to finance non-bank lenders, analysts said, raising fears about the non-bank sector in Mexico.

With information from Reuters