A before and after, this is how this week can be defined in the grain markets, with deep price falls in soybeans, corn, wheat and rapeseed. The positive: food prices drop. In uruguay the price of cattle fell and the prospects are not auspicious for the export price of meat. Wool, for its part, fell to its lowest value in six months.

The prices of the soybean in Uruguay illustrate the phenomenal drop that had the value of the grain this week: from $500 a ton last week to a pivot of $440 to $450 This Friday the 19th.

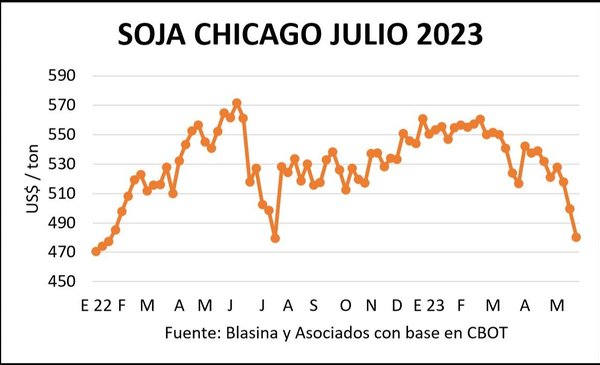

In the Chicago market, the drop was almost US$35 between Monday and Friday: a fall of 6.67% for the July position, which closed at US$480, its lowest value in 10 months.

The causes? The successive record harvests of Brazil and the United States and the impassive Chinese demand. Brazil’s soybean production, which is flooding the market with its 155 million tons, will rise to 162 million tons in 2024 according to the United States Department of Agriculture (USDA). The American will be almost 123 million tons.

The meager harvest in Argentina and the bankruptcy in Uruguay no longer weigh on the markets. The Buenos Aires Grain Exchange (BCBA) cut its harvest projection to 21 million tons, 1.5 million tons less than its previous projection and a 52% drop in volume compared to 2022.

With 70% of the harvested area, the average yield in Argentina is just 1,520 kilos per hectare, the lowest record in history.

In Uruguay, with more severe losses than expected from a much-delayed harvest, soybean production is projected to fall from 3 million tons to about 800,000.

Wheat lost US$15 per ton since Monday, more than 6% of its value, to close at US$218 the July position US$ 194.7 for September. Added to the reactivation of the Black Sea export corridor, from Ukrainian ports intervened by the Russian invasion, is the downward pressure of a positive harvest in the United States and improvements in production projections for Russia and Europe.

The price of corn also fell more than 6% in the Chicago market between Monday and Friday: it fell from US$233 to US$218 per ton, its lowest value since October 2021.

John Samuelle

Corn harvest in a field of Dolores.

The main bearish factor lies in the progress of planting in the United States, at a much higher rate than last season and with rains that alleviated the moisture deficit in key areas for cultivation.

The bulky safrinha from Brazil is pushing prices down in the local market. This Friday corn was trading at US$280 a ton, when a couple of weeks ago it was above US$330 and US$340compromising the costs of animal supplementation at the gates of a winter with little availability of grass.

Rapeseed also had a black week, with the European benchmark falling from US$420 to US$370 a tonneto. In Uruguay, depressed prices and the limitations of farms suitable for this crop will reduce the area by around 30%.

Closing in the markets

Bearish combo for the cattle market

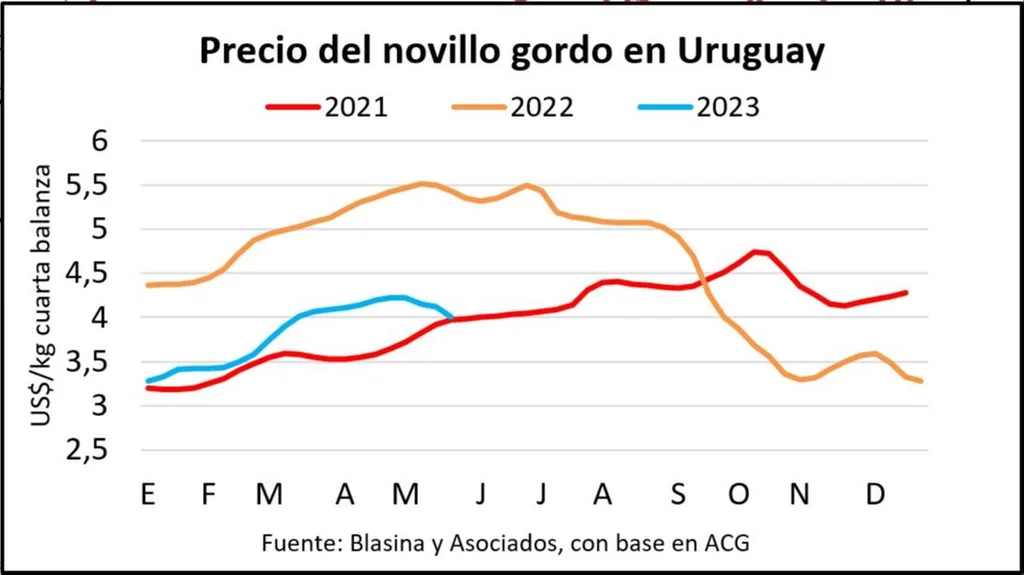

Exactly one year ago, the steer played values never seen in Uruguay. He was topping $5.50 a kilo on the fourth scale, fueled by a voracious appetite from China. Today cold cloths are arriving from the SIAL fair, which took place this week in Shanghai. This weakening of international prices is added to the lack of water and fodder, as well as the slaughter of mostly free-range cattle, and translates into new adjustments in the price of the ranch.

The references for the good heavy steer fell back to a range of US$ 4 per kilo, with some industry proposing values below. Steers well finished and in volume, which is almost non-existent, can exceptionally reach US$ 4.10, a current value two weeks ago. Cows are quoted between US$3.70 and US$3.80 and heifers are around US$3.90, reaching up to US$4 per kilo in exceptional cases. Entries range from a week to 12 days.

Very complete, special cattle, appears counted on the fingers. The weather continues to be key, with the intense cold delayed but without water. If the forecasted rains for next week hold up, “producers are in a more comfortable position to see what happens going forward,” said Christopher Brown, director of Agro Oriental.

Closing in the markets

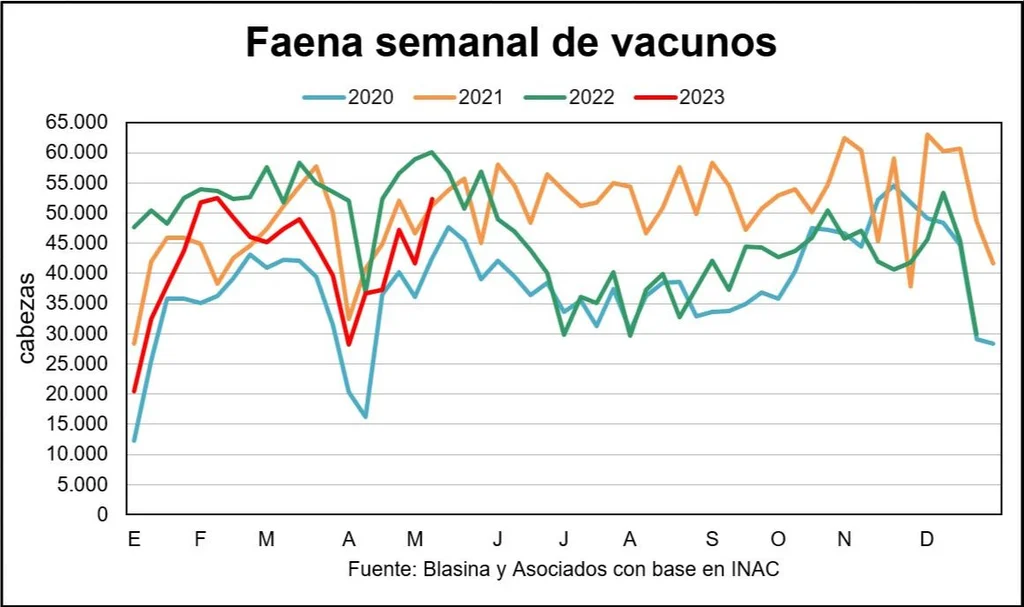

The slaughter volume is supported by free-range cattle and the slaughter of pasture cattle to send to Europe within the Hilton quotaalready closing the exercise. Last week was the second highest of the year with 52,347 cattle, mostly steers.

“After the quota ends, the work will drop substantially because there is no offer,” said Pablo Sánchez, Walter Hugo Abelenda’s desk and director of the Association of Livestock Shippers.

Livestock waiting for the cold and without water.

Winter will be marked by the lack of cattle. “It is not the same that it rains now than that it does not rain and losing meals. And there it is critical going forward because people are going to take cattle of inferior quality”, considered Sánchez.

Kosher crews are leaving and when the corral work is over – which is in its last days – some plants will stop and issue licenses.

to the little offer There are signs of weakness in the international meat markets, mainly China, where the decline in consumption has increased the stock of meat to around 800,000 tons, the equivalent of four months of imports..

From the SIAL fair held in Shanghai, which was attended with high expectations, industry operators confirm a speculative stance of importers, with slow demand and a marked downward trend in prices. The expectation is that it will gradually become more dynamic for the second semester. But the strong supply from Brazil and the slow recovery of the Asian giant’s economy create uncertainty about how much the market will be able to strengthen or not.

For now, in full quota shipments, the export price for beef published by the National Meat Institute remains solid and in the last week it registered the second highest value of the year. It was $4,916, taking the 30-day average above $4,500 for the first time in 2023.

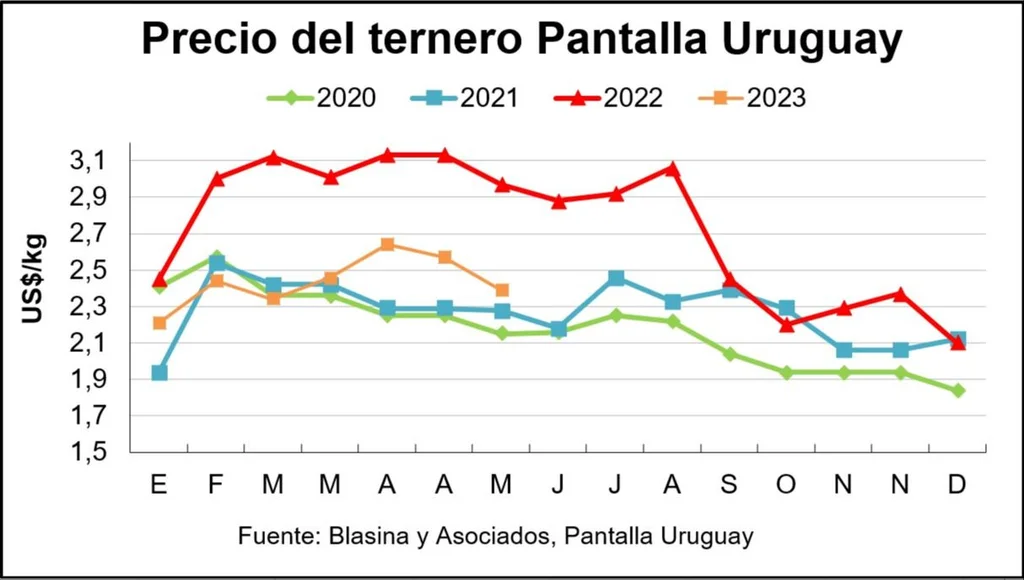

The fall of the fat man and the delay in the rains caution has increased in the replacement market, with price falls except for whole calves, supported by live exports. Demand is very selective in the face of a bulky supply. On Screen Uruguay this week 75.4% of the offer was placed, with marked losses for practically all categories. The average for calves was down 7% to $2.39.

Closing in the markets

The market for sheep is also under pressure, with red arrows on prices and more significant restrictions on entries for carcasses over 24 kilos. The values proposed this week are around US$3 for sheep and lamb, and between US$2.40 and US$2.50 for sheep.

Sheep slaughter data is closely watched, after the peaks recorded in March and April, with a weekly maximum that exceeded 48 thousand heads. In the last week there were 21,870 animals, 12% above the previous week and 35% above the same period of 2022. If the annual accumulated is observed, the 600,000 industrialized heads have already been exceeded so far in 2023 (602,209 sheep). , with a year-on-year rise of 39%.

The price per ton of exported sheep meat reached US$4,144 in the last 30 days, the highest in the year, after closing April below US$3,900.

Closing in the markets

The wool does not find a floor

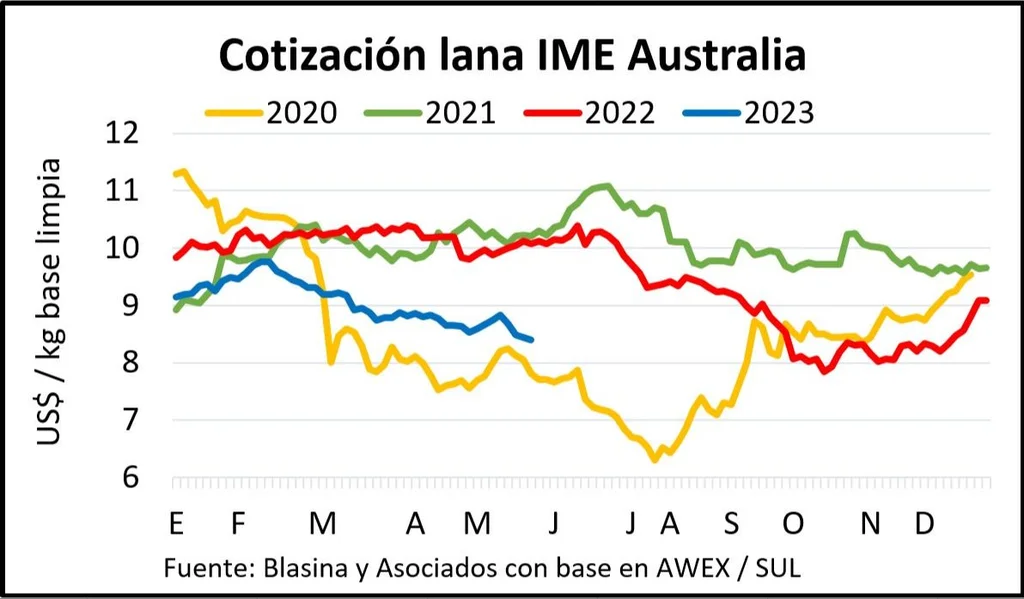

The price of wool fell 3.2% in dollar terms in Australia in the last week, reaching its lowest value since the beginning of December 2022. The market withdrew, with demand flattened by the heterogeneous quality of the product. Exporters find it difficult to satisfy the quality requirements of their customers. Even so, a significant volume of almost 42,500 bales was sold.

The Eastern Market Indicator (IME) fell from US$ 8.68 to US$ 8.40 per clean base kilo, with declines that were accentuated in the three days of auctions. The indicator is 16.6% below a year ago.

In local currency, the drop was less as a result of the depreciation of the Australian currency. The price fell 1.6%, from AU 12.84 to AU 12.63.

15% of the registered wool was withdrawn from the auctions. The volume traded so far in 2023 is 0.6% higher than last year with 1.65 million bales.

Merino categories suffered losses of up to 55p in Australian currency.

The buyers favored batches of fine wool from 18.5 to 20.5 microns with the best specifications and lower vegetable content, the only sectors in which there was competition.

Problems in the wool market continue to be the most frequent.

In Uruguay, business operations continue to be limited due to the low level of contributions.

The Union of Wool Consignees and Auctioneers reported no business in the last week.

The Uruguayan Wool Secretariat only surveyed the commercialization of a batch of Merilín wool of 4,000 kilos and 23 microns conditioned with green griffin that was quoted at US$ 2.80 per kilo fleece.