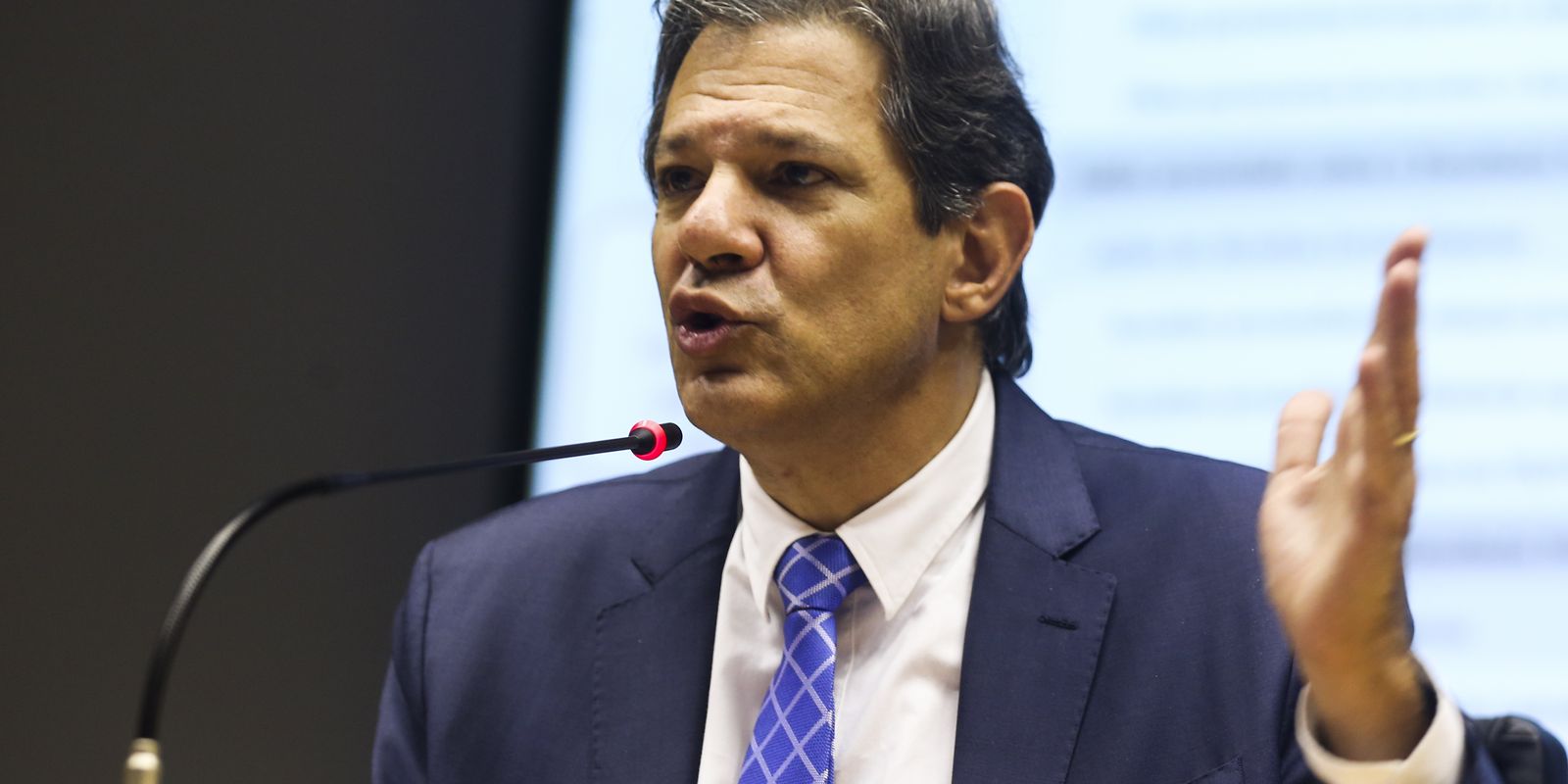

The public spending review measures necessary to rebuild the 2026 Budget will be incorporated into a project that will be reported by deputy Juscelino Filho (União Brasil-MA), said this Tuesday (28) the Minister of Finance, Fernando Haddad. The text, which establishes the Special Regime for Patrimonial Update and Regularization (Rearp), should concentrate on the “least controversial” part of the fiscal package that the government seeks to approve later this year.

According to Haddad, the proposals to limit expenses and review social registries represent around 60% of the effort needed to complete the 2026 Budget.

“President Hugo [Motta] called me several times last week and said that two or three parliamentarians would be available to incorporate the uncontroversial part of the MP [Medida Provisória 1.303]which accounts for 60% of the problem that we have to solve by the end of the year”, stated the minister this morning.

Withdrawal from the agenda by the Chamber At the beginning of the month, MP 1,303 raised taxes on financial investments, bets (virtual betting companies) and fintechs and introduced cost-cutting measures to compensate for the partial dehydration of the decree that raised the Tax on Financial Operations (IOF).

The spending review portion will be included in the project reported by Juscelino Filho. If Congress approves the text, the government will save R$4.28 billion in 2025 and R$10.69 billion in 2026.

Adjustments

Approved in the Senate in 2021, Bill 458/2021, reported by Juscelino Filho, creates Rearp. The text is in the Chamber plenary and should be adjusted to include the new measures. With the changes, the proposal will need to return to the Senate.

The decision to use Juscelino’s project occurred after the president of the Chamber, Hugo Motta (Republicanos-PB), suggested that the spending control measures be moved from another project in progress not related to spending control. According to Motta, this would guarantee “thematic relevance” and avoid regulatory questions.

“For us, what matters is voting. This part of the MP [de revisão de gastos] it gives comfort to close the budget with ease, as we have done in the last two years”, said Haddad.

Saving measures

Among the measures to be incorporated into Juscelino’s text are:

- Nest egg – inclusion of spending on the incentive program for high school students in the constitutional floor for investments in education, reducing expenses by R$4.8 billion in 2026;

- Medical expertise (Atestmed) – limitation from 180 to 30 days in the period for granting benefits due to temporary incapacity without expertise, generating savings of R$1.2 billion in 2025 and R$2.6 billion in 2026. Atestmed is the digital medical certificate system of the National Social Security Institute (INSS);

- Closed season insurance – linking payments to artisanal fishermen to the amount in the Budget and to the approval of fishing records by city halls, with savings of up to R$1.7 billion;

- Pension compensation – ceiling for the financial compensation that the Union pays to pension schemes for state and municipal employees to incorporate time served in the INSS, reducing expenses by around R$1.5 billion per year.

On the revenue side, the government intends to rescue the device that restricts tax compensations from the Social Integration Program (PIS) and the Contribution to Social Security Financing (Cofins), when there is no direct relationship with the company’s activity. The estimated additional revenue is R$10 billion per year between 2025 and 2026. Tax compensations are discounts that offset taxes paid in excess by companies along the production chain.

Voting

The president of the Chamber stated that he intends to put the proposal to a vote this week, a measure that Haddad classified as essential for preparing next year’s Budget.

“The important thing is to vote on the topic and give predictability to the 2026 budget”, highlighted the minister.

After voting on the expense cutting project, the economic team must resume sending proposals to increase revenue, including taxation of fintechs and online betting houses (bets).

“We are evaluating how to complement [as medidas] after this vote, to find the best way to balance the budget”, said Haddad. He stated that he had support from part of the PL to approve the new taxation rules. “The PL is not monolithic. There is a large part that agrees to correct tax injustices, such as the low taxation of bets”, he added.

The overturn of MP 1,303 removed a series of adjustment measures from the government, including taxation on electronic betting, fintechsincome from LCI and LCA, and interest on equity (JCP). Rules that limited tax compensation and cut spending on social programs were also annulled.