The recent rise in the dollar and uncertainty surrounding inflation have led the Central Bank (BC) to raise interest rates for the first time in more than two years. Unanimously, the Monetary Policy Committee (Copom) increased the Selic rate, the economy’s basic interest rate, by 0.25 percentage points, to 10.75% per year. The decision was expected by the financial market

The last interest rate hike occurred in August 2022, when the rate rose from 13.25% to 13.75% per year. After spending a year at this level, the rate had six 0.5 point cuts and one 0.25 point cut between August last year and May this year. At the June and July meetings, Copom decided to keep the rate at 10.5% per year.

In a statement, Copom justified the interest rate hike based on the following factors: resilience in economic activity, pressures in the labor market, a positive output gap (the economy is moving towards consuming more than its production capacity), rising inflation estimates and a unanchoring of inflation expectations. Regarding the future, the text was vague about the intensity and duration of the interest rate hike cycle.

“The pace of future adjustments in the interest rate and the total magnitude of the cycle now initiated will be dictated by the firm commitment to convergence of inflation to the target and will depend on the evolution of inflation dynamics, especially of the components most sensitive to economic activity and monetary policy, inflation projections, inflation expectations, the output gap and the balance of risks”, informed Copom.

Inflation

The Selic is the Central Bank’s main instrument for keeping official inflation, measured by the Broad National Consumer Price Index (IPCA), under control. In Augustthe Broad National Consumer Price Index (IPCA), considered the official inflation rate, was negative by 0.02%. According to the Brazilian Institute of Geography and Statistics (IBGE), the drop in energy prices pulled the index down, but the relief in inflation is temporary.

Electricity tariffs will rise from September because of the red tariff flag. In addition, the prolonged drought will have an impact on food prices. Last week, Finance Minister Fernando Haddad argued that the food supply shock is not resolved through interest.

With this result, the indicator has accumulated an increase of 4.24% in 12 months, close to the ceiling of this year’s target. For 2024, the National Monetary Council (CMN) set an inflation target of 3%, with a tolerance margin of 1.5 percentage points. The IPCA, therefore, could not exceed 4.5% or fall below 1.5% this year.

In the latest Inflation Report, released at the end of June by the Central Bank, the monetary authority kept the forecast IPCA is expected to end 2024 at 4%, but the estimate may change due to the rise in the dollar and the impact of the prolonged drought on prices. The next report will be released at the end of September.

Market forecasts are more pessimistic. According to the Focus bulletin, a weekly survey of financial institutions released by the Central Bank, official inflation is expected to close the year at 4.35%, close to the ceiling of the target. A month ago, market estimates were at 4.22%.

For the first time, the Copom statement brought the Central Bank’s updated expectations on inflation. The monetary authority predicts that the IPCA will reach 4.3% in 2024, 3.7% in 2025 and 3.5% in the accumulated 12 months at the end of the first quarter in 2026. This is because the Central Bank works with what it calls an “extended horizon”, considering the scenario for inflation in up to 18 months.

More expensive credit

Increasing the Selic rate helps to contain inflation. This is because higher interest rates make credit more expensive and discourage production and consumption. On the other hand, higher rates hinder economic growth. In the latest Inflation Report, the Central Bank increased to 2.3% the growth projection for the economy in 2024, but the number should be revised after growth of 1.4% in Gross Domestic Product (GDP) in the second quarter.

The market projects much better growth. According to the latest edition of the Focus bulletin, economic analysts foresee expansion 2.96% of GDP in 2024.

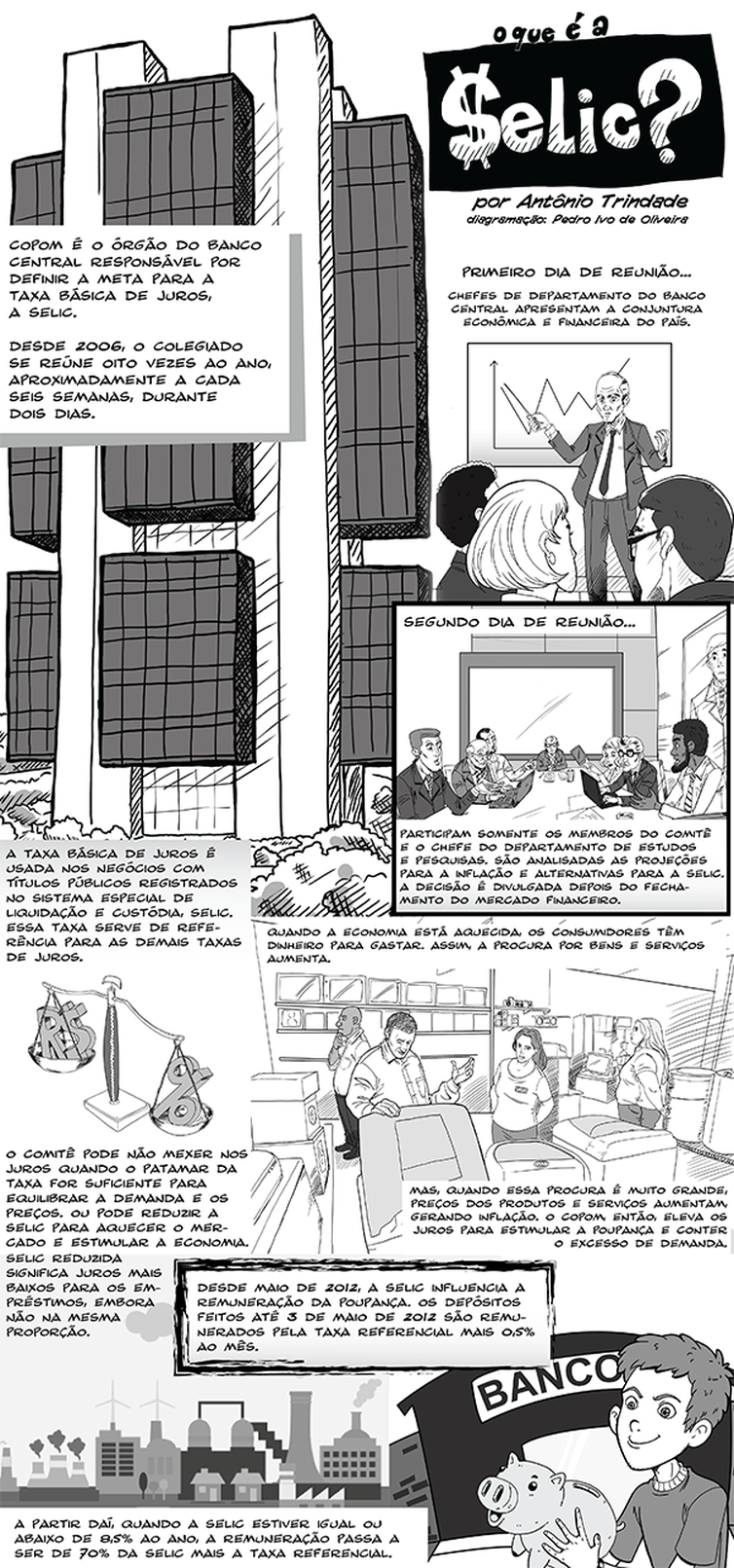

The basic interest rate is used in negotiations of government bonds in the Special Settlement and Custody System (Selic) and serves as a reference for other interest rates in the economy. By adjusting it upwards, the Central Bank controls excess demand that puts pressure on prices, because higher interest rates make credit more expensive and encourage savings.

By reducing the base interest rate, Copom makes credit cheaper and encourages production and consumption, but weakens inflation control. To cut the Selic rate, the monetary authority needs to be sure that prices are under control and are not at risk of rising.