The recent dollar discharge and the uncertainties around inflation and the global economy have made the Central Bank (BC) increased interest rates once again. Unanimously, the Monetary Policy Committee (Copom) increased the Selic rate, the basic interest of the economy, in 1 percentage point, to 13.25% per year. In addition to expected by the financial marketthe elevation in 1 point had been announced by the Central Bank at the December meeting.

This was the fourth high followed by Selic. The rate has been at the highest level since September 2023, when it was also 13.25% per year. High consolidates a cycle of contraction in monetary policy.

After reaching 10.5% in June to August last year, the rate began to be elevated in September last year, with a 0.25 point, a 0.5 point and a 1 percentage point .

Inflation

SELIC is the main instrument of the Central Bank to keep official inflation under control, measured by the National Consumer Price Index (IPCA). In December, the Broad National Consumer Price Index (IPCA), considered the official inflation, It was 0.52%. According to the Brazilian Institute of Geography and Statistics (IBGE), despite the green flag in light bills, the price of food, especially meat and some fruits, continued to rise.

With the result, the indicator accumulates high of 4.83% in 2024, above the roof of last year’s goal. For the new continuous goal system In force this month, the inflation target that must be pursued by the BC, defined by the National Monetary Council, is 3%, with a tolerance interval of 1.5 percentage up or down. That is, the lower limit is 1.5% and the upper is 4.5%.

In the continuous goal model, the goal is calculated month by month, considering the accumulated inflation in 12 months. In January 2025, inflation since February 2024 is compared to the goal and tolerance interval. In February, the procedure is repeated, with calculation from March 2024. Thus, the verification moves over time, no longer restricted to the closed index of December of each year.

In the last inflation report, released in late December by the Central Bank, the monetary authority maintained the forecast that the IPCA will end 2025 by 4.5%but the estimate can be revised, depending on the behavior of the dollar and inflation. The next report will be released at the end of March.

Market predictions are more pessimistic. According to the bulletin Focusweekly research with financial institutions released by the BC, the official inflation should close the year at 5.5%1 point above the roof of the goal. A month ago, market estimates were 4.96%.

The Copom statement brought up -to -date Central Bank expectations on inflation. The monetary authority foresees that the IPCA will reach 5.2% in 2025 (above the target ceiling) and 4% accumulated in 12 months at the end of the third quarter in 2026. This is because the Central Bank works with what it calls “ Extended horizon ”, considering the scenario for inflation within 18 months.

The Central Bank increased inflation estimates. At the previous meeting of November, Copom predicted IPCA of 4.5% in 2025 and 4% in 12 months at the end of the second quarter of 2026.

Expensive credit

Increased Selic rate helps contain inflation. This is because higher interest rates make credit more expensive and discourage production and consumption. On the other hand, higher rates make economic growth difficult. In the last Inflation reportthe Central Bank raised the growth projection to 2.1% for the economy in 2025.

The market projects a little smaller growth. According to the last edition of the bulletin Focuseconomic analysts predict Expansion of 2.06% of GDP in 2025.

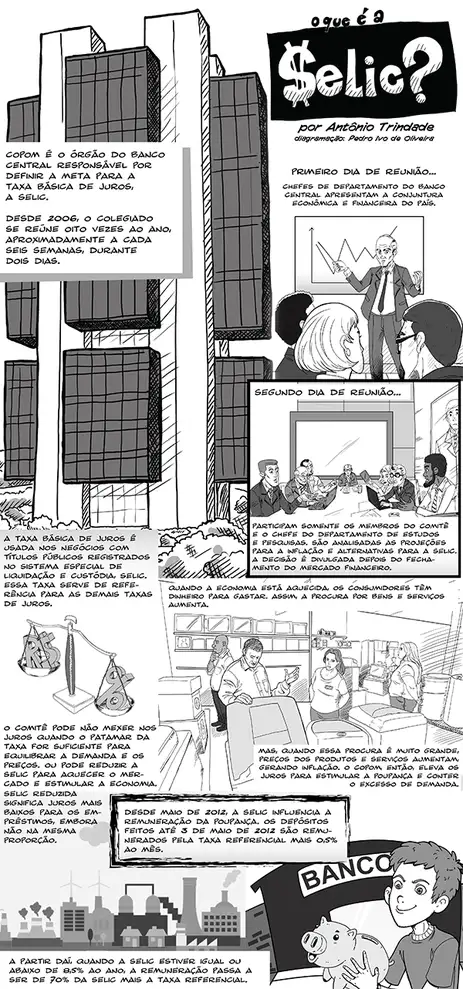

The basic interest rate is used in public securities negotiations in the Special Settlement and Custody System (Selic) and serves as a reference for the other interest rates of the economy. By adjusting it up, the Central Bank holds the excess demand that pressures prices, because higher interest rates make credit more expensive and stimulate savings.

By reducing basic interest rates, copom cheeses credit and encourages production and consumption, but weakens inflation control. To cut Selic, the monetary authority needs to be safe that prices are under control and are not at risk of climbing.