According to rumors, the new Tax Reform could raise this tax from 4×1000 to 5×1000.

Colombia News.

In Colombia, the recent controversy over a A possible increase in the tax on financial transactions, known as 4×1000, has captured public attention.

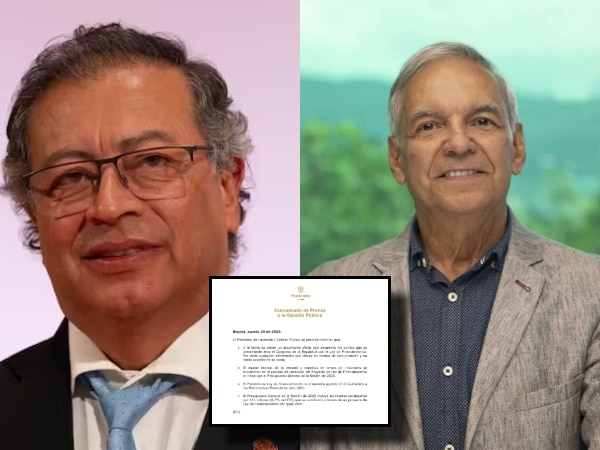

According to rumors, The new tax reform that Gustavo Petro’s government would present could raise this tax from 4×1000 to 5×1000. However, the Ministry of Finance has assured, “this is false.”

In a statement, the Ministry of Finance denied the speculation, stating that, “To date, there is no official document that develops the points that will be presented to the Congress of the Republic with the financing law. Therefore, any information circulating in the media and social networks is not true.«.

The Ministry also assured that its technical team and tax experts are working on drafting the financing bill in line with the general budget of the Nation for 2025.

They clarified that the project will not propose adjustments to the taxation of financial transactions.

4×1000 does not disappear, but neither does it increase to 5×1000: Ministry of Finance

The general budget of the Nation for 2025 includes a contingent resource of 12 billion pesosequivalent to 0.7% of GDP, which will be made visible through a financing bill with the same value.

Despite this clarification, various media outlets are asking the National Government for clarity.

Many have even published that after having access to the first draft of the tax reform that the Petro Government will present to Congress in September, they were able to learn that It includes proposals to gradually reduce corporate income tax rates and increase the tax rate for companies, as well as a flat rate for windfall profits for corporations.

In addition, it is It contemplates the possibility of making significant changes to the tax on financial transactions, which could go from 4×1000 to 5×1000.

This tax, widely criticized for its impact on the digitalization of the economy and banking, remains a point of friction between the government and various economic sectors.

The proposal will be thoroughly discussed in Congress, and the business community and citizens will be attentive to the developments and decisions made regarding this controversial tax.

#Ministry of Finance It is allowed to clarify:

1️⃣ The Project of #FinancingLaw will not propose adjustments to the Tax on Financial Transactions (4×1,000).

2️⃣ The entity’s technical team and tax experts are in the process of drafting the Project, in line with the #PGN2025 pic.twitter.com/OHStTXpoOX

— MinHacienda (@MinHacienda) August 20, 2024