On November 20, the Congressional Budget Committee approved the Public Sector Borrowing project for Fiscal Year 2026, in line with next year’s budget. Later, on the 28th of that same month, a substitute text entered the Plenary debate with a surprise: changes in the operation of the Municipal Savings and Credit Banks (CMAC).

This, which was approved that same day and which was published yesterday in the legal regulations, is something that the Superintendency of Banking, Insurance and AFP (SBS) itself had already opposed because it would generate negative effects on the corporate governance of these entities.

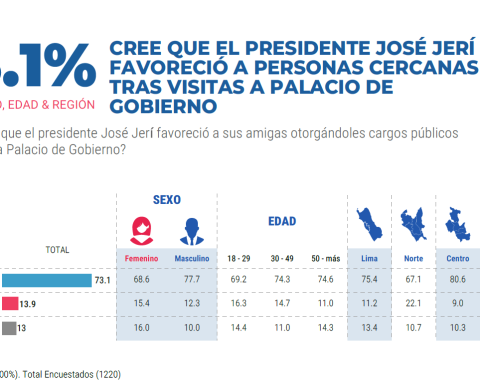

By the way, the law has the signature of President José Jerí, who during his time at the Economy Commission as vice president of the group, wanted to include projects that already proposed modifications in the board of directors of these entities.

What is intended now? The fifteenth complementary provision modifying the norm establishes changes in articles 10 and 11 of Law 30607, Law that modifies and strengthens the operation of the CMAC. Thus, currently, the board of directors of these entities was made up of seven members, including two who represent the majority of the municipal council, one the minority of the municipal council, one Cofide, one the chamber of commerce, one the clergy and one the small merchants and producers of the territorial area where the entity operates.

The law now indicates that the latter will be selected by the vice minister of Mype and Industry of the Ministry of Production, that is, there will be interference from the government in power.

The rule also emphasizes that mayors, councilors and those who do not meet the technical and moral suitability requirements cannot be part of the board.

The other questionable point is that it is established that the president of the board of directors is elected for only one year, and that he may be re-elected for two consecutive annual periods. Previously, the rule established three consecutive years in office and the possibility of re-election without limit.

POSITION OF THE SBS

As mentioned above, the SBS had already ruled against it. The regulator noted that the proposal to limit the time in office of the president of the board of directors could negatively affect the strategic continuity and the fulfillment of long-term business objectives of each savings bank.

“That is why, if the objective of this measure is to favor dynamism in the formation of the board, avoiding exposure to particular positions of dominance, this Superintendency is of the opinion that the limitation in question should be focused on the maximum period that can be held as director, and a reasonable period must be established to ensure compliance with the strategic plans and allow a new formulation of this based on the identified gaps,” the SBS stated.

STRENGTHENING

Something that is not being taken into account in the standard is the solidity of these financial entities. As of October, the profits of municipal savings banks grew 135.7%. In addition, rural savings banks stopped reporting losses.

Receive your Perú21 by email or WhatsApp. Subscribe to our enriched digital newspaper. Take advantage of the discounts here.

RECOMMENDED VIDEO