“It is imperative that reform fiscal “comprehensive approach that will sustainably increase tax revenues by broadening the tax base and eliminating exemptions,” says the mission of the International Monetary Fund (IMF) who was recently in the country completing an annual visit.

The statement, contained in its conclusions published today on the website of the IMFoccurs in a context in which the country is debating the imminent submission of a reform fiscal.

However, the mission notes that this “imperious” reform fiscal comprehensive, must go “in parallel with a reduction in evasion fiscal and improved spending efficiency, including lower subsidies to the sector electricity and lower non-targeted transfers.”

The mission considers that said reform “will create space fiscal additional and will provide resources for the necessary spending on development (included infrastructure “disaster resilient”

He understands that, in order to mitigate the impact of the reforms on the most vulnerableyou can resort to measures targeted through existing social programs.

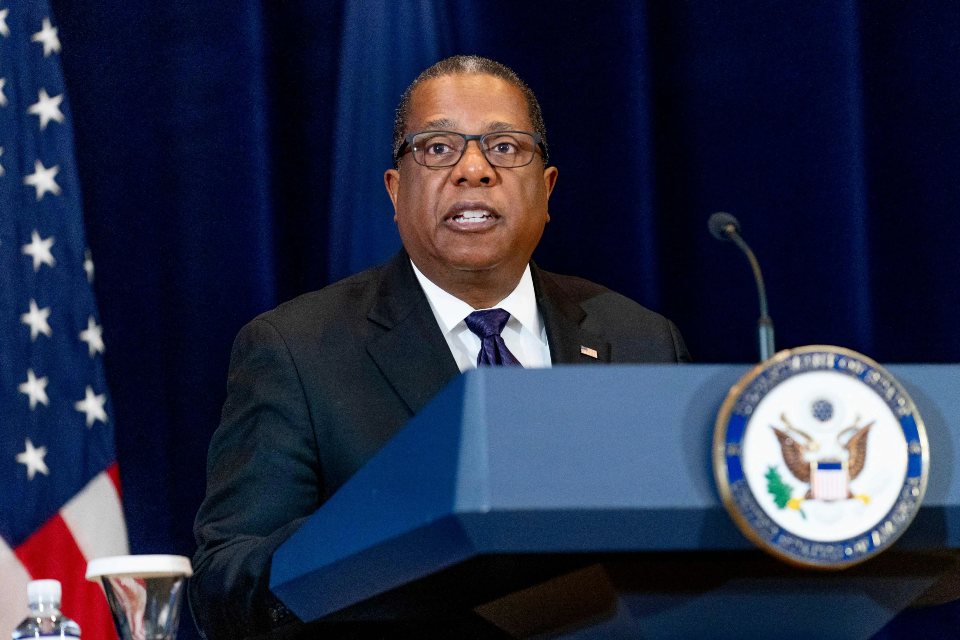

The mission, headed by Emilio Fernández-Corugedo, also applauds “the commitment of the authorities to allocate more resources to speed up the recapitalization of the Central Bank in order to strengthen its autonomy“.

- The team held meetings with the Governor of the Central Bank, Héctor Valdez Albizu; the Minister of Finance, José Manuel -Jochi- Vicente, and other senior officials and representatives of civil society and the sector private. It was part of the periodic (usually annual) consultations within the frame of Article IV of the Constitutive Agreement of the IMF.

The full conclusions of the meeting are shared below. IMF mission

Dominican Republic: Statement by technical staff at the end of the Article IV consultation mission for 2024

Santo Domingo Dominican Republic:

A history of solid policies and strong institutional frameworks have helped the Dominican Republic achieve a growth economic Robust and resilient with a low inflation over the past two decades. Effective policies contributed to a moderation of the growth which duly facilitated the rapid and sustained return of the inflation at your level goal last year.

The authorities provided timely support through policies to support recovery while closely monitoring the sector financialwhich was able to weather the period of high interest rates well and growth slower in 2023.

From now on, the policies They must focus on preserving macroeconomic and financial stability, which includes gradually normalizing the policy monetary and, at the same time, allow the replacement of fiscal and external spaces.

TO medium termthe planned improvements to the frameworks of the policies and the deepening of structural reforms – in particular, comprehensive reforms at the national level fiscal and in the sector electric—have the potential to promote competitiveness and growth inclusive.

The policies successful and determined have achieved that the inflation return firmly to its level goal…

After a strong recovery after the pandemic, the growth economic slowed to 2.4 percent in 2023 due to conditions financial more restrictive global and domestic policies, weak demand for exports and transitory internal factors, mainly of a climatic nature.

The slowdown of the growthcoupled with the decrease in raw material prices, caused the inflation converged sooner than expected towards the range goal (4±1 percent) in May 2023. In response, the Central Bank of the Dominican Republic (BCRD) prudently and appropriately reduced its main interest rate policy monetaryallowing greater exchange rate flexibility, which together with the due adjustment of the policy fiscal —with an increase in the investment public—allowed to stimulate the economy.

In view of historically low levels of the interest rate differential with respect to the US Federal Reserve rate, the BCRD increased its foreign exchange interventions to smooth the daily volatility of the exchange rate.

He deficit in account current In 2023, it was sharply reduced to 3.6 percent of GDP, driven by reduced domestic demand for imports, moderating commodity prices and record tourism revenues; being fully financed by cash flows investment foreigner direct investment (FDI), with continued and favourable capital market access.

Rising spending and interest rates and lower growth of GDP caused increases in deficit of the sector public and the debt in 2023, although in the case of the latter it also had an impact on greater exchange rate flexibility.

He sector financial He was able to navigate the restriction period well. policy monetary and the minor growth in the first half of 2023, and is adequately capitalized and profitable.

…and have laid the groundwork for a growth sustained…

Supported by the solidity of the policiesfundamentals and favourable external conditions, the outlook is positive despite high uncertainty (mainly global). For 2024 and beyond, the growth of real GDP to remain around its long-term trend term of 5 percent, with the inflation around of the goal of 4 percent.

It is projected that the deficit in account current be financed mainly by investment foreigner directly and gradually reduced to less than 3 percent of GDP. medium termdriven by lower energy expenditure and higher revenues from tourism and free trade zones.

The risks to short term for the performance of the economy —derived from the conditions financial global economic slowdowns, geopolitical tensions and volatile commodity prices—have moderated since last year but remain elevated and tilted downwards.

TO medium termthe risks are more balanced with an upward bias if the main reforms are successfully implemented.

…which creates space for the replenishment of fiscal and external buffers…

The policies to short term must ensure that the inflation stay within range goalwhile preserving financial stability and allowing for the replenishment of fiscal and external space. The priorities are as follows:

- The policy fiscal must remain focused on replenishing space fiscal. The consolidation fiscal gradual planned by the authorities, in accordance with the law of responsibility fiscal in the Senate, it is appropriate to place the debt on a firm downward trajectory. In addition, Comprehensive tax reform is imperative which will sustainably increase tax revenues by broadening the tax base and eliminating exemptions, in parallel with a reduction in evasion fiscal and improved spending efficiency, including lower subsidies to sector electricity and lower non-targeted transfers. This reform will create space fiscal additional and will provide resources for the necessary spending on development (included infrastructure disaster resilient). To mitigate the impact of reforms on the most vulnerable vulnerable you can resort to measures targeted through existing social programs.

- The normalization of the policy monetary may continue, given that there is still slack in the economy and that the inflation is firmly situated within the range goal. To further strengthen the credibility of the target regime, inflationearned through hard work, currency interventions and measures Liquidity measures should focus on cases of major shocks. Greater exchange rate flexibility would allow for the absorption of such shocks, and greater reserve accumulation can increase the space to cope with future shocks.

- He sector financial remains resilient and is adequately capitalized. Stress tests conducted by the technical staff of the IMF —consistent with those published by the BCRD— show that the sector banking is in a position to absorb various shocks. Given higher-for-longer interest rates and previous spikes in the growth credit, careful monitoring remains necessary to contain any buildup of vulnerabilities.

…and to begin essential structural reforms to promote the growth inclusive.

The team congratulates the authorities for the initiatives they are carrying out to strengthen the frame of the policies and implement reforms.

Other improvements to the frameworks policiesgovernance, the climate businesssocial safety nets and the sector electric can promote the growth inclusive to medium term and reduce vulnerabilities:

- To further strengthen the frame of the policy fiscal and the efficiency of spending and income It is necessary to continue improving public financial management (in particular transparency and effective supervision of companies) publicas well as the planning of the investment) and continue to strengthen public revenue administration. Develop a frame A cost/benefit analysis for evaluating tax exemptions and subsidies would also ensure that the expected increases in public revenues through tax reforms are long-lasting.

- The mission welcomes the commitment of the authorities to allocate more resources to expedite the recapitalization of the Central Bank in order to strengthen its autonomy. Efforts should be continued to deepen the foreign exchange market and expand the use of hedging mechanisms, support greater exchange rate flexibility and thus further strengthen the effectiveness of the targeting regime. inflation.

- Update frame of regulations financial and prudential to the latest international standards, as well as expanding the macroprudential toolkit, and closing regulatory and supervisory gaps (for example, in the case of savings and loan cooperatives) will continue to increase the resilience of the sector financial.

- Ongoing efforts to improve the institutions public and the climate business are bearing fruit and are essential to preserve the firm trajectory of the investment and the growth. Educational and labour market reforms, together with further improvements in the results of the policies social and the adoption of policies adaptation and climate mitigation, will be crucial to support the growth inclusive and resilient and continue to reduce vulnerabilities.

The mission had meetings with the Governor of the Central Bank, Héctor Valdez Albizu; the Minister of Finance, José Manuel Vicente Dubocq, and other senior officials and representatives of civil society and the sector private.

The team wishes express their sincere gratitude to the authorities for their exceptional hospitality, their full cooperation and an open, frank and productive dialogue.