Soybeans once again exceeded US$ 500 in Chicago, in a market dominated by climate projections and with little influence from the mostly stable estimates of the monthly report of the United States Department of Agriculture (USDA) for this Friday. At the same time, in Uruguay The livestock market cools down, with the slaughter in decline and little supply of finished cattlesomething that could change within 20 or 30 days. Wool price rebounded in Australiadue to the effect of the exchange rate.

Drought, also in the US

Drought conditions are spreading across the central and eastern United States and medium- and short-term forecasts are unfavorable, conditions that prompted a strong rise in soybeans this Friday in Chicago. The oilseed closed the week at US$ 509 per ton for July, with an increase of 2.5%. The soybean in March 2024 was quoted at US$ 445.

In Uruguay the reference for available soybeans is US$ 445with a significant gap with respect to the Chicago price, and for the coming year US$ 407.

The reference for malting barley is US$246 and US$215 for export barley, while 2024 rapeseed is strengthened with prices of US$396 per ton.

The USDA’s monthly grain report, released at noon on Friday, had little influence on the market.

The projections were within estimates, maintaining the production expected in the United States at 122.4 million tons, as well as an increase of 155 to 156 tons for the Brazilian crop and a decrease of 27 to 25 million for the from Argentina. This figure is still well above local estimates: the Buenos Aires Grain Exchange maintained its projection of 21 million tons this week.

The final stock of US soybeans was corrected upwards, explained by the lower volume of exports.

Price fluctuations will largely depend on the weather situation in the coming weeks in North Americaa climate market exposed to unexpected events such as the massive fires in eastern Canada, with more than 3 million hectares of forest burned and thousands of people evacuated.

Weekly closing in the markets

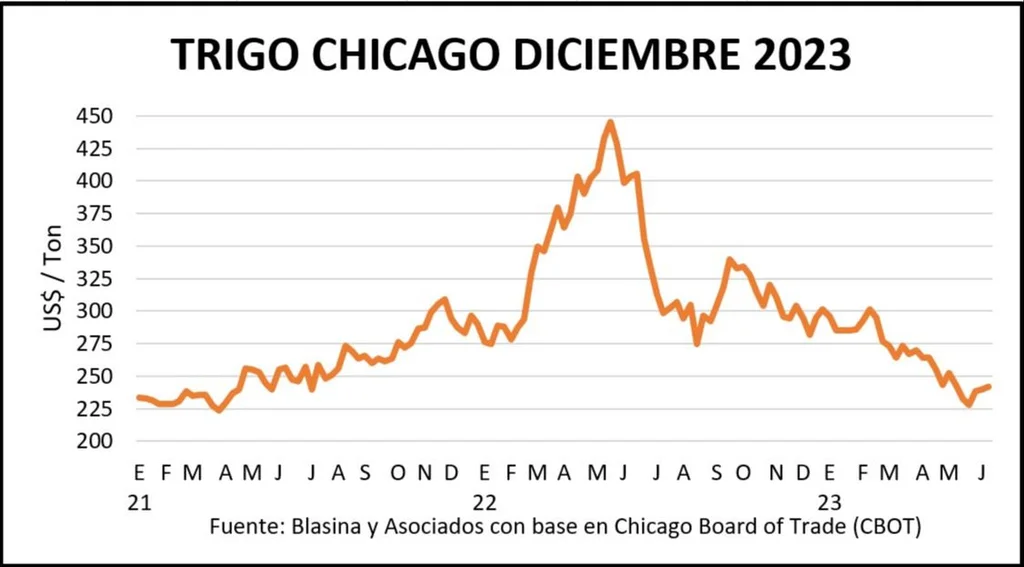

Wheat in Uruguay reached US$290 and corrected to US$285 per ton. In Chicago, the July position rose for the third consecutive week, adding 1.8% at the end of the week to close at US$ 231.58 per ton. The December position is at US$ 242.

Some support was provided by the USDA report, which slightly raised US production from 45.16 to 45.32 million tons, still below private estimates of 45.51 million, so it remains at adjusted levels and stocks do not move from the lowest levels in 15 years.

The boost in Russian production, with increases in volume and the exportable balance of the next harvest, contrasted with the uncertainty added by tensions in Ukraine. Adding to the difficulties in the Black Sea export corridor is the explosion this week of the Kahkova dam, which flooded irrigated agricultural production areas and caused serious environmental impacts.

The huge production of safrinha corn in Brazil – some 100 million tons – led the grain to close the week US$ 2 lower with a price of US$ 237.88 and a drop of 2% for the September position that stood at US$ 206.49. The exchange rate in Brazil, with an increasingly strong real, halted the decline, as well as the drought conditions in growing areas in the United States.

The new USDA projections maintained the record production that is projected for the United States in the 23/24 harvest, of 387.75 million tons, raised the Brazilian crop by two million tons and corrected Argentina’s from 37 to 35 million , somewhat less than the local estimate of 35 million tons.

cold cattle market

The work was adjusted again in the last week, the industry does not press and proposes lower prices due to the low supply that persists in the livestock market.

Even so, the top steers resist over US$ 4 per kilo in fourth scale.

The downward adjustment continues for the categories of lower completion, with a disparity of entries between plants that continues to be marked. The average is 10 days.

For now, the temperatures have been playing in favor of production, with a strong push from the pastures. “The one who has a good cattle today is better positioned, with better negotiating capacity and can put a few more kilos at least until the cold weather does not appear seriously”said Diego Arrospide, of the desk Antonio Arrospide and sons, of Florida.

The bulk of good heavy steers are marketed between US$4 and US$4.10 per kilo in fourth scale. For several days there have been proposals below but they are not fully consolidated.

In the case of the fat cow, there is a greater price gap compared to the usual, with prices ranging from US$3.60 to US$3.85 with some exceptional business for special, heavy and volume cattle, a few cents per on. The average business is between US$3.70 and US$3.75. The heifer sits at an average of US$ 3.95.

“In 20 or 30 days you will begin to notice a greater supply of green cattle,” estimated Arrospide.

This punctured market is transferred to the job, which fell for the third week in a row. The latest data was 38,957 cattle, 6% less than the previous week and 32% below the same week last year.

Weekly closing in the markets

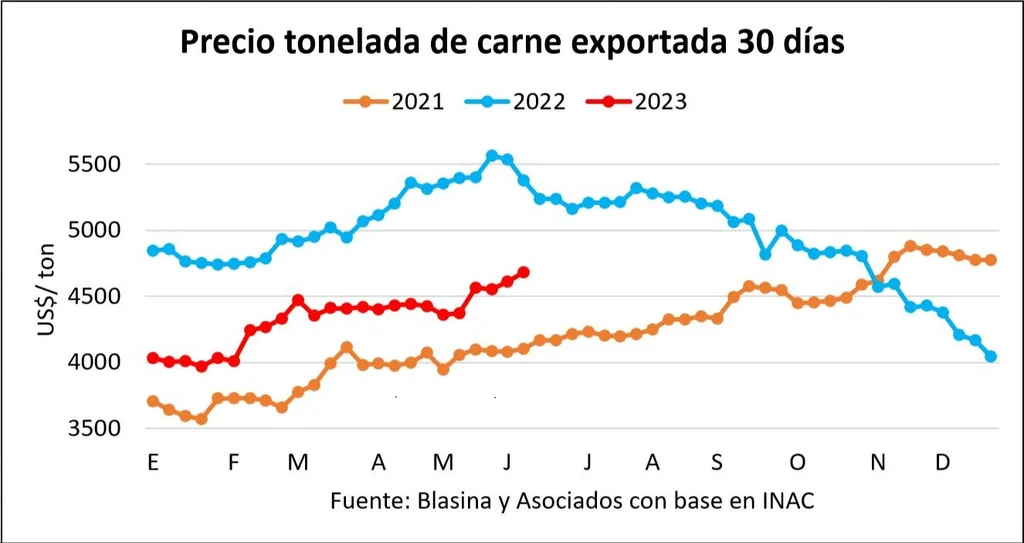

External signs continue to be weak in the main markets, although this has not yet been reflected in the export price in recent weeks, possibly driven by placements within Quota 481 and the closure of the Hilton.

The ton of beef exported averaged US$ 4,717 in May, 8% more than in April and 16% higher than in January. A year ago, when Uruguay registered historical prices for beef, the monthly average reached US$5,473.

A timid international market translates into industrial caution depressed values for the fat, which also reach the replacement. The drop in the supply of cattle for the field, typical of the season, is becoming more noticeable, and the demand is more active due to the stimulus of a friendly weather, with insufficient rains for the waterfalls but which have boosted the pastures.

In the replacement market, private businesses are restrained in terms of prices, with a clear preference for short businesses and also for calves. In Lote 21 this Friday this category averaged US$ 2.44, marking a 1.2% rise compared to the previous auction.

Live export is still active for the whole calf. In the last month, a shipment left for Morocco, one for China, and this Friday a ship was loaded that will set sail with 18,000 head to Turkey.

Arrospide considered that “the logic of the market begins to be reversed in the replacement where the demand is more active and the supply begins to decrease.” “It seems to me that in the coming weeks we are going to find stability in values,” she anticipated.

As for the sheep, there is not much supply, and although there is an active demand, the prices clearly continue to fall. “This week is going to have a more significant drop again than previous weeks.”

The latest references from the Livestock Consignee Association (ACG) set US$3 for heavy lamb, US$2.58 for capons, and US$2.48 for ewes.

Sheep slaughter was 15,958 heads, the lowest of the year if the first week of January is excluded.

The volume of sheep meat exported so far this year is 50% higher than the same period last year, with 12,247 tons, but the average annual value is 25% below: US$ 3,885.

Weekly closing in the markets

Rebound in the wool market

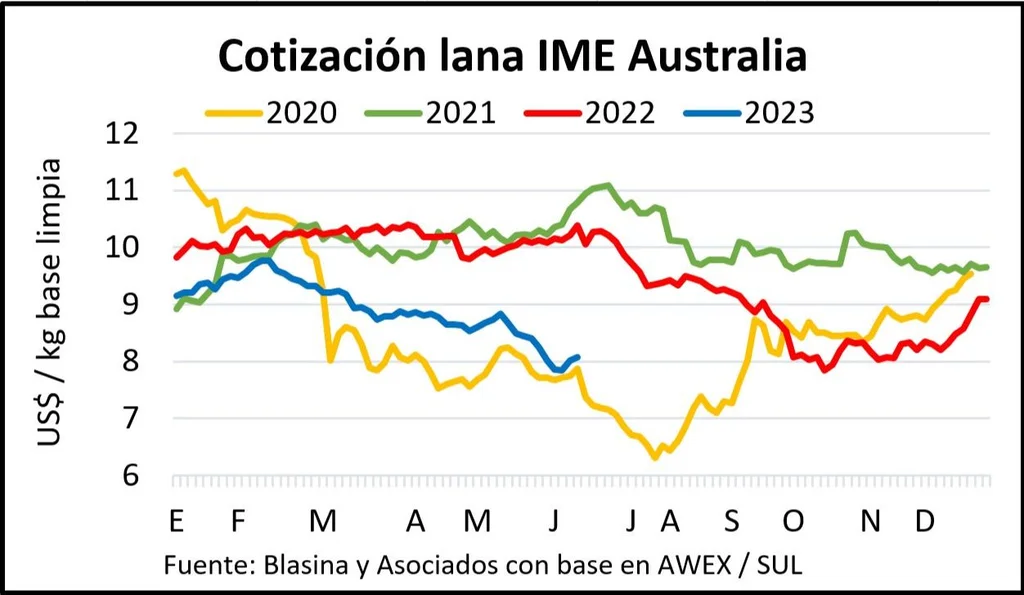

The Surprise interest rate hike announced on Wednesday by the Australian Central Bankfrom 3.85% to 4.10%, was key for the price of wool to rise almost 3% in US dollars this week, moving away from the floor of values of the 2022/23 harvest.

With lower supply than the previous week (33,435 bales) and active demand, the Eastern Markets Indicator (IME) rose from US$7.85 to US$8.07 per kilo of clean base, a weekly increase of 2.8%. .

The appreciation of the Australian currency in response to the rise of 25 basis points translated into a reverse trajectory in the local currency indicator, which fell one cent.

The market opened on Tuesday with sustained demand and a boost in prices in all types, diameters and qualities of wool. This trend was not sustained on Wednesday due to the change in financial conditions. Buyers took a more selective position, favoring lots with certifications and low vegetable content.

The increases in dollars were lower in the range of finer wools than in crossbreeds. Those of 17 microns increased 1.8%, those of 21 microns rose 1.9% and those of 28 microns 2.3%.

In the local market, with limited operations due to the proposed price level, the Uruguayan Secretariat of Wool (SUL) reported business of two Merino batches of 1,500 kilos each, conditioned with green taping. One of 19.8 microns that obtained US$ 5.80 per kilo fleece and one of 20.6 microns priced at US$ 4.20 per kilo.

Between January and May of this year, 12.9 million kilos were exported for an amount of US$ 65 million. Volume was down 2% and revenue was down 15%. Italy was the main client with 23% of the currencies entered and China the second with 21%.

The behavior is uneven between dirty, washed and tops (combed) wool. While the volume of dirty wool grew 24%, revenues fell 5%. In washed wool the decreases are 13% in volume and 26% in turnover, while for the tops the drop in kilos is 8% and 17% in foreign currency.