The Central Bank of the Dominican Republic (BCRD) reports that between the months of January and June 2022, the remittances received reached a figure of US$4,861.1 million.

It also highlights that this amount exceeds by US$1,403.7 million the remittances received in the first six months of 2019, the period prior to the start of the COVID-19 pandemic, in which the United States did not yet have the aid schemes that were implemented after March 2020 and that ended in September 2021, which is why, when comparing the flows received as of June 2022 with those of the same month of In 2021, in which the Dominican diaspora in the US still received these incentives, a reduction of just US$66 million was observed.

We invite you to read: Economy grows 5.6% from January to May 2022

An important aspect to highlight is that the US$803.8 million received during the month of June reaffirm the establishment of a new level of monthly remittance flows. In that sense, when comparing this amount for June 2022 with the average value in the same month for the period prior to the 2015-2019 pandemic, which was US$499.2 million, a significant increase is observed.

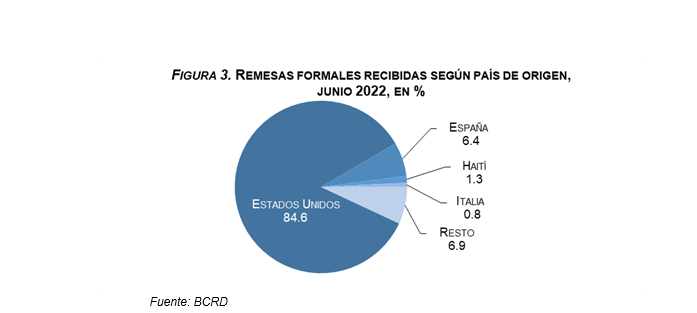

The Central Bank explains that the conditions of the United States labor market It is one of the main factors that continues to affect the behavior of remittances, since 84.6% of the flows in June came from that country. During that month, the US economy created 372 thousand jobs, keeping the unemployment rate at 3.6% in June 2022. Particularly, the unemployment of Hispanics in the US did not change in June, remaining at 4.3%.

The BCRD also highlights receiving remittances from other countries, such as Spain, in the order of 6.4%, second country in terms of total residents of the Dominican diaspora abroad, as well as Haiti and Italy with 1.3% and 0.8% of the flows received, respectively. The rest of the reception of remittances is divided among countries such as Switzerland, Canada and Panama, among others.

Regarding the distribution of remittances received by provinces, the BCRD indicates that the National District obtained the highest proportion, 33.9%, followed by the provinces of Santiago and Santo Domingo, with 14.4% and 9.0%, respectively. This indicates that more than half (57.3%) of remittances are received in the metropolitan areas of the country.

The BCRD reaffirms that the evolution of the external sector for this year will be characterized by the dynamism of remittances, exports, foreign direct investment and the recovery of tourism, which in recent months has registered record figures in tourist arrivals.

These events will contribute to a increased currency flow to the country and will help maintain the relative stability of the exchange rate that is currently observed, in such a way that the exchange rate showed an appreciation of 4.8% at the end of June compared to December 2021.

All these elements, together with the strong macroeconomic fundamentals of the country, indicate that the Dominican Republic has particularly favorable conditions to accommodate external shocks arising from a complex and uncertain international environment.

The institution highlights that this greater flow of foreign currency has also allowed the accumulation of international reserves, which by the end of June 2022 were placed around US$14,450 million, representing 13.3% of GDP and equivalent to about 6.0 months of imports. These metrics exceed the levels recommended by the IMF, helping the Dominican Republic to maintain a favorable external position, projecting a flow of remittances by the end of 2022 of around US$10 billion and a current account deficit between 3.0% and 3.5%. % of GDP.