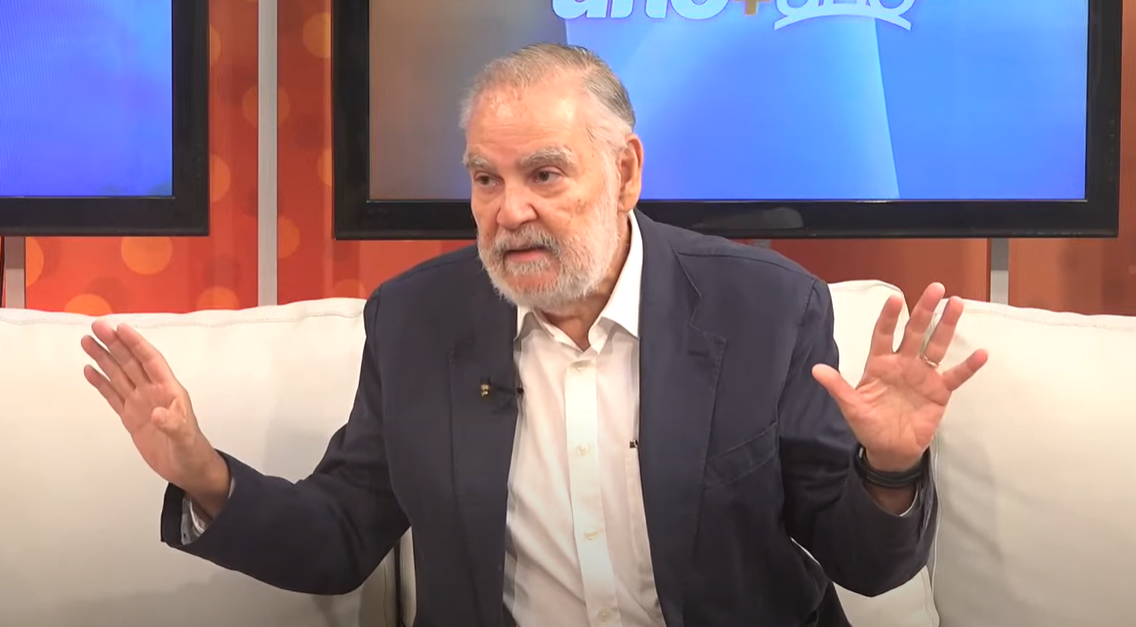

The superintendent of Health and Occupational Risks, and former Minister of Economy, Planning and Development, Miguel Ceara Hatton, stated that the tax reform proposed by Luis Abinader’s government, although it harms some sectors, could be compensated through other benefits.

According to Hatton, the tax increase would be balanced by improvements in key areas of the country. “It is important to understand that this is a package,” he explained, referring to the expansion of the ITBIS base.

As an example, he mentioned that the middle class requires citizen security, a service that “costs a lot of money.” In addition, he highlighted that to optimize salaries, acquire equipment and improve services such as health, infrastructure and communication routes, more resources are needed. “With what there is now it doesn’t work, there is no way you can comply,” he added.

Hatton recalled that, during his career in the economic sector, he has witnessed several reform proposals that have failed because, although they were coherent, “they affected certain sectors.”

In his opinion, “it is necessary to modify all this,” warning that if the government gives in to all pressures, past mistakes could be repeated.

The economist stressed that the central point of the debate about the reform is that it “affects” different groups, but insisted that “it is necessary to do it.”

He added that the measure is key to ensuring a more stable future for the country and highlighted the importance of the government improving the quality of spending to guarantee a process of development and transparency.

Hatton He also warned that the reform should not be subject to the demands of all sectors, since that could lead to an incoherent proposal: “If not, we are going to have a Frankenstein,” he concluded.

These statements were offered in the Uno+Uno program.

You can also read: They warn tax reform would leave 6 out of 10 Dominicans without access to their first home