The recent intervention of Caja Sullana by the Superintendency of Banking, Insurance and AFP (SBS) has raised alarm bells about the health of the Peruvian financial system. This episode, far from being an isolated incident, should be seen as an opportunity to reflect on the impact of certain laws approved by Congress that, with the intention of protecting consumers, are having counterproductive effects on the sector.

Jorge Antonio Delgado, president of the Association of Microfinance Institutions of Peru (SBS), said that the action of the SBS “should generate peace of mind,” highlighting the existence of the Deposit Insurance Fund as a protection mechanism for savers. However, Delgado warned about the dangers of legislation such as the Law against Usury in the financial system.

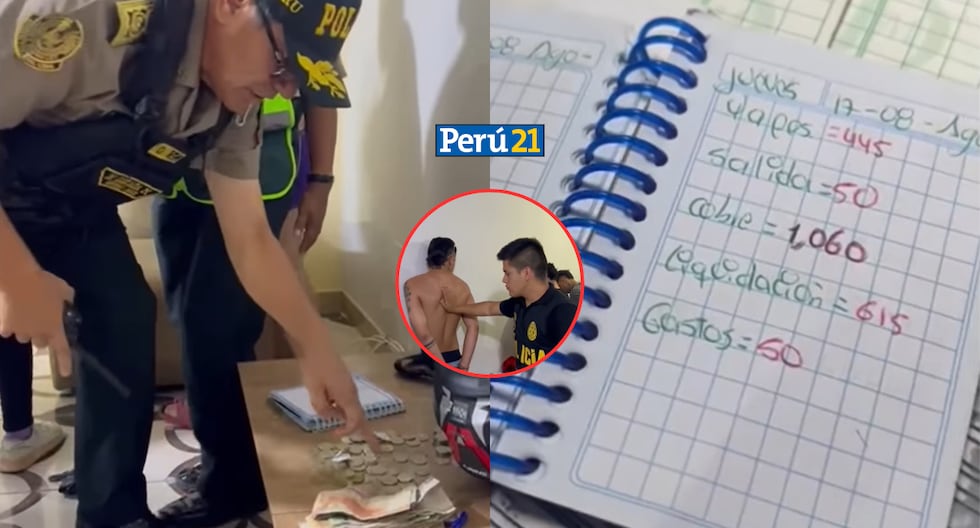

“Entrepreneurs and the most vulnerable people are precisely the ones affected by laws such as the one on interest rate caps, which expose them to extortionate loans such as the ‘gota a gota’ (gota-gota) law,” Delgado said. According to data from the Central Reserve Bank (BCR), this law has harmed 542,600 users, excluding them from the formal financial system and exposing them to informal and potentially dangerous credit practices.

The BCR reported that 40% of those affected (218,300 people) were expelled from the client portfolios of financial institutions, while the remaining 60% (324,600) were excluded from the banking process. This has mainly impacted low-income debtors without sufficient credit history.

Delgado called on Congress to create “laws that are positive for the financial system” and on the Executive to promote economic growth. “The Government must ensure that the economy grows at a faster rate, where it is more permeable for income to trickle down to entrepreneurs, who are the largest part of the population,” he said.

The intervention of Caja Sullana serves as a reminder of the delicate interplay between regulation and the market in the financial sector. While seeking to protect consumers, it is necessary to avoid measures that, paradoxically, push them towards riskier and less regulated financial options.

Peru21 ePaper, enter here and try it for free