The Ministry of Development and Social Assistance, Family and Combating Hunger (MDS) and Caixa Econômica Federal launched today (9), in the capital of São Paulo, the microcredit opportunity for families in the Single Registry (CadÚnico), a registry that allows the government to know who low-income families in Brazil are and how they live.

Still in the pilot phase, microcredit will operate on an experimental basis for 90 days, starting in São Paulo, Rio de Janeiro and Belo Horizonte and will then be extended to the rest of the country. The loan is part of the Believe in First Step program, which aims to combat poverty and inequality through work, offering credit and qualifications to families with greater social vulnerability.

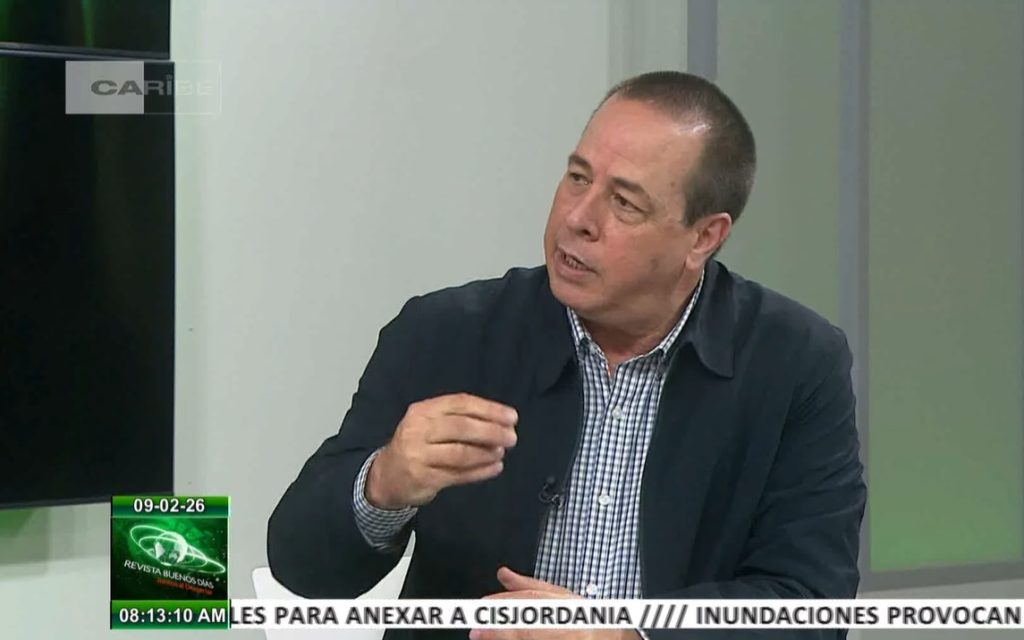

The first contracts were signed on Monday afternoon by the Minister of Development and Social Assistance, Family and Fight Against Hunger (MDS), Wellington Dias, and the president of Caixa, Carlos Vieira.

“It’s not just financing, it’s assisted credit. There’s credit, but there’s assistance for the business itself, such as the beauty business, gastronomy, small commerce”, explained the minister, in an interview with Agência Brasil.

“A person who wants financing, but the interest rate is high, here they will have an adequate rate for financing with Caixa. If they want [empreender]but does not have a guarantor or does not have a guarantee, President Lula created a guarantee fund”, he added.

The focus of the program is women, black people, young people, people with disabilities and traditional peoples and communities. The credit varies between R$500 and R$21 thousand, guaranteed by the Operations Guarantee Fund (FGO). The term varies between 4 and 12 months.

“We are expanding these credits so that these people can develop their work activities. This is the main purpose”, highlighted the president of Caixa.

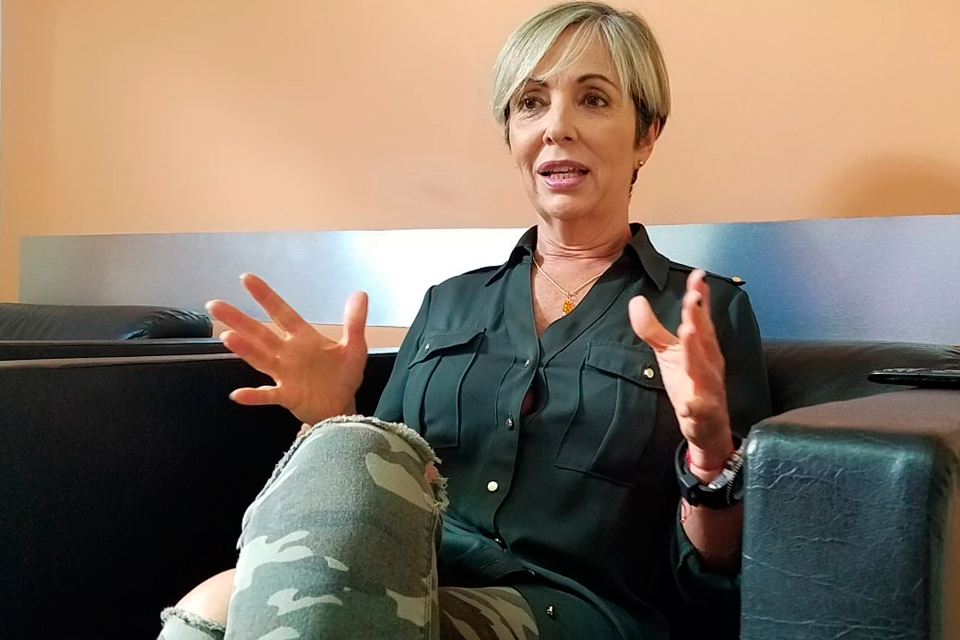

Some of the people who will benefit from the credit are street vendors from Associação Guerreiros, which brings together street vendors, street vendors and informal workers in São Paulo.

According to the president of the association, Margarida Ramos, this credit should help street vendors, especially when purchasing goods.

“People want to invest in merchandise or get some credit for times of need,” he said.

“I was worried because I saw several government programs for all types of workers, but it wasn’t enough for informal workers. This program came at the right time,” she added.

Financial education

Also this Monday, the minister launched, in the capital of São Paulo, the Financial Chatan online financial education game, developed together with the Visa brand, and aimed at CadÚnico subscribers.

In this game, participants will answer questions about everyday situations about controlling expenses, organizing the family budget and financial planning. With each correct answer, the team advances on the field and scores a goal. In case of error, the player loses possession of the ball, but can try again.

The objective of the game, highlights the ministry, is for everyone to learn how to deal with money.

“We have been working with financial training since 2023, but the language of football is an asset to democratize this knowledge, with qualification, technical support and financing for these entrepreneurs”, said the minister, during the launch of the game.

Free and online, the game can be used by people of all ages, and can be accessed from both cell phones and computers.

“By bringing this content in a playful way to the audience served by CadÚnico, we help this audience develop essential skills to make more conscious financial decisions throughout their lives,” said Rodrigo Cury, president of Visa do Brasil.