Santo Domingo.-The business sector confirmed its participation in the public hearing called by the National Congress to discuss the tax reform project.

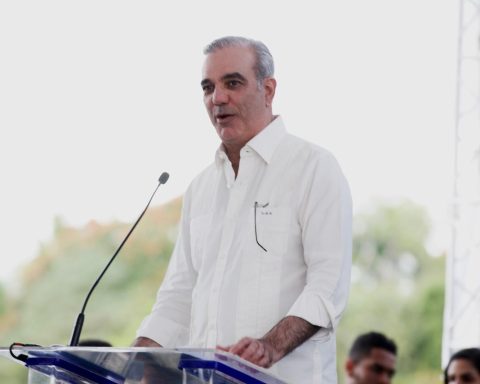

This decision comes after the announcement by President Luis Abinader, who expressed the Government’s willingness to consider modifications or changes to the proposal presented before the Chamber of Deputies.

During a meeting held last Monday, the special commission studying the tax reform project received the Minister of Finance, Jochi Vicente, who explained the details of the initiative.

In his speech, Vicente stressed that the Government is willing to dialogue with the sectors that have expressed concerns and criticism regarding the content of the reform.

The business sector, which has expressed concerns about some points of the reform, such as the elimination of exemptions and the impact on competitiveness, sees in this dialogue an opportunity to achieve consensus that favors economic growth without affecting the productivity of companies or to the well-being of workers.

Yesterday the businessmen grouped in the Association of Industries of the Dominican Republic (AIRD) met with the Finance Commission in the Chamber of Deputies sharing their concerns.

“On Thursday we will participate in public hearings. We will continue to participate in the dialogue spaces that are called for these discussions,” said Mario Pujols, executive vice president of the Industry Association.

Yesterday the work agenda included Alberto Nogueira, president of the Dominican Association of Rum Producers (Adopron), in addition to the participation of Annerys Meléndez, president of the Dominican Association of Home Builders and Developers (Acoprovi).

Also participating were Fabián Suárez, president of the Dominican National Brewery (CND), and Nicole Valerio Issa, executive director of the Association of Non-Alcoholic Beverage Industries (Asibenas).

Legislator Francisco Paulino chairs the Permanent Finance Commission of the Chamber of Deputies.

Impact

– Warning

The National Council of Trade in Supplies considered that it would be a strong blow for consumers to only contemplate seven products exempt from the tax on transfers of industrialized goods and services.

The Dominican State needs to spend well

Efficiency. Economist Antonio Ciriaco Cruz stated that the Dominican State needs to spend well and that is what the Fiscal Modernization Bill is about.

“That the State receives those resources and spends them well,” said Ciriaco Cruz, after pointing out that there is no apparent contradiction between taxes and competitiveness, that on the contrary, it will depend on how those resources are used and where they are allocated, that It must be in key sectors.

He explained that the countries that today enjoy a high level of well-being are those that also have high levels of taxes because much of it is used to improve productive capacity, public services and people’s quality of life.